The next big battleground for AT&T, T-Mobile, and Verizon will revolve around 5G for business, enterprise, and edge computing. And each wireless giant has its own spin and strategy.

Here’s a look at how the big three wireless carriers in the US plan on tackling the business markets. Like the consumer market, T-Mobile sees itself as a disruptive force to incumbents AT&T and Verizon, two carriers that dominate business accounts today.

T-Mobile plans to run the Uncarrier playbook in the enterprise

T-Mobile CEO Michael Sievert laid out the stakes on the wireless carrier’s investor day.

Another space that’s ready for real competition and disruption is enterprise and government. For example, remember shared data plans that were so common in consumer postpaid until we forced AT&T and Verizon into unlimited about four years ago? Well, guess what, they’re still doing that to business customers. After having successfully redefined consumer wireless for good over the past 8 years, it’s time that we bring that freedom to businesses as well.

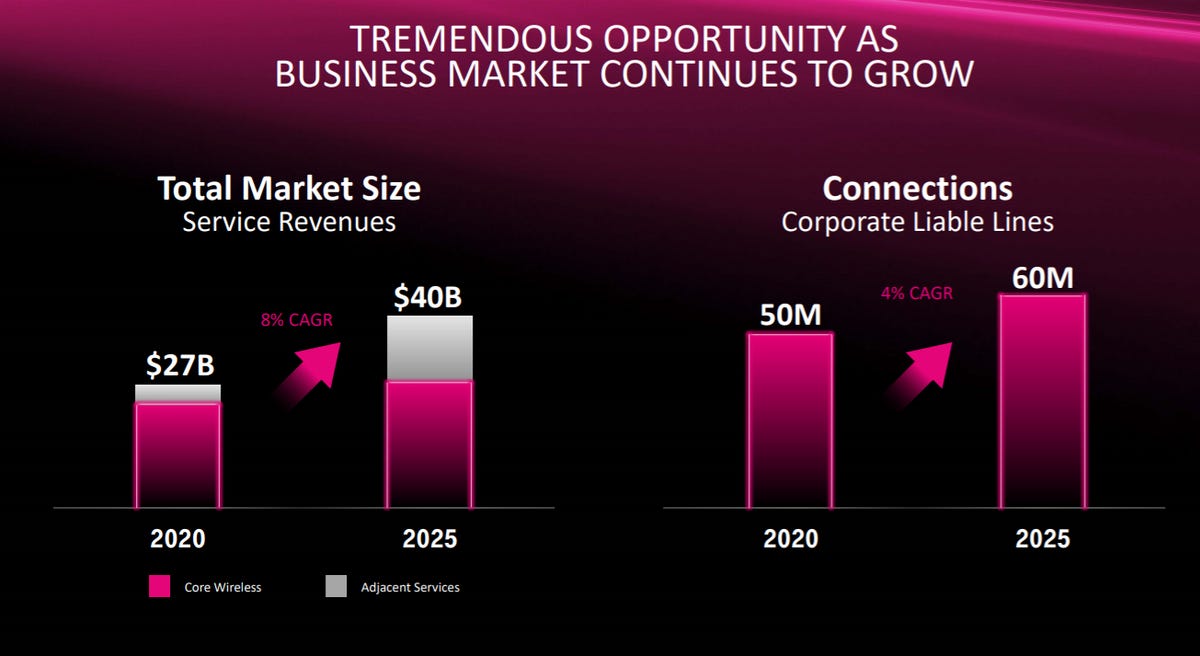

Our Un-carrier value proposition has performed well with small businesses in recent years. And of course, we’ll look to continue to grow and support that part of the market. However, our share in the large enterprise and government space is less than 10%, and it’s a space where we’re winning. There are over 50 million corporate liable lines today and growing. That is a big opportunity.

He added that T-Mobile sees room to run to about 20% market share over the next five years.

For smaller companies, T-Mobile plans to enter the home broadband market, which will also double as connectivity for home-based businesses.

Michael Katz, executive vice president of T-Mobile for Business, said the company is looking to target enterprise, public sector, and SMBs. Katz added that T-Mobile is looking to gain share in corporate-liable smartphone plans as well as adjacent services.

Must read:

Katz highlighted the following:

- T-Mobile home office Internet product is designed so enterprises can provide employees with in-office connectivity when working remote.

