Sean Gallup

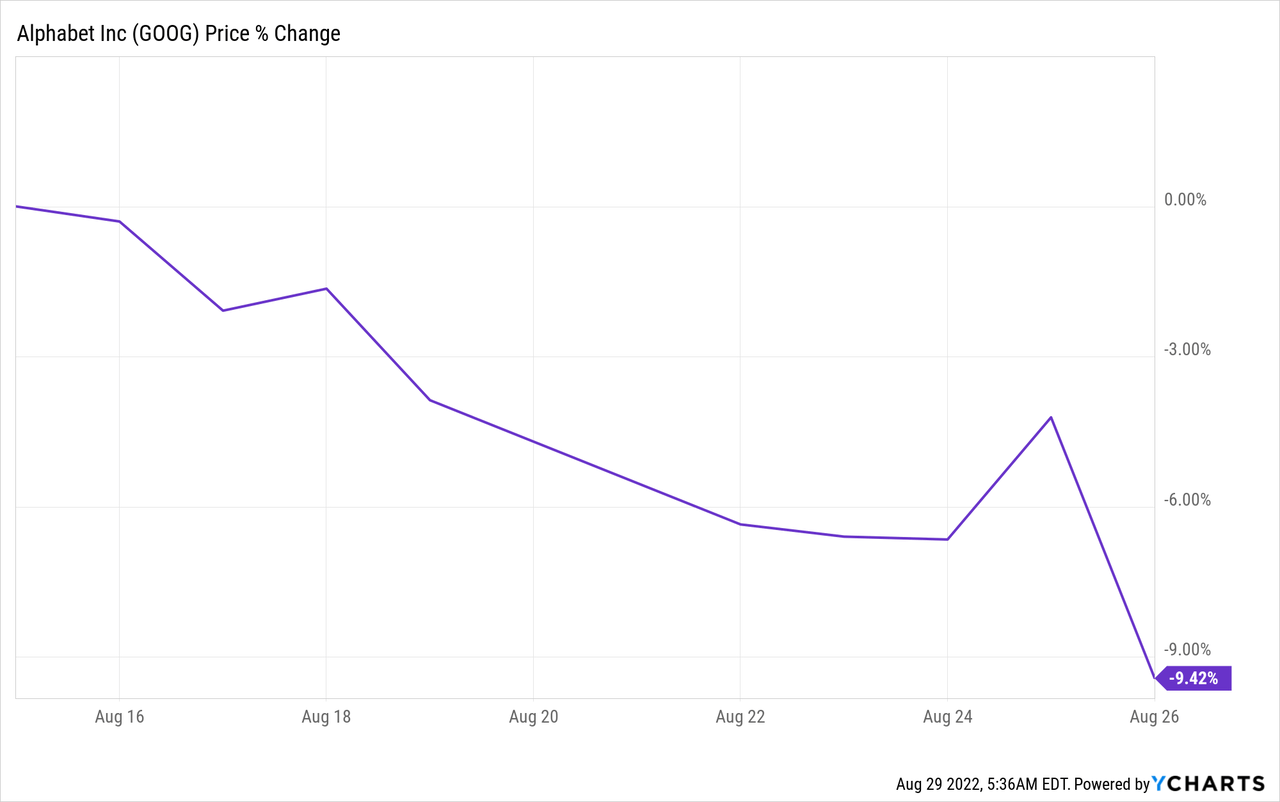

The market appears to be on the precipice of another down-leg: inflation continues to be a major threat to the U.S. economy, and Jerome Powell’s speech last week indicated that the market needs to anticipate even more interest rate increases in 2022. However, Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) is uniquely positioned to ride out the current market volatility due to strong free cash flow, aggressive stock buybacks, and an increasingly diversified business model. Google’s Cloud business especially has potential to deliver strong cash flow growth going forward and help the technology company offset some of the declines in the advertising market. Since shares of Google have dropped about 10% since mid-August, I believe the risk profile (and the valuation) are extremely attractive right now!

