• Dust and water resistance are the most sought after features in premium smartphones

More than half of the respondents of Counterpoint Research’s India Premium Smartphone Consumer Survey are interested in purchasing a premium smartphone in the next 12 months. Further, data from the survey reveals that replacement cycles among the potential premium smartphone buyers (who are currently using a smartphone priced above INR 20,000 or roughly US$280) are around 25 months.

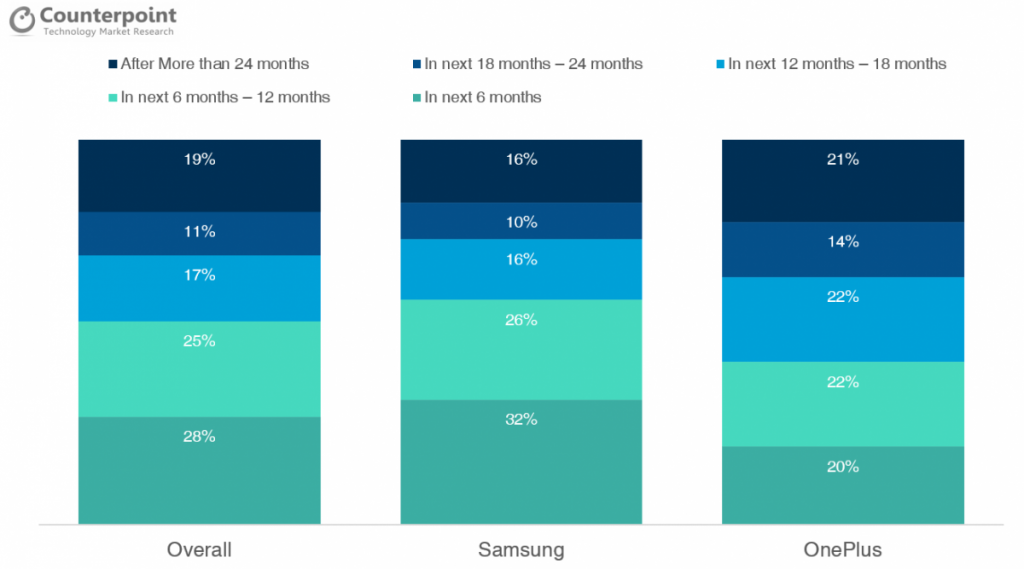

Commenting on the findings, Pavel Naiya, Senior Analyst at Counterpoint Research, said, “The Indian market has been growing at a healthy rate. There is a close competition between Samsung and OnePlus in the premium segment. Our survey reveals Samsung users replace their smartphones slightly faster than average while OnePlus users hold onto their devices for a bit longer. Almost six out of ten Samsung users are interested in re placing their smartphone within the next year. About four out of every ten users of OnePlus plan to buy a new smartphone in the next year.”

In India, while Apple struggles to gain momentum in the premium segment, Chinese brands like OPPO, Huawei, and Vivo are trying hard to break into the segment. Counterpoint conducted this study to better understand why consumers are choosing a particular brand or purchase channel, their future intention of buying a premium smartphone, and their spending patterns. For the study, we targeted upper-mid and premium segment (>INR 20,000) Android smartphone users. The survey had 800 respondents from the top cities in India.

Exhibit I : Next Purchase Intention by Current Brand

Source: Counterpoint Consumer Lens

Source: Counterpoint Consumer Lens

According to the survey’s findings, almost half of the respondents are interested in spending INR 40,000 (roughly US$580) or more for their next purchase. Further, one in every five respondents is interested in spending more than INR 60,000 (roughly US$870) or more. And around 8% of these respondents indicated their interest in spending INR 80,000 (roughly US$1,150) or more.

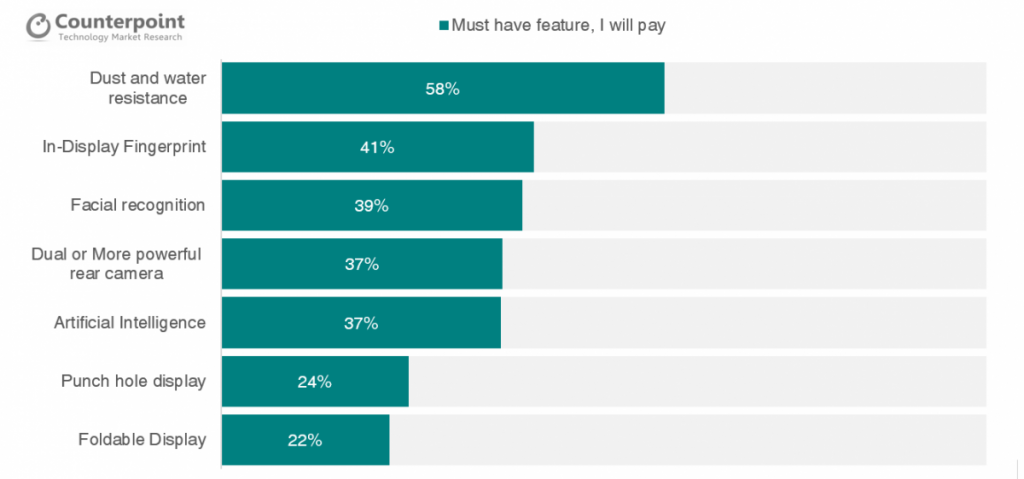

In terms of features, a majority of the respondents indicated that dust and water resistance is something that they want in their next smartphone. Almost six out of ten respondents think it is a must have and are willing to pay for the feature. Commenting on the consumer preferences for features, Tarun Pathak, Associate Director at Counterpoint Research said, “In-display fingerprint, facial recognition, dual or more cameras, and AI capabilities came up as key features, where almost four out of every ten respondents thought that these are a ‘must have’ in their future premium smartphones. Longer battery life along with fast charging, higher memory storage, new designs, and multiple cameras are the other key features which will influence future purchase decisions. Punch hole displays and foldable displays are yet to make any significant impact on consumers minds in India.”

Exhibit II: Consumer Payment Intention by New Features

Source: Counterpoint Consumer Lens

Source: Counterpoint Consumer Lens