HP published its third quarter financial results on Thursday, delivering mixed results as demand for desktops decreased and interest in notebooks increased. The year-over-year growth rate continues to benefit from the prior year impact of COVID-19 and supply chain disruptions.

For the third quarter, HP’s non-GAAP diluted net EPS was $1.00. Third quarter net revenue was $15.3 billion, up 7% from the prior-year period.

Analysts were expecting earnings of 84 cents per share on revenue of $15.91 billion. HP shares were down 3.71% in after-hours trading.

“Strong and sustained demand for our technology drove another quarter of top and bottom-line growth and we more than doubled non-GAAP EPS year over year,” said Enrique Lores, HP President and CEO.

“We are performing while we are transforming our business models and service offerings to accelerate growth opportunities across our portfolio. The evolving hybrid world is driving innovation and market expansion for HP and we are well positioned to capitalize on trends in our markets,” Lores added.

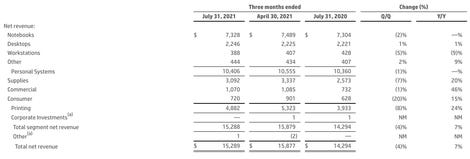

Personal Systems net revenue was $10.4 billion, flat year over year, while consumer net revenue increased 3% and commercial net revenue decreased 1%. Total units were flat, with Notebooks units up 2% and Desktops units down 7%.

Printing net revenue was $4.9 billion, up 24% year over year. Total hardware units were down 4% overall, with consumer units down 8% and commercial units up 29%. Consumer net revenue was up 15% and commercial net revenue was up 46%. Supplies net revenue was up 20%.

HP has been preparing itself for coming changes to how people work and study in a post-pandemic world. The company acquired Teradici in July under the assumption that core remote desktop software is a large and expanding segment projected to grow at a 17% compound annual growth rate through 2028.

For the fourth quarter, HP expects a non-GAAP diluted net EPS to be in the range of $0.84 to $0.90. For fiscal year 2021, HP is expecting non-GAAP diluted net EPS to be in the range of $3.69 to $3.75.