In this weekly series, CNBC takes a look at companies that made the inaugural Disruptor 50 list, 10 years later.

There have been very few digital media companies to grace CNBC’s annual Disruptor 50 list in its 10-year history, in part because it is a tough industry to make money in.

Even as daily life has become centered online, it’s the gatekeepers of the internet who keep most of the money, such as Google and Facebook. A focus on viral content made sense for BuzzFeed with the rise of Facebook and advertising shifts. BuzzFeed, which made CNBC’s inaugural Disruptor 50 list in 2013, started in 2006 with a focus on lists, videos and memes that are uplifted by social media.

But relying on the internet giants is a risk, whether it is SEO or viral success, as their algorithms and larger business goals shift in ways that can punish the most recent successful digital media model, or audiences simply move on from the last fad in content.

In the years since its inception, BuzzFeed added more traditional reporting in an attempt to bridge the worlds of “snackable” content with breaking news and investigative journalism — it has won a Pulitzer Prize and was at the center of the media storm during the Trump presidency over the “Steele dossier” when its then editor-in-chief Ben Smith decided to publish the document.

It hasn’t been a smooth ride financially, and investors became wary of the future for digital media companies in recent years. BuzzFeed notably missed its 2015 revenue goals.

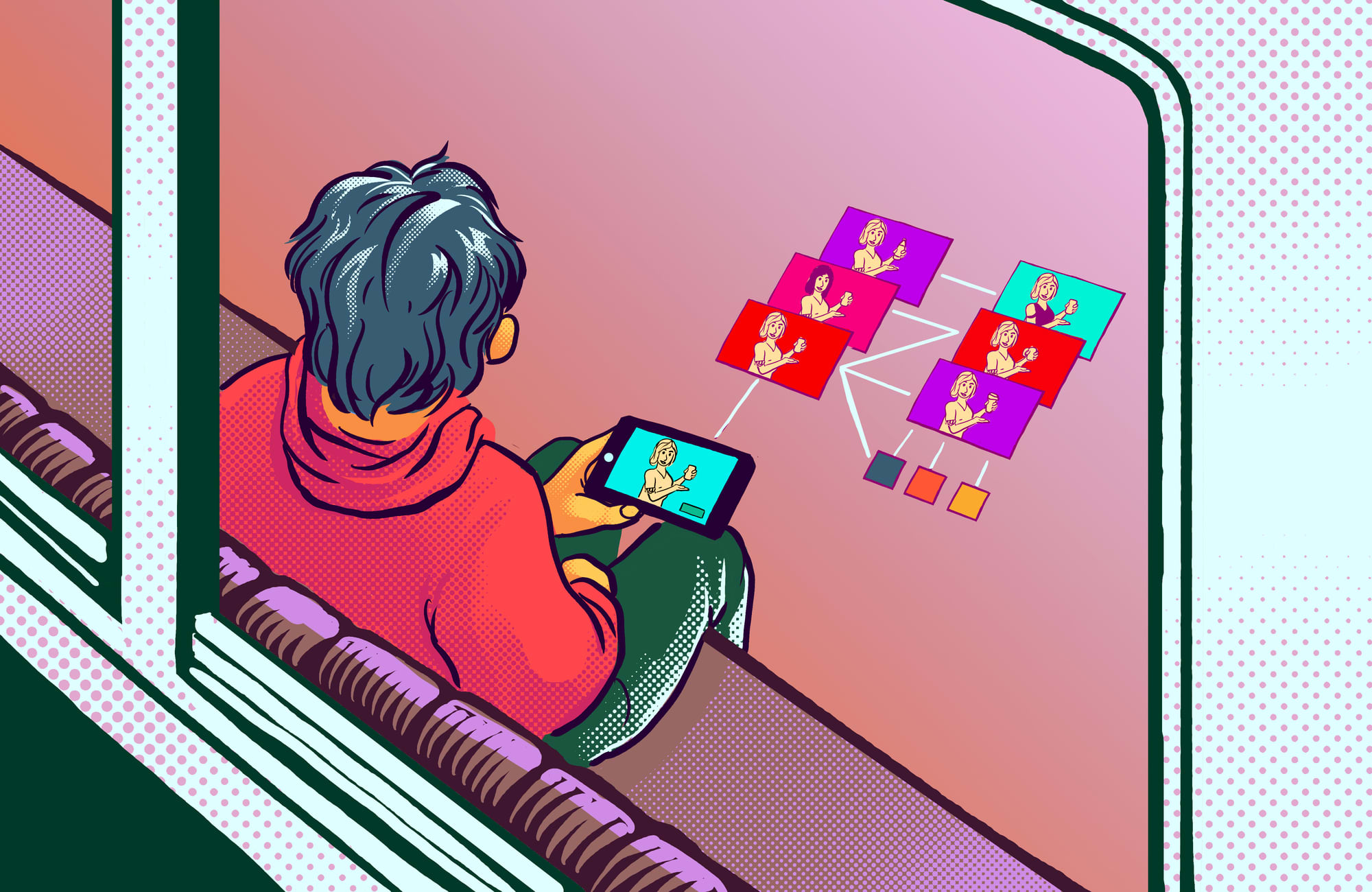

At the time, press reports indicated that BuzzFeed’s move to a “distributed” media strategy, where the goal is to find large audiences beyond its own websites and apps, was a big part of the challenge. Attracting lots of clicks on Facebook and Snap didn’t necessarily translate into an advertising revenue juggernaut.

Throughout its history, BuzzFeed has made progress in finding new revenue streams. One big example, Tasty, the Facebook video brand dedicated to food, along with other branded video projects. But it was only a matter of time before the content landscape disrupted the original disruptors, especially with the rise of streaming services and new ways to curate content.

