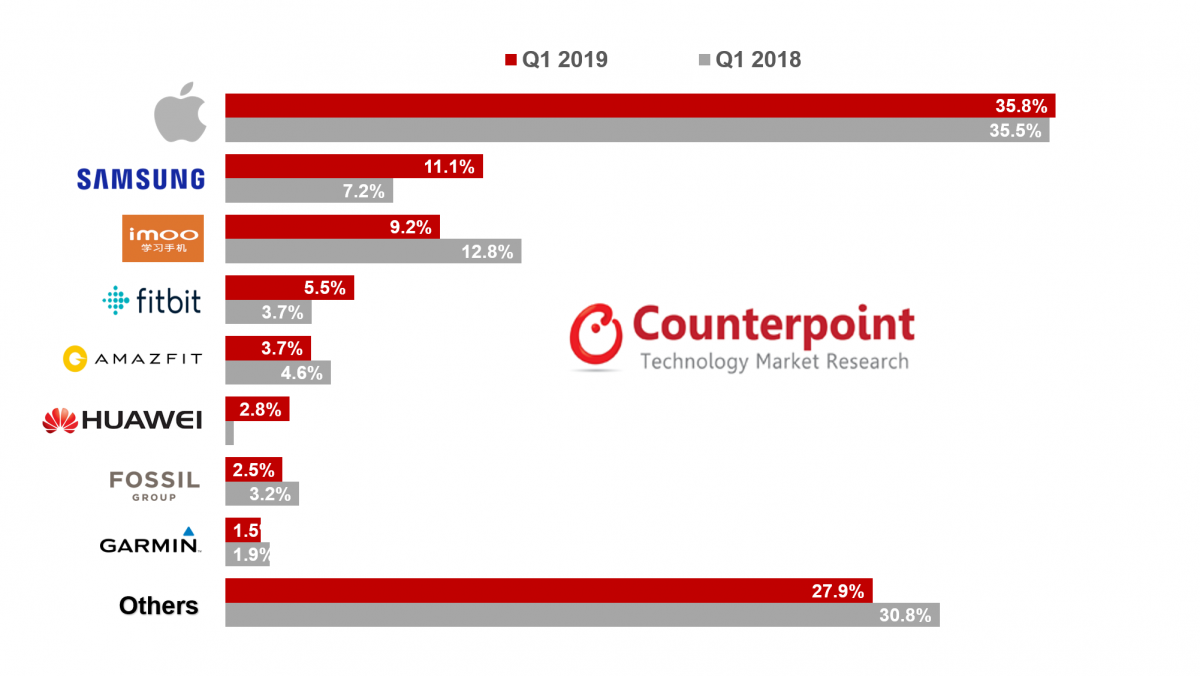

Top nine brands contribute to 75% of the market shipment. Samsung, Fitbit, and Huawei grew exponentially in Q1 2019

Global smartwatch shipments grew a healthy rate of 48% year-on-year (YoY) in Q1 2019 driven by Apple, Samsung, Fitbit, and Huawei, according to the latest research from Counterpoint’s Global Smartwatch Tracker. Commenting on the major shift in the market, Counterpoint Research Analyst, Satyajit Sinha, noted, “Apple Watch shipments grew a solid 49% YoY despite the weak demand for its iPhones. Apple continues to focus on the health-related features like ECG and fall detection in the Apple Watch Series 4. The ECG capability in the Apple Watch is the most desirable feature, according to our latest Consumer Lens survey. Apple has now received approval on its ECG features from healthcare authorities of Hong Kong and 19 other countries including France, Germany, Italy, Spain, and the UK.”

Sinha, further added, “The heart rate sensor for health monitoring, GPS and pedometer sensors for fitness, and NFC embedded for payment are some of the key integrated technologies. Related use-cases and in addition to notifications with cellular capability are driving the smartwatch adoption. However, limited battery life remains a pain point for consumer’s decision-making process, irrespective of region and price band.”

Global Smartwatch Shipments market share by brand in Q1 2018 vs Q1 2019

Commenting on other vendors’ performance, Senior Analyst, Sujeong Lim, noted, “Samsung grew exponentially at 127% YoY as the Korean brand’s market share jumped to 11% in Q1 2019. Its success was due to the latest Galaxy watch series which came with better battery life as well as a very traditional round clockface design. Further, it provides cellular LTE connectivity which gives it an edge over others targeting Android-based smartphone users. It is a great alternative to the Apple Watch for Android and Samsung’s huge installed base of users.”

Huawei’s market share jumped to 3% in Q1 2019 due to good traction for its latest Huawei Watch GT. The striking design, affordability, leveraging the growing ‘Huawei’ brand mindshare, and the smartphone user base is driving demand. Further, Huawei has shifted focus to sell more Huawei branded smartwatches whereas the smart bands are selling well under its HONOR brand.

Commenting on innovation across smart wearables segment, Associate Director, Brady Wang, noted, “Foldable displays are coming to smartwatches. Nubia’s attempt to design “smartphone + smartwatch” adds smartphone level capability to the wrist form-factor. The UI of Nubia Alpha comes with features like gesture control, shortcuts with image capture, and moving through apps. This makes the smartwatch versatile and user-friendly. However, we are still in nascent stages in the evolution of smartwatch form-factors. These new form-factors will need to excel on various metrics. They need to be less bulky, ruggedized but stylish and also possess a less fragmented software/UI which at the same time is also intuitive. We estimate flexible smartwatches will hit mainstream post-2025.“