- Private networks for various business use cases in banking, automotive, and manufacturing.

- Enterprise unlimited plans to simplify purchasing.

“We will invest in making sure that T-Mobile is not just on the map, but we’re on the top of mind for every CIO across America, opening up more of the market to us. And like I mentioned, we plan to win with the best team, including expanded and specialized sales in dedicated care,” said Katz.

He added that T-Mobile will expand its sales teams to focus on verticals as well as technologies.

T-Mobile executives said 5G will also drive IoT, mobile edge computing, and private network opportunities, but those emerging markets aren’t baked into the company’s outlook.

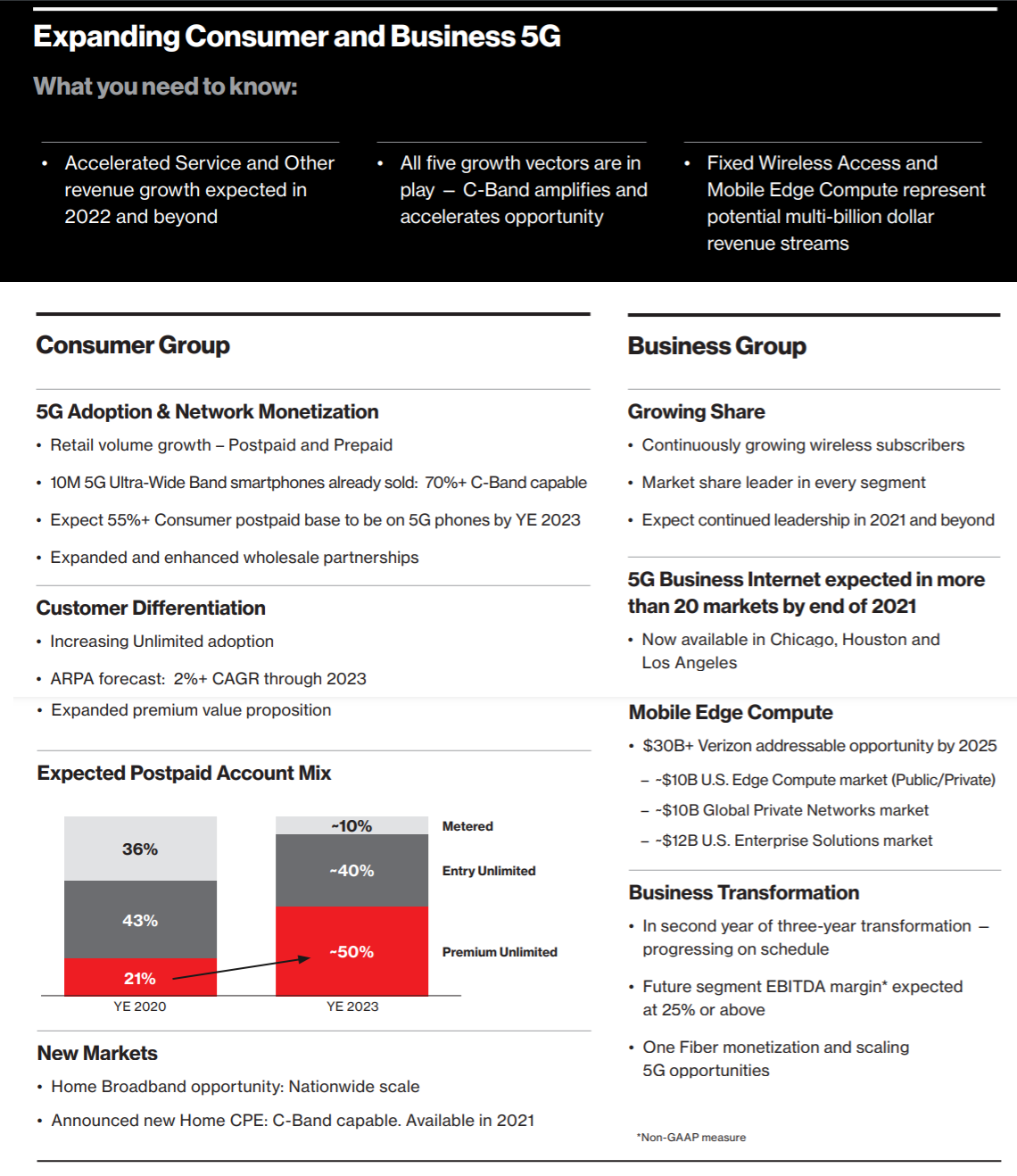

Verizon melds 5G with edge computing, IoT

While T-Mobile aims to add mobile enterprise accounts and move up the stack, Verizon is all about melding 5G with edge computing and creating an ecosystem with tech giants such as AWS and Microsoft Azure.

