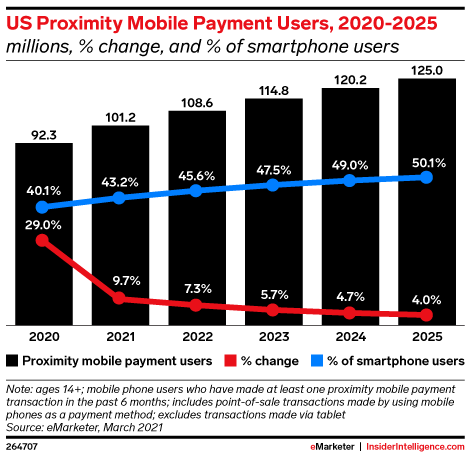

Among other technology trends accelerated by the Covid-19 pandemic, the use of contactless mobile payments boomed in 2020. According to a recent report by analyst firm eMarketer, in-store mobile payments usage grew 29% last year in the U.S., as the pandemic pushed consumers to swap out cash and credit cards for the presumably safer mobile payments option at point-of-sale.

Last year, 92.3 million U.S. consumers age 14 or older used proximity-based mobile payments at least one time during a 6-month period in 2020 — a figure the firm expects to grow to reach 101.2 million this year. And that usage is now on track to surpass half of all smartphone users by 2025, eMarketer forecasts.

Image Credits: eMarketer

Adoption last year was largest among younger consumers, including Gen Z and millennials. The former is expected to account for more than 4 million of the total 6.5 million new mobile wallet users per year from 2021 to 2025. Millennials, meanwhile, will continue to account for around 4 in 10 mobile wallet users.

Several industry reports had already noted the pandemic impacts on the mobile wallet industry in general, with one from earlier this month by finance and investment company Finaria estimating that the industry would grow 24% from last year to reach $2.4 trillion in 2021. It had said that while Asian markets and particularly China had been leading the way in mobile payments adoption, the U.S. had earlier struggled due to the slow rollout of mobile payment technologies by retail stores. But now, the U.S. has grown to become the second-largest market with $465.1 billion worth of mobile payment transactions, which will grow to $698 billion in 2023.

The pandemic had pushed lagging retailers to finally get on board with mobile payments. A mid-year survey published in 2020 by the National Retail Federation and Forrester, found that no-touch payments had increased for 69% of retailers, and that 67% now accept some form of contactless payment, including both mobile payments and contactless cards.

Image Credits: eMarketer

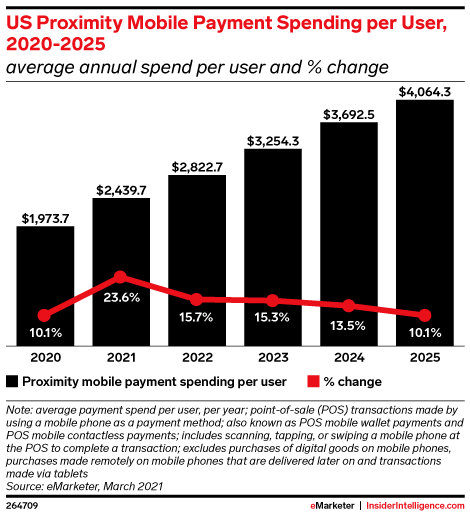

As a result of the industry changes, eMarketer reports that not only has mobile wallet usage increased, the average annual spend per user is increasing, as well. The firm predicts that figure will grow 23.6% from ~$1,973.70 in 2020 to $2,439.68 in 2021, and will surpass $3,000 by 2023.

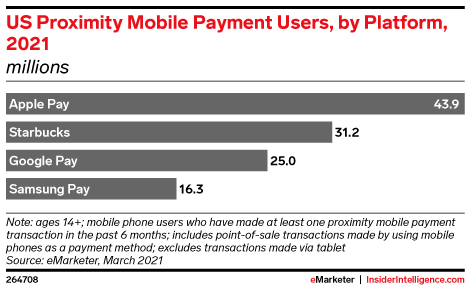

In the U.S., Apple Pay remains the top mobile payment player with 43.9 million users in 2021, growing by 14.4 million between 2020 and 2025 — more than its competitors. Starbucks will remain the No. 2 player with 31.2 million users, followed by Google Pay, which will add 10.2 million users during that time frame. Samsung Pay, meanwhile, is seeing stagnant growth, adding just 2 million more users between 2020 and 2025.

Image Credits: eMarketer