Uber reported a second-quarter loss on Tuesday but beat analyst estimates for revenue and posted $382 million in free cash flow for the first time ever.

Shares of Uber popped 14% in premarket trading.

Here are the key numbers:

- Loss per share: $1.33, not comparable to estimates.

- Revenue: $8.07 billion vs. $7.39 billion estimated, according to a Refinitiv survey of analysts.

The company reported a net loss of $2.6 billion for the second quarter, $1.7 billion of which was attributed to investments and a revaluation of stakes in Aurora, Grab and Zomato.

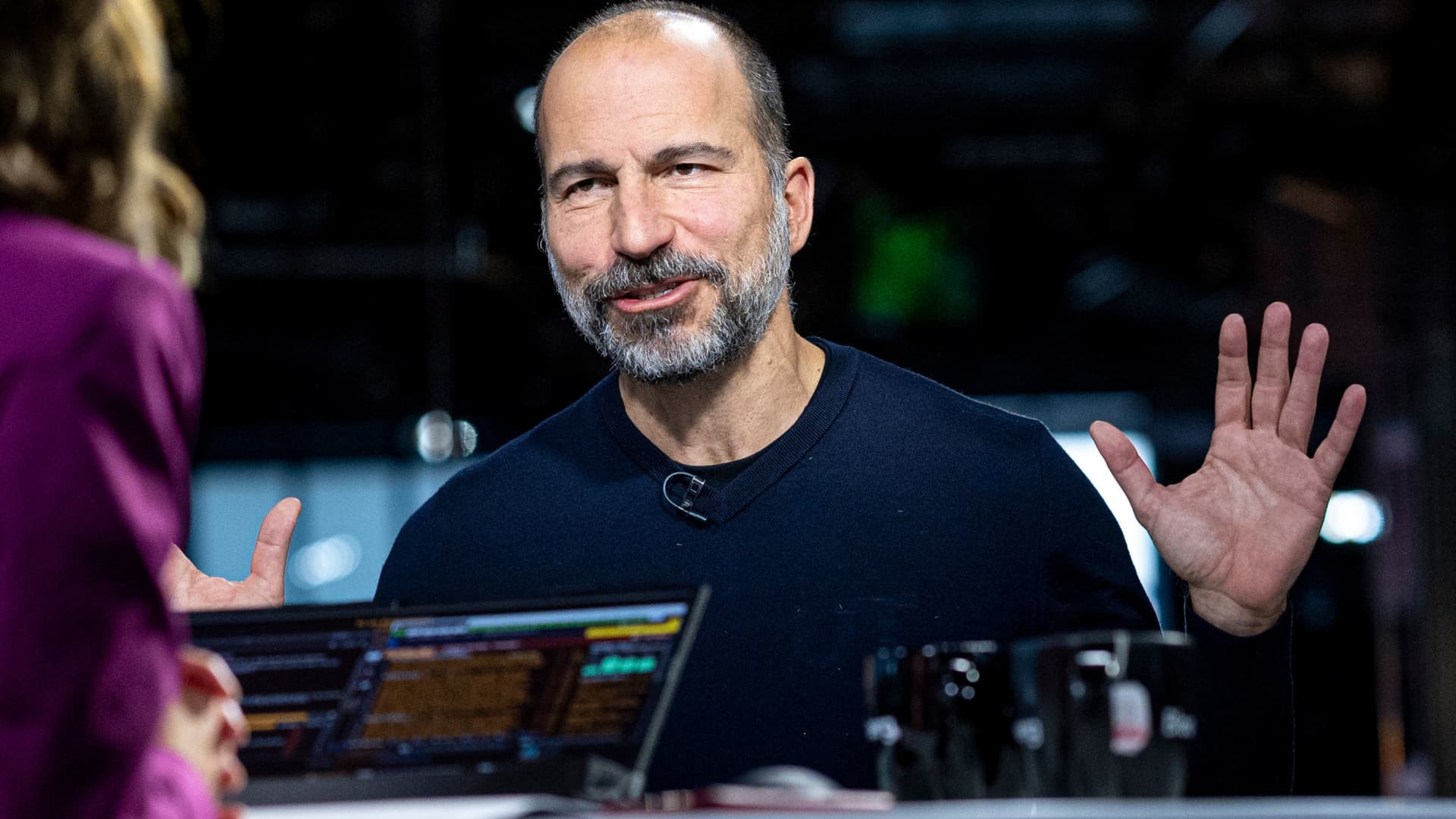

But CEO Dara Khosrowshahi said in a prepared statement that Uber continues to benefit from an increase in on-demand transportation and a shift in spending from retail to services.

The company reported adjusted EBITDA of $364 million, ahead of the $240 million to $270 million range it provided in the first quarter. Gross bookings of $29.1 billion were up 33% year over year and in line with its forecast of $28.5 billion to $29.5 billion.

Here’s how Uber’s largest business segments performed in the second quarter of 2022:

Mobility (gross bookings): $13.4 billion, up 57% from a year ago in constant currency.

Delivery (gross bookings): $13.9 billion, up 12% from a year ago in constant currency.

Uber relied heavily on growth in its Eats delivery business during the pandemic, but its mobility segment surpassed Eats revenue in the first quarter as riders began to take more trips.

That trend continued during the second quarter. Its mobility segment reported $3.55 billion in revenue, compared with delivery’s $2.69 billion. Uber’s freight segment delivered $1.83 billion in revenue for the quarter. Revenue doesn’t include the additional taxes, tolls and fees from gross bookings.

Despite the increase in fuel prices during the quarter, Uber said it has more drivers and couriers earning money than before the pandemic, and it saw an acceleration in active and new driver growth.

“Driver engagement reached another post-pandemic high in Q2, and we saw an acceleration in both active and new driver growth in the quarter,” Khosrowshahi said in prepared remarks. “Against the backdrop of elevated gas prices globally, this is a resounding endorsement of the value drivers continue to see in Uber. Consequently in July, surge and wait times are near their lowest levels in a year in several markets, including the US, and our Mobility category position is at or near a multi-year high in the US, Canada, Brazil, and Australia.”

Uber recently announced new changes that may help it continue to attract and keep drivers. They’ll be able to choose the trips they want, for example, and will be able to see how much they’ll earn before they accept a trip.

The company reported 1.87 billion trips on the platform during the quarter, up 9% from last quarter and up 24% year over year. Monthly active platform consumers reached 122 million, up 21% year over year. Drivers and couriers earned an aggregate $10.8 billion during the quarter, up 37% year over year.

Khosrowshahi said on a call with investors that new driver sign-ups were up 76% year over year. He said over 70% of drivers said inflation and cost of living played a part in their decision to join Uber.

Uber also benefited from the resurgence in travel. It said airport gross bookings had reached pre-pandemic levels, at 15% of total mobility gross bookings, up 139% year-over-year.

For the third quarter, Uber expects gross bookings between $29 billion and $30 billion and adjusted EBITDA of $440 million to $470 million.

Khosrowshahi will be on CNBC’s “Squawk on the Street” at 9 a.m. ET.