Google uniquely positioned to ride out cyclical advertising down-turn

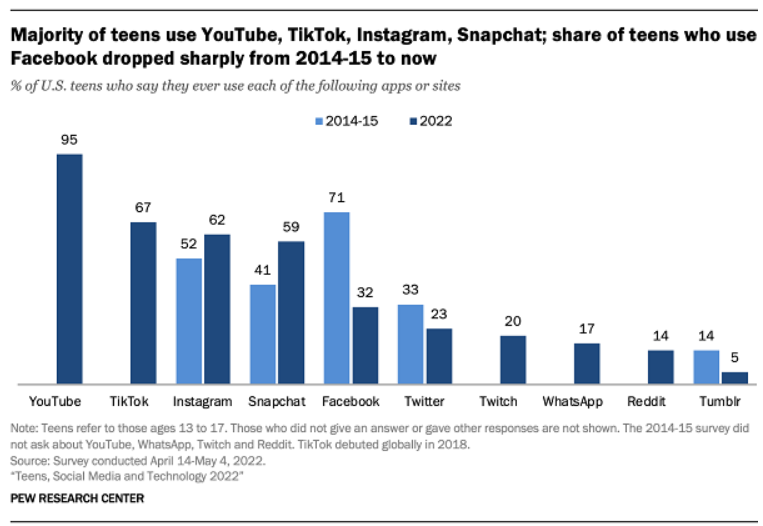

Plenty of technology companies have warned of a down-turn in the advertising business, including Snap (SNAP) and Meta Platforms (META). Both companies are seeing growing top line pressure not only because advertisers are pulling back in a market that has become less predictable due to high inflation and reductions in corporate ad-spend, but TikTok is posing a growing challenge to established U.S. social media companies as well. Bytedance-owned Tik-Tok especially has been making in-roads with younger users in the U.S., and it has been the most downloaded application in Apple’s App Store in Q2’22 with 60M downloads. Facebook has been most affected by the rise of TikTok, and the company wildly disappointed with its Q3’22 revenue forecast, in part, because of TikTok’s success in attracting younger users that are highly coveted by advertisers.

Pew Research

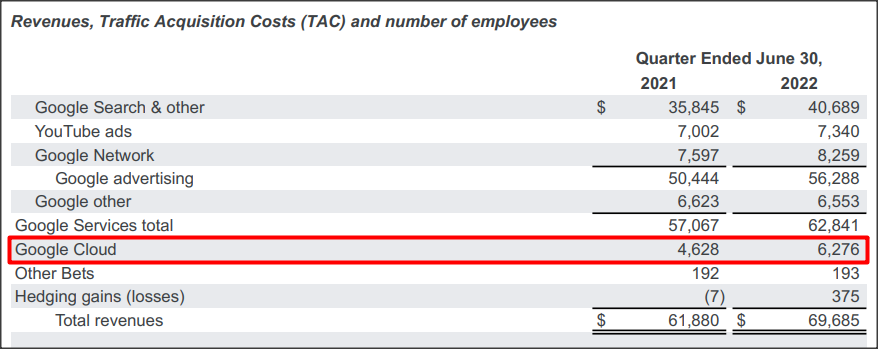

While advertising is still responsible for creating the majority of revenues (81% in Q2’22) for Google, the technology company offers investors something that other ad-heavy technology firms may not: a potential offset to a downturn in the advertising industry.

Google’s Cloud business is gaining momentum due to more and more workloads shifting to the cloud and companies investing more money into their IT infrastructure and scalability. Google’s Cloud segment grew revenues 36% year over year to $6.28B in Q2’22, which helps the company counter revenue challenges in an increasingly difficult advertising market.

