The COVID-19 impact has been devastating on Indian startups and SMEs. With the lockdown being ordered throughout the country, production, delivery, sales, marketing and at the end earnings are taking a big hit, as people are not allowed to move out of their houses. The millions of startups and SMEs, which were considered as the backbone of the Indian economy, are now looking up to the Government as their last hope.

While many businesses are exercising force majeure to get out of contracts, some are giving work from home as an excuse to not being able to pay vendors. All of this, creates tremendous pressure on SME and startups, many of which operate with 1-2 months of cashflow. To make things worse, several district magistrates have started issuing orders mandating businesses to pay daily wages of factory workers and shop workers that are unable to come to work due to the lockdown orders issued by the State Government.

LocalCircles conducted a survey in its 35,000 strong startup and SME community to get a pulse on what the Government could do to mitigate the impact of Coronavirus on small businesses. The survey received more than 29,000 responses from startups, SMEs and entrepreneurs.

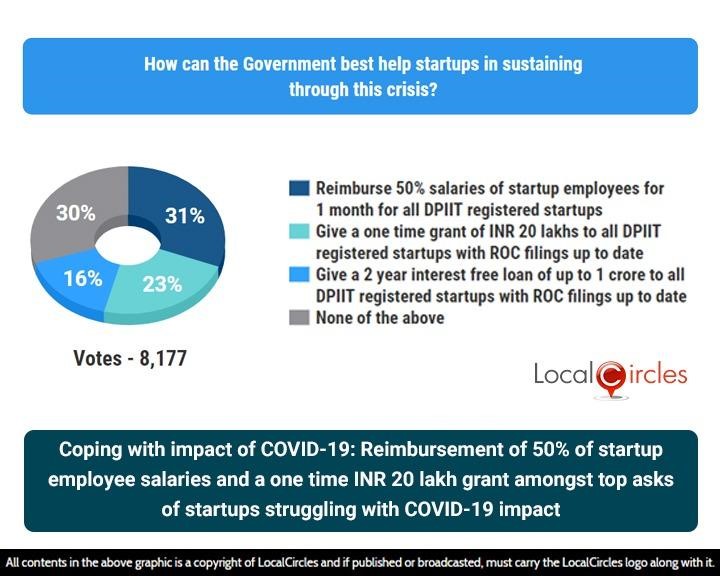

In the wake of the Coronavirus outbreak and the effect it is having on small businesses, the first question asked how the Government can best help startups in sustaining through this crisis. 31% said Government should reimburse 50% salaries of startup employees for 1 month for all DPIIT registered startups. 23% said a one-time grant of Rs. 20 lakhs should be given to all DPIIT registered startups with ROC filings up to date. 16% said a 2-year interest free lean of up to 1 crore should be given to all DPIIT registered startups with ROC filings up to date, while 30% said none of the above should be done.

Coping with impact of COVID-19: Reimbursement of 50% of startup employee salaries and a one time INR 20 lakh grant amongst top asks of startups struggling with COVID-19 impact

The next question asked startups and SMEs how should the Government restructure 2% of corporate profits (2020-21) currently designated for Corporate Social Responsibility or CSR to save small businesses. 38% respondents said that 1% should be allowed to be put into Startups/SMEs and the other 1% into CSR. 27% said the entire 2% should be allowed to be put into Startups/SMEs and none into CSR. 15% said it should be kept as is and none should be allowed to be used for startups/SMEs. 20% said they were unsure about it.

Coping with impact of COVID-19: Small businesses demand that some or all CSR funds be permitted into Startups/SMEs

The Government has already accepted one demand of startups and SMEs which was put forward through LocalCircles, by extending the March 2020 GST deposit and returns filing deadline to June 30, 2020. The extension of these deadlines is not expected to yield any losses for the Government but will ensure some additional cash flow for small businesses, which may prevent some of them from going out of business.

The following question asked if the Government should ensure that TDS refunds for businesses are processed within 15 days of income tax return being filed. Here again, a large 82% answered in an affirmative while only 12% answered in a negative. This will provide some relief to the Indian startup & SME sector by ensuring some cashflow, which has been completely derailed with the lockdown to prevent spreading of Covid-19.

Coping with impact of COVID-19: 82% startups/SMEs want FY 2019-20 TDS refunds to be processed within 15 days of return filing

In the final question, startups and SMEs were asked how can the Government best assist them with cash flow or faster receivables realisation. In reply, 6% said all PSUs and Government Departments should be mandated to pay 2019-20 invoices of startups/SMEs by April 15, 2020 while 16% said that all corporates should be mandated to pay startup/SMEs invoices due over 45 days by April 15, 2020. 73% said that Government should ensure both of these.

Coping with impact of COVID-19: Large majority of startups/SMEs want Government to ensure PSU and Govt departments pay all startup/SME dues by April 15; corporates to clear all 45 day old invoices

The US Government recently announced a $2 trillion relief package for its citizens and businesses who have been impacted by the COVID-19 pandemic. This includes $350 million in loans and other assistance for the small businesses of the country. The UK also announced a £3 billion per month bailout for Britain’s 3.8 million self-employed.

The demand that small businesses have from the Indian Government is pretty clear – extend the tax filing deadlines and allow some CSR funds to be put into Startups/SMEs. Startups and SMEs are hopeful that the Indian Government will announce a bailout package soon, which would help them in keeping their business afloat.