• The global smartphone market declined the fastest ever, -13% YoY, during the quarter

• 5G smartphone shipment share increased to 8% in Q1 2020 from 1% in Q4 2019

Xiaomi (7%) YoY, and realme (157% YoY) were the only major brands to achieve growth

Apple remained resilient even during the COVID-19 as iPhone shipments declined only 5% YoY Q1 2020

The global smartphone market declined its fastest ever, down 13% YoY in Q1 2020, according to the latest research from Counterpoint’s Market Monitor service. This is the first time since Q1 2014, that the smartphone market has fallen below 300Mn units in a quarter. The COVID-19 pandemic has disrupted the signs of any recovery that the market started showing in Q4 2019.

The first-quarter decline was mainly driven by a 27% YoY shipment decline in China, the initial epicenter of the pandemic. Some of the declines was offset by sales shifting to online channels. Overall, the market share of China in the global smartphone market, in Q1 2020 reduced to 22% from 26% a year ago. The disruption in China also impacted the supply side of handsets and components for some OEMs, which in turn, affected global shipments. In the long run, this could lead to OEMs diversifying their supply chain across regions. This could be a silver lining for countries like India and Vietnam.

By the end of the quarter, as COVID-19 started to spread to other regions, and lockdowns of varying severity were imposed, the pendulum of disruption started to swing from supply to demand.

Commenting on the impact of COVID 19 on smartphone demand, Tarun Pathak, Associate Director at Counterpoint Research noted, “From the consumer standpoint, unless replacing a broken phone, smartphones are mostly a discretionary purchase. Consumers, under these uncertain times, are likely to withhold making many significant discretionary purchases. This means the replacement cycles are likely to become longer. Lockdowns in most parts of the world will be lifted in a staggered way, which will mean it could take time before the retail activity completely resumes. Even after the lockdown ends, there will likely be changes in consumer spending patterns”.

“Online channels are likely to be preferred and there will likely be shifts in the price band distribution with some consumers opting for a cheaper device, which could lead to a decrease in overall ASPs. OEMs will have to embrace a more omnichannel strategy. Retailers will also have to find ways to reach their consumers digitally. This could increase the adoption of O2O channels and hyper-local delivery services in smartphones. However, users staying at home are engaging on their smartphones more than ever. This provides opportunities for services like mobile gaming and OTT services. This will likely lead to operators being able to upsell to larger data packages with higher ARPUs”, he added.

COVID 19 has also impacted the pace of 5G rollouts in some countries. Commenting on this, Varun Mishra, Research Analyst at Counterpoint Research noted, “COVID-19 has disrupted the implementation plans of 5G in some countries, with auctions being postponed in markets like Spain and India. However, led by Huawei, the growth of 5G in China remains as expected. As the situation returns to normal, the 5G sales will be further driven by OEMs including Samsung, Oppo, Vivo, Xiaomi, and realme launching devices in the sub $300 price band. This is likely to be complemented by SoC players launching cheaper 5G-capable chipsets. The share of 5G smartphones increased to 8% in Q1 2020, compared to 1% in Q4 2019. 5G is likely to help the rate of recovery during the second half of 2020.”

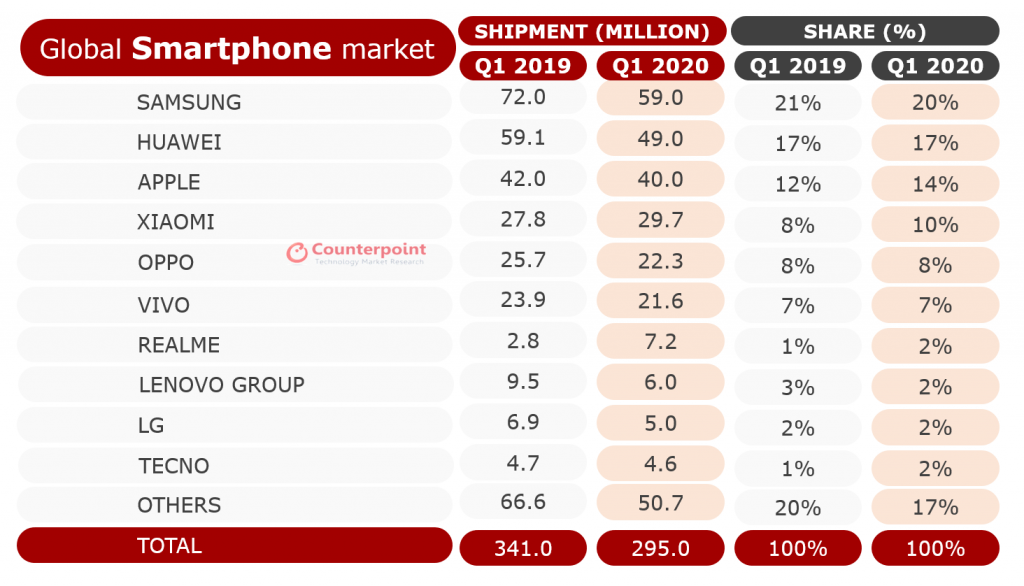

The combined market share of the top 10 brands has increased to 83%, from 80% in Q1 2019. The consolidation trend is likely to continue, as smaller brands, with a higher offline distribution, are likely to be affected more by the pandemic. As expected, due to the pandemic, all the major OEMs declined during the quarter, except Xioami (7% YoY) and realme (157% YoY). This is partly because, India, which is the largest market for both these brands, implemented a severe lockdown in the last week of March.

Smartphone Shipment Market Share Q1 2019 and Q1 2020

The ongoing effect of the pandemic on the smartphone market is likely to be worse in the second quarter. The impact on the OEMs will depend on the markets, channels, and price bands they operate in with some OEMs affected more than others.

Market Exposure:

- Demand Side: The China market is recovering, while many other major markets are under lockdown. Depending on the severity of the pandemic, the recovery in some of these markets could also take longer. Going forward, brands with a larger share in China, like Huawei, are in a better position than brands like Samsung, for which almost all its major markets remain under lockdown.

- Supply Side: In Q1 2020, OEMs with components and factories in the worst-hit areas of China were exposed the most, for example, Lenovo. In the second quarter, the trend will be reversed, as China’s manufacturing recovers, but many other manufacturing centers are closed.

Sales Channel: The brands with higher online presence are likely to remain more immune than offline ones. Some offline demand is shifting to online.

Price Band Exposure:

- The entry-level segment is likely to hit the most, especially in the emerging economies, driven by an impact on the people’s income in the unorganized labor sector and higher offline purchase tendency. The mid-segment will continue to drive volumes.

- The premium segment is least likely to be directly affected by the economic meltdown. As the consumers would adjust to the new normal, the sales in the segment are likely to rebound.

Key Takeaways:

- Samsung led the smartphone market during the quarter capturing one-fifth of the global smartphone shipments. The OEM declined 18% YoY during the quarter and is expected to see a steeper decline in Q2 2020.

- Huawei continued its push in China and surpassed Apple again during the quarter. The OEM declined 17% YoY during the quarter. Over half of the smartphone shipments for Huawei are now in China.

- Apple remained resilient even during the COVID-19 as iPhone shipments declined only 5% YoY during the quarter. The iPhone revenues were down 7% YoY for the same period. The impact on some European and Asian countries was mild.

- Xiaomi grew 7% YoY during the quarter. The OEM continued to lead the India smartphone market reaching its highest ever market share (30%) since Q1 2018.

- Compared to other major OEMs, Vivo declined less (10% YoY) during the quarter. A strong performance in the Indian Smartphone Market partially offset declines in other markets.