Google: Revenue Breakdown Q2’22

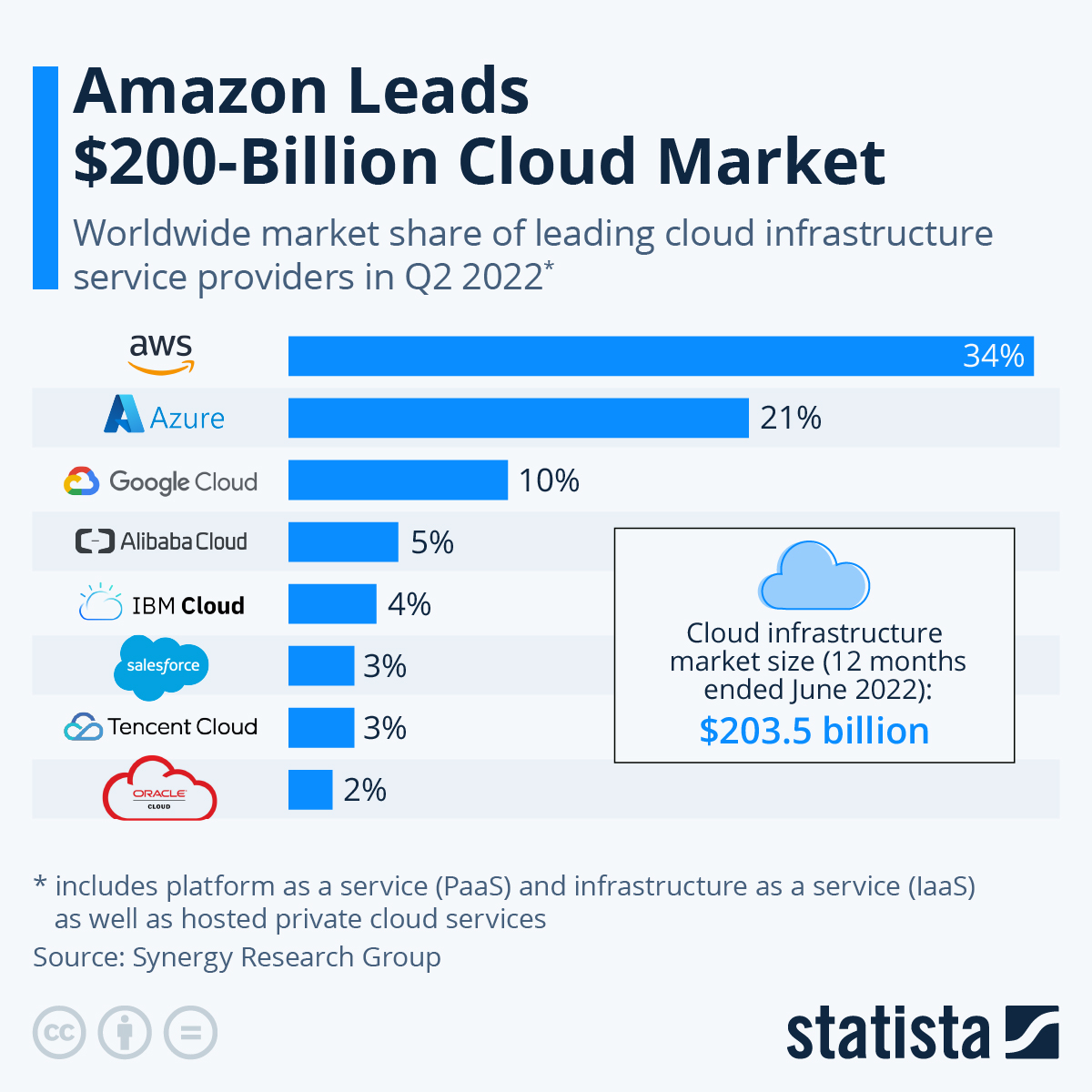

Google is not the market leader in Cloud, however. Amazon.com, Inc.’s (AMZN) Web Service is the market leader with a share of 34%, followed by Microsoft’s (MSFT) Azure which has a share of 21%. Google is the number three in the market with a market share of approximately 10%.