Verizon’s investor day last week featured a heavy dose of 5G as well as enterprise partnerships.

Must read:

Tami Erwin, CEO of Verizon Business, said:

We’ll serve customer segments, small and medium, global enterprise and our public sector. And we’ve continued to do that. We have never been better positioned to meet the needs of our business customers. And the ability to clearly articulate and deliver, not only network products but above network on platforms and solutions, whether it’s mobile edge compute, whether it’s private networks, what we’re doing around real-time enterprise solutions. We had 10 million new machine-to-machine connections last year alone. And as you think about mobile edge compute, the sensors that go out, the sensor densification, the ability to really be there for our customers, small and medium, global enterprise, public sector, not only with connectivity but really winning above connectivity.

Erwin said Verizon’s partnerships with AWS and Microsoft Azure on cloud and edge computing give the company a line into edge computing market share. Erwin said Verizon is also gunning for the applications market as well as 5G, Internet of Things, and edge computing.

We have a direct line of sight to the applications and solutions marketplace, another $12 billion addressable opportunity by 2025 that we will commercialize through our growing partner ecosystem. And we’re not wasting any time. We’ve already started developing enterprise solutions with IBM, Cisco, Deloitte and SAP across many industry verticals, including manufacturing, retail, distribution and logistics. Verizon Business is well positioned to capture significant edge compute share through our existing assets. We are in market today with leading cloud providers and expect to continue growing our roster of market making partnerships.

The upshot from Verizon CEO Hans Vestberg is that enterprise and business use cases will expand the company’s market. “Whether it is through 5G mobility, fixed wireless access or mobile edge compute or any of these other technologies we are looking at breakthroughs that both solidify and expand the total addressable market that Verizon serves,” said Vestberg.

Must read:

Not surprisingly, Verizon also plans on using 5G to keep broadband customers with fixed wireless services. Verizon 5G Business Internet will continue to expand too, but the wireless carrier is looking to play higher in the networking stack.

AT&T’s business play: Combining 5G with fiber

AT&T’s investor day revolved around HBO Max as well as 5G and consumer businesses. However, enterprises matter to AT&T too. AT&T’s spin on 5G for business includes a heavy dose of last-mile fiber.

Jeffery Scott McElfresh, CEO of AT&T Communications, said the company is looking to grow both its fiber and wireless businesses.

He said:

While both mobile and fixed broadband usage is growing, we’re actually seeing an increased dependence on the fixed network as it provides the performance and capacity customer applications require. And while this trend has been recently influenced by COVID-19, as employees work from home and students learn from home, it’s a trend that we expect will continue. This increased dependence on the fixed network gives us confidence that AT&T’s hybrid fixed, and mobile networks are well positioned to capture growth in this environment.

According to AT&T, the hybrid approach to 5G and fiber is critical because customer segments have different demand curves. “Businesses need a combination of fast, reliable, and secure fixed and wireless solutions for their distributed workforce. Students are highly mobile, preferring the flexibility of remote education offered over wireless platforms. The performance, capacity, and cost advantages make the fixed network relevant to serve all of these customer segments,” said McElfresh.

AT&T’s business portfolio includes 5G, secure fiber, private networks, and value-add efforts to support voice and collaboration. FirstNet is AT&T’s primary play for the public sector with customers including police departments, fire departments, FEMA, FBI, and the Coast Guard.

Like Verizon, AT&T is also focused on the enterprise ecosystem and edge computing. AT&T counts IBM, Accenture, Google, and Deloitte as partners. Key verticals for AT&T’s 5G enterprise efforts include:

- Sports and venues.

- Retail.

- Gaming.

- Travel and transportation.

- Education.

- Healthcare.

- Edge computing.

- And security, public sector, and public safety.