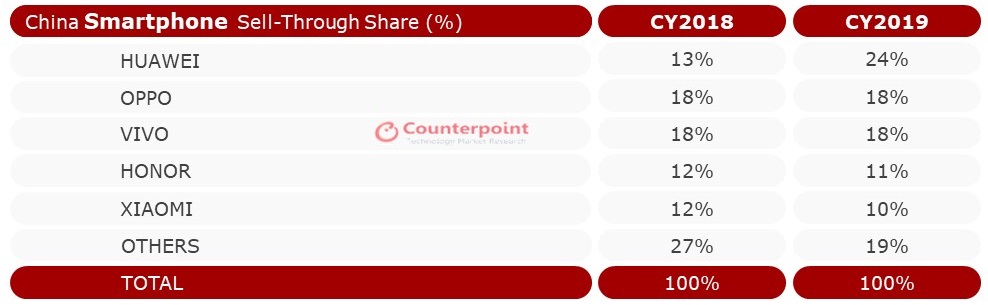

The China smartphone market sell-through declined 8% YoY in CY 2019, according to the latest research from Counterpoint’s Market Pulse Service. The decline was steeper than the Global Smartphone Market sell-through, which reduced 3% YoY in CY 2019. While all the major OEMs declined – OPPO (down by 12% YoY), Vivo (6% YoY), Xiaomi (22% YoY), Apple (26% YoY), Huawei (including Honor) grew 28% for the full year, capturing over one-third of the largest smartphone market in the world. Huawei has been aggressive in China after the US trade ban, which has led to this growth.

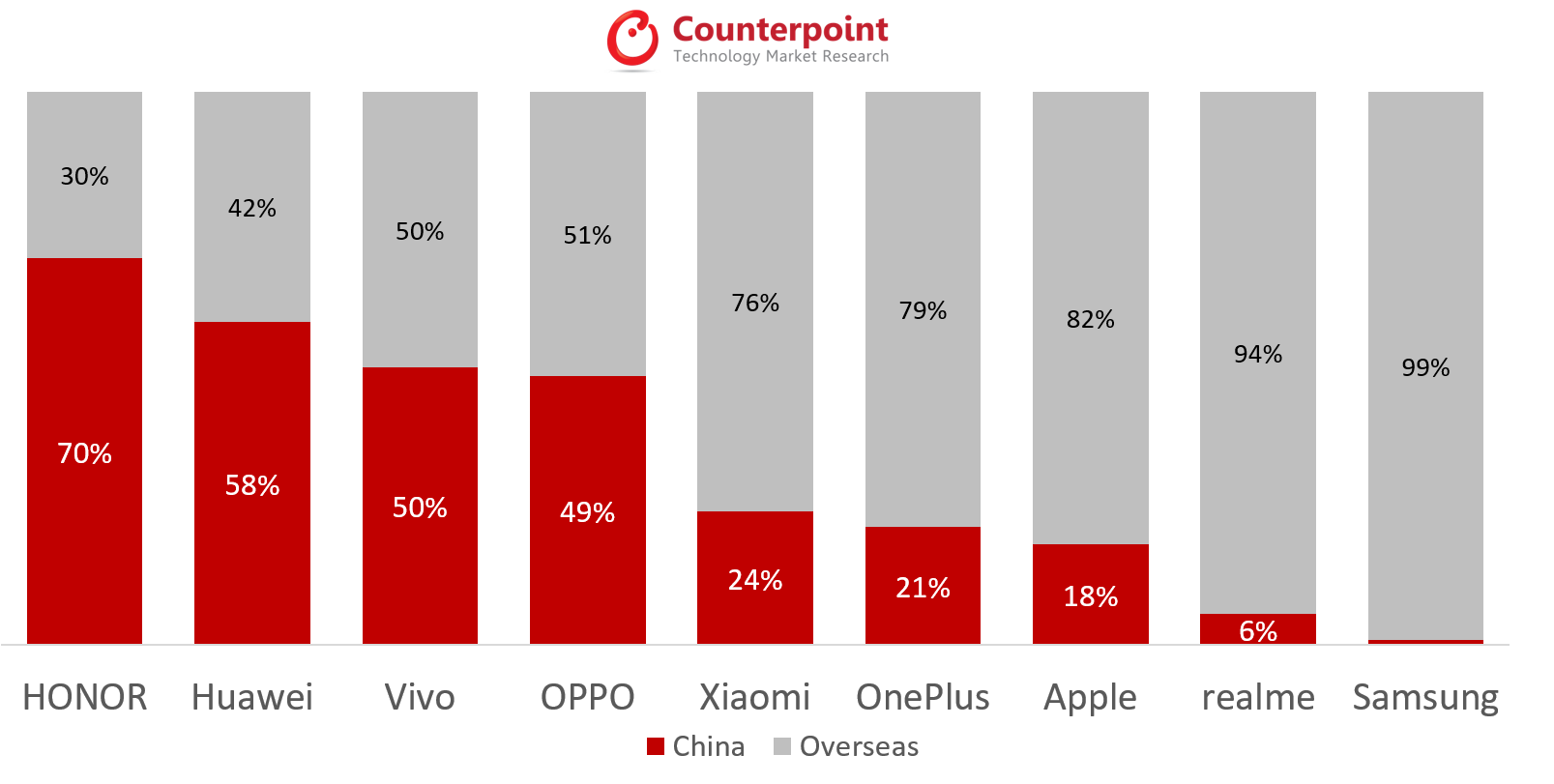

China remained the largest contributor to the global 5G market, capturing 46% of the total 5G devices sell-through in 2019. This was again driven by Huawei. While Samsung led global 5G sales with over 40% market share, Huawei (including Honor) alone captured 74% of 5G sales in China. However, the high dependence of Huawei on the Chinese market makes it most vulnerable to the effects of the COVID-19 outbreak on the smartphone market.

Commenting on COVID-19 and its effect on the China smartphone market, Varun Mishra, Research Analyst at Counterpoint Research noted, China handles at least 50% of global smartphone production and the coronavirus outbreak is bound to adversely affect China as well as the global smartphone market. There will be disruption from the supply-side with production facilities of smartphones and components either shut down or running below full capacity due to labor shortages.

The overall demand will also dramatically fall due to disruption in retail. Offline stores will be affected the most. We are estimating sales to drop over 20% in China in Q1 2020. The OEMs which will be affected the most are the ones having production facilities in the Wuhan area like Lenovo and Motorola, and the ones for whom China is the major market like Huawei. OEMs like realme, Honor, and Xiaomi, which are more reliant on online distribution are likely to be least affected compared to those that have a relatively high share of offline sales, he added.

While the overall market declined, there was considerable shifts within the price bands. The US$600 to US$800 price band increased 33% YoY to account for 6% of the total sales, compared to 4% in 2018. This was mostly driven by the popularity of Apple’s iPhone 11 and Huawei. Huawei led the $200 to $600 price band and was in the top three players in every other price band.

Commenting on the market outlook, Flora Tang, Research Analyst at Counterpoint Research noted, “Going forward, the decline in the Chinese market and the disruption in the supply chain will also lead to a decline in the global smartphone market by 5%. Our base case assumption is that COVID-19 will be largely contained in March. Nevertheless, we are expecting negative growth in China for both Q1 and Q2 2020. In Q3 2020, the demand is likely to pick-up but there will likely be a supply mismatch.

There will be demand for newer models while the available inventory will be of models that are not able to be sold now. We had expected 5G would catalyze global smartphone market growth in 2020, but now it is likely to remain flat.”