Statista: Google Cloud Market Share

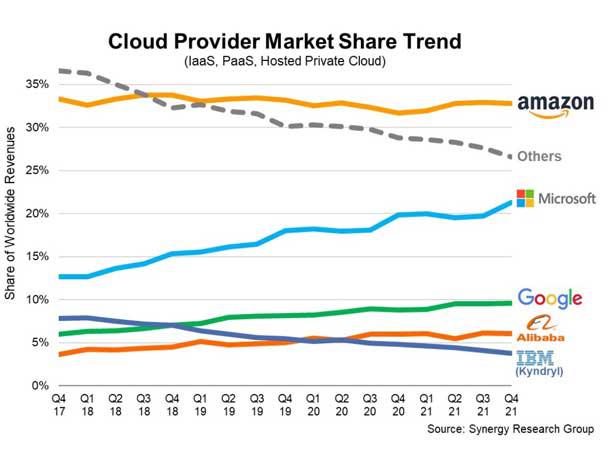

According to Synergy Research Group, enterprise spending on Cloud services totaled $178B in FY 2021, showing an increase of 37% year over year. With more workloads shifting to the Cloud, companies and retail customers are set to drive demand for Google’s cloud-based services going forward. While Microsoft has seen the strongest market share growth in Cloud in the last four years — which is a top reason to buy the software company — Google has made steady progress as well, growing its market share from 6% to 10% over a four-year period ending in Q4’21. Google Cloud hasn’t grown its market share as quickly as Microsoft’s Azure did, but Google is still a considerable force in the market with 36% revenue growth in Q2’22.

Synergy Research Group

$70B stock buyback creates support for the stock

Google has an authorization in place to repurchase $70B of its shares in the market which is representative of approximately 5% of the technology company’s total market cap. The $70B authorization followed a $50B authorization in the year-earlier period and Google generates a ton of free cash flow to pay for it. Google has quarterly free cash flow margins of 20-30% and averaged quarterly free cash flow (“FCF”) of $16.3B in the last year. The $70 stock buyback provides support for Google stock, and considering that Google is cheaper today than a year ago, stock buybacks are a very sensible investment opportunity for management right now.