Dealing with technology changes is nothing new in media, and the battles between content creators and distributors are constant, such as negotiations between cable companies and content originators. Digital media companies with aggressive growth plans in a fierce market can end up where BuzzFeed did: rounds of layoffs like it experienced in 2019.

But BuzzFeed flirted with profitability a year later (despite weathering a dip in digital advertising from pandemic quarantines), and the company began to build scale, acquiring HuffPost from Verizon Media in a deal that reunited BuzzFeed co-founder and CEO Jonah Peretti with HuffPost — a site he co-founded in 2005 with Andrew Breitbart, Arianna Huffington and investor Ken Lerer.

As 2020 ended, digital media companies had bounced back, and that was occurring alongside the rise of SPACs, the blank-check companies that boomed in a hot initial public offering market as a new generation of stock investors flooded into equities after the brief pandemic crash. The public market boom also allowed original VC investors, including Buzzfeed’s Series A investors, to get the return they had been waiting on since 2008.

The company fell 39% in its first week of trading in December, and its trading hasn’t gotten better.

Loading chart…

As CNBC’s Alex Sherman reported, it was “an inauspicious start for the prospects of digital media companies on public markets.” But he added there was something of a silver lining: “even if its valuation is disappointing, Buzzfeed’s debut gives peers something they didn’t have before: a public market valuation comparison.”

BuzzFeed says that as a public company it will begin rolling up the industry, but as Sherman reported, the speed of consolidation will depend on the personalities of those in charge.

“Confidence in BuzzFeed’s future prospects may grease the wheels for consolidation. BuzzFeed will need outsider faith in its equity to use it as viable currency for acquisitions,” he wrote.

Now the question is whether BuzzFeed, having made it public, can make the right calls on scale, distribution and audience to regain investor confidence, all within a media landscape where a bet on more disruption is probably a safe one.

—CNBC’s Alex Sherman contributed to this report.

Sign up for our weekly, original newsletter that goes beyond the annual Disruptor 50 list, offering a closer look at companies like BuzzFeed before they go public, and founders like Peretti who continue to innovate across every sector of the economy.