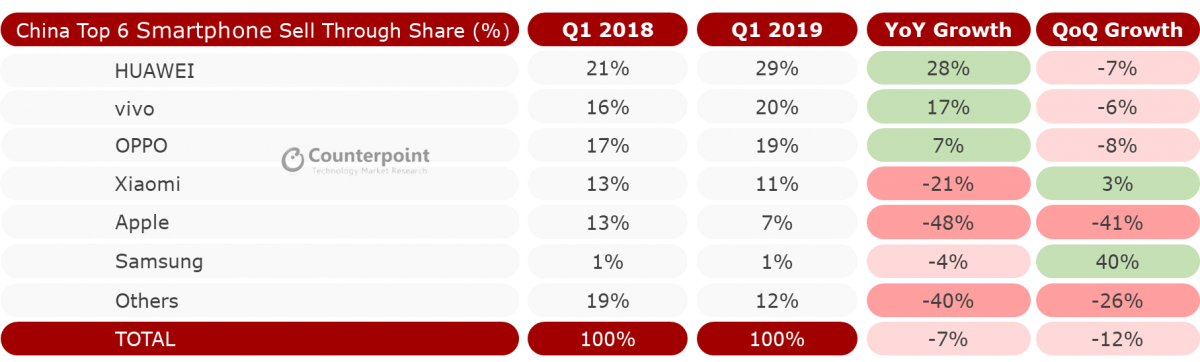

• Sell-Through in China’s Smartphone Market Continues to Decline but Bright Spots Emerge in Q1 2019

• Huawei, OPPO and Vivo maintain YoY growth.

• With the release of new models, Samsung and Xiaomi began to rebound QoQ

Sales volumes in the Chinese smartphone market continued to slow down in Q1 2019, both on year-on-year (YoY) basis and a quarter-on-quarter (QoQ) basis, according to the latest research from Counterpoint’s Market Pulse service. Volumes declined 7% YoY and 12% QoQ. However, the decline was smaller than in 2018. The top five brands accounted for a record 87% of the market, the market continued to gravitate towards the top vendors, while sales volumes for other OEMs continued to shrink and decline.

Commenting on the overall Chinese smartphone market, James Yan, Research Director at Counterpoint Research said, “As the largest smartphone market in the world, the start of 2019 continues the sluggishness from H2 2018.The sustained decline can be attributed to the overall economic downturn in China which has resulted in consumers’ prolonged replacement cycles for smartphones. Ordinary electronic products like smartphones can hardly stimulate consumers’ desire to buy in a gloomy economic scenario.”

Yan added, “Consumer demand continues to remain divided. While some are delaying smartphone upgrades others are buying other electronic products to satisfy their desire for freshness. In addition, other factors affecting sales in Q1 2019 includes the lack of new product launches. Most of the new OEM products were launched from March onwards. Therefore, they did not contribute enough to sales in Q1 2019.”

China Smartphone Sell Through Market Share Q1 2019

Source: Counterpoint Research Market Pulse Q1 2019

Huawei (including the HONOR brand) leads the Chinese smartphone market with its market share growing to 29% and sales volume close to 30 million. About Huawei’s performance, Yan said, “Huawei and HONOR continue to do well in China. HONOR’s sales come mostly from online channels but has expanded to many offline retail channels. Huawei successfully promoted its products through all channels right through the Chinese New Year holiday.”

OPPO and Vivo’s have charted a very different route from Huawei. They focus on products in the price range of RMB 1,500 (roughly US$220) with models like A5 and A7X series from OPPO and Vivo’s Y93 series. These are products with an average quarterly sales volume of more than 2 million. Vivo and OPPO are the second and third largest brands in China, with 20% and 19% market share, respectively. Speaking about the performance of Vivo and OPPO, Yan added, “Vivo surpassed OPPO and climbed to the second spot in Q1 with its new product X27 that features a pop-up camera. Its sub-brand iQOO also performed well.”

The market share of the Xiaomi brand dropped to 11% from 13% last year. However, it was the only brand in the top five to show QoQ growth. Mengmeng Zhang, an analyst at Counterpoint, pointed out that the reason behind this was Xiaomi’s organizational restructuring in the Q4 2018 and as a result it did not launch a new product until Xiaomi’s Mi 9 release in February 2019 and Redmi Note 7 in March.

Apple’s iPhone was a dismal performer in Q1, with its market share down nearly 50% from last year. Although the price of the new generation of iPhone products has dropped by about 10% since January, the price is still high enough to deter buyers. This is especially true for the new iPhone XS whose quarterly sales volume is even less than one million.

According to data from Counterpoint, the YoY change of Samsung is not significant, but the QoQ sales volume increased by 40%. Commenting on Samsung’s performance, Yan said, “Samsung’s strategy in China has clearly shifted to a more cost-effective one. This combined with the strong promotion of the new flagship Galaxy S10 and S10 Plus series, and the promotion of entry-level Galaxy A series products helped Samsung’s QoQ rebound in Q1 2019.”