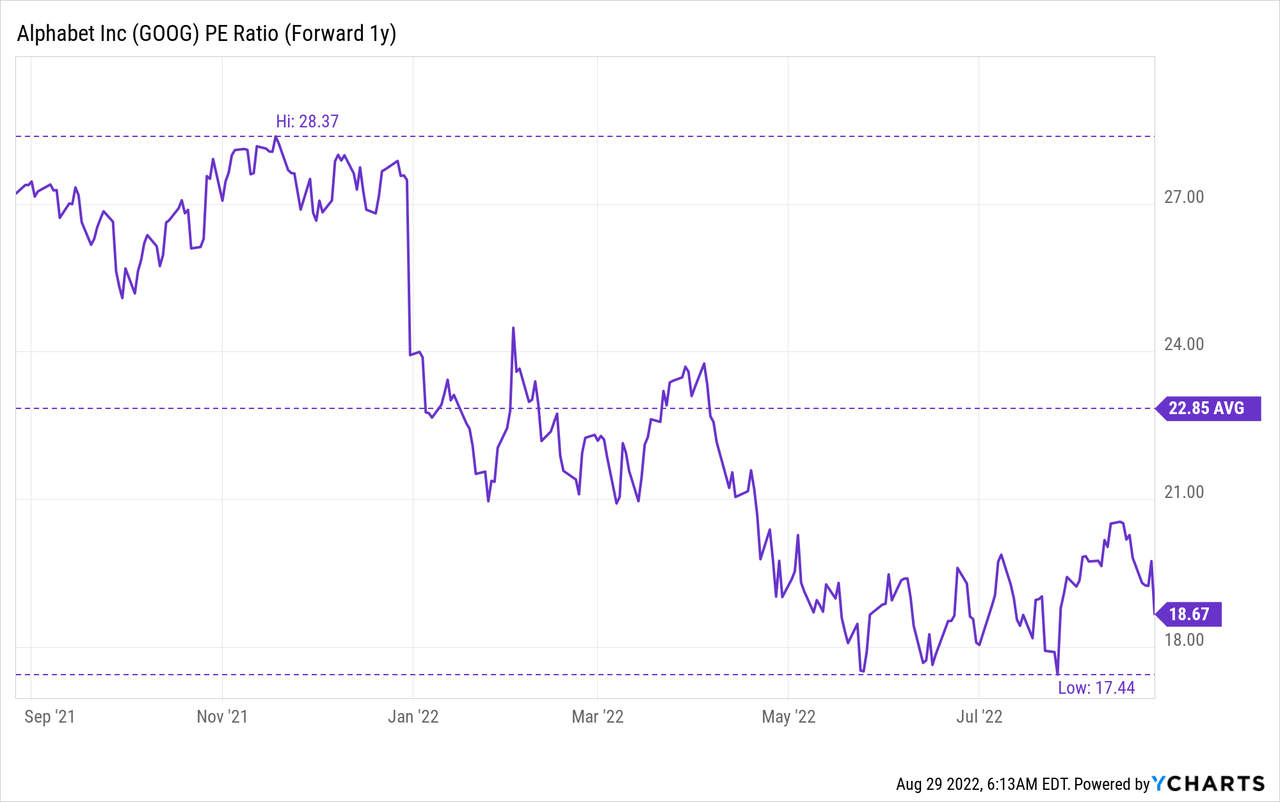

Above all, Google stock is really cheap

I am buying Google chiefly because of its robust presence in the Cloud business, strong market positioning in Search, and strong free cash flow that allows for such large buybacks. What improves Google stock’s appeal for investors is that the technology firm has an extremely attractive valuation based off of earnings… especially after GOOG went through a near-10% decline in pricing in since mid-August.

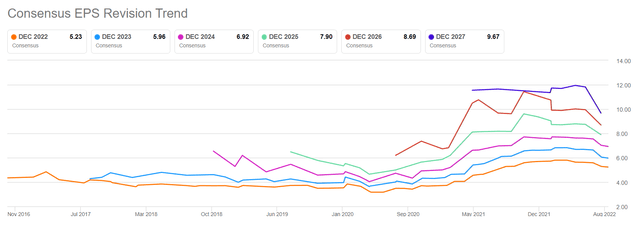

The market has adjusted its expectations for EPS growth downwards lately, in part because of Google’s exposure to the digital advertising market. In the last 90 days, there were 34 downward EPS revisions and only 1 upward revision.

Seeking Alpha: Googles EPS Revisions

Because of a fairly recent wave of down-grades in EPS predictions, the stock is very attractively valued at a P/E ratio of 18.7 X and it now trades below the 1-year average P/E ratio of 22.9 X. The expectation is for Google to generate EPS of $5.96 in FY 2023 which calculates to a year over year growth rate of 14%. As Google’s valuation ratio drops towards its 1-year P/E low of 17.4 X, I would consider buying more.

Risks with Google

The biggest commercial risk for Google is an unexpected slowdown in the Cloud business and the possibility of losing market share to Amazon Web Services and Microsoft Azure. Google is the third-largest Cloud provider in the U.S. market and has seen steady market share gains in the last four years which gives the technology company a good position to grow revenues rapidly. However, if Google lost momentum in the Cloud market at the same time as the ad business goes into in a cyclical down-turn, shares could revalue lower.

Final thoughts

The more it drops, the better the value of Google gets. Google is still an advertising-dependent business with an ad revenue share of 81%, but this is going to change going forward. I believe Google is uniquely positioned to ride out the down-turn in the digital advertising market as enterprise customer adoption of Cloud services grows. The firm’s huge free cash flow, strong prospects for growth in the Cloud market and stock buybacks make Google stock a buy-once-and-forget stock. I consider Google’s valuation, based off of earnings to be extremely attractive for long term investors and I believe that the risk profile is heavily weighted towards the upside after a near-10% drop!