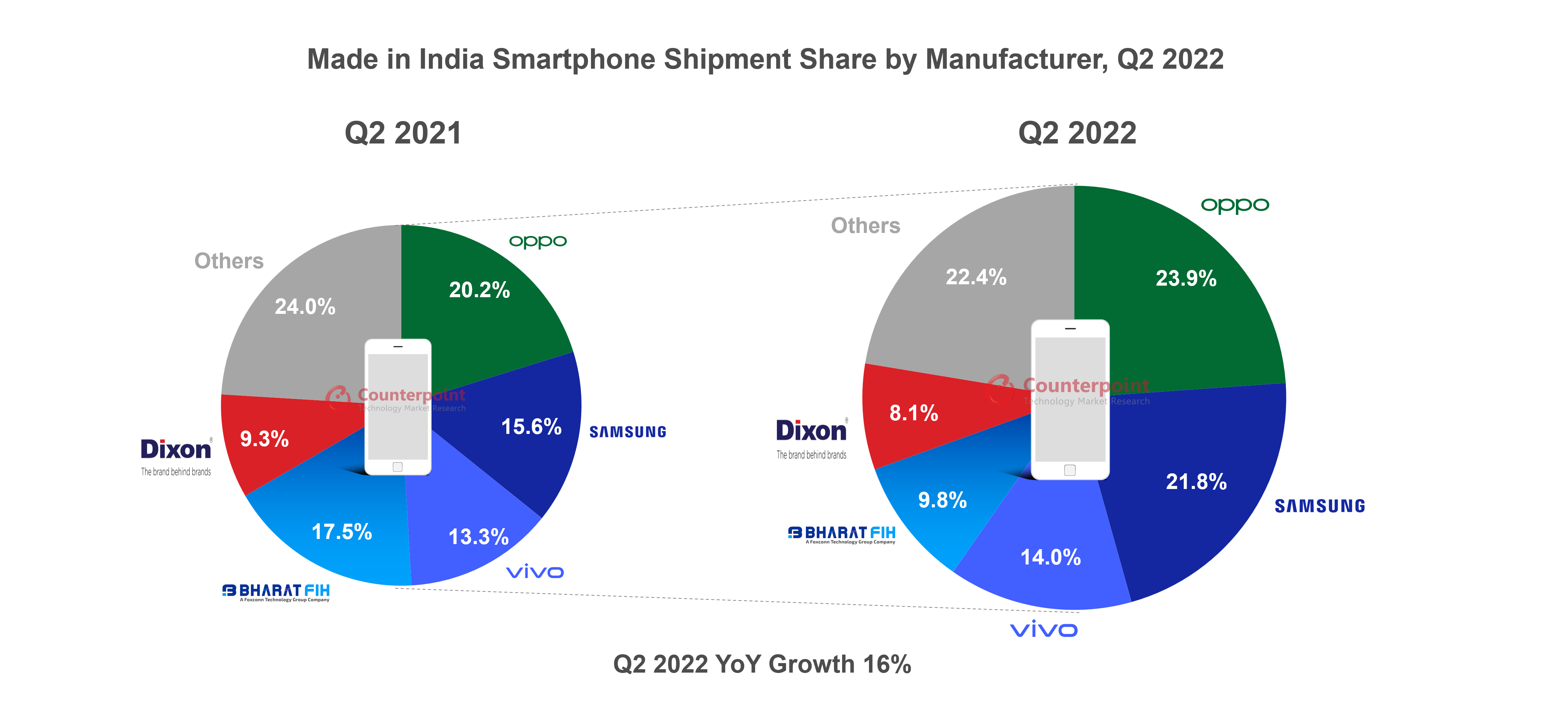

- OPPO led the ‘Made in India’ smartphone shipments with a 24% share, followed by Samsung.

- Lava led the ‘Made in India’ feature phone shipments with a 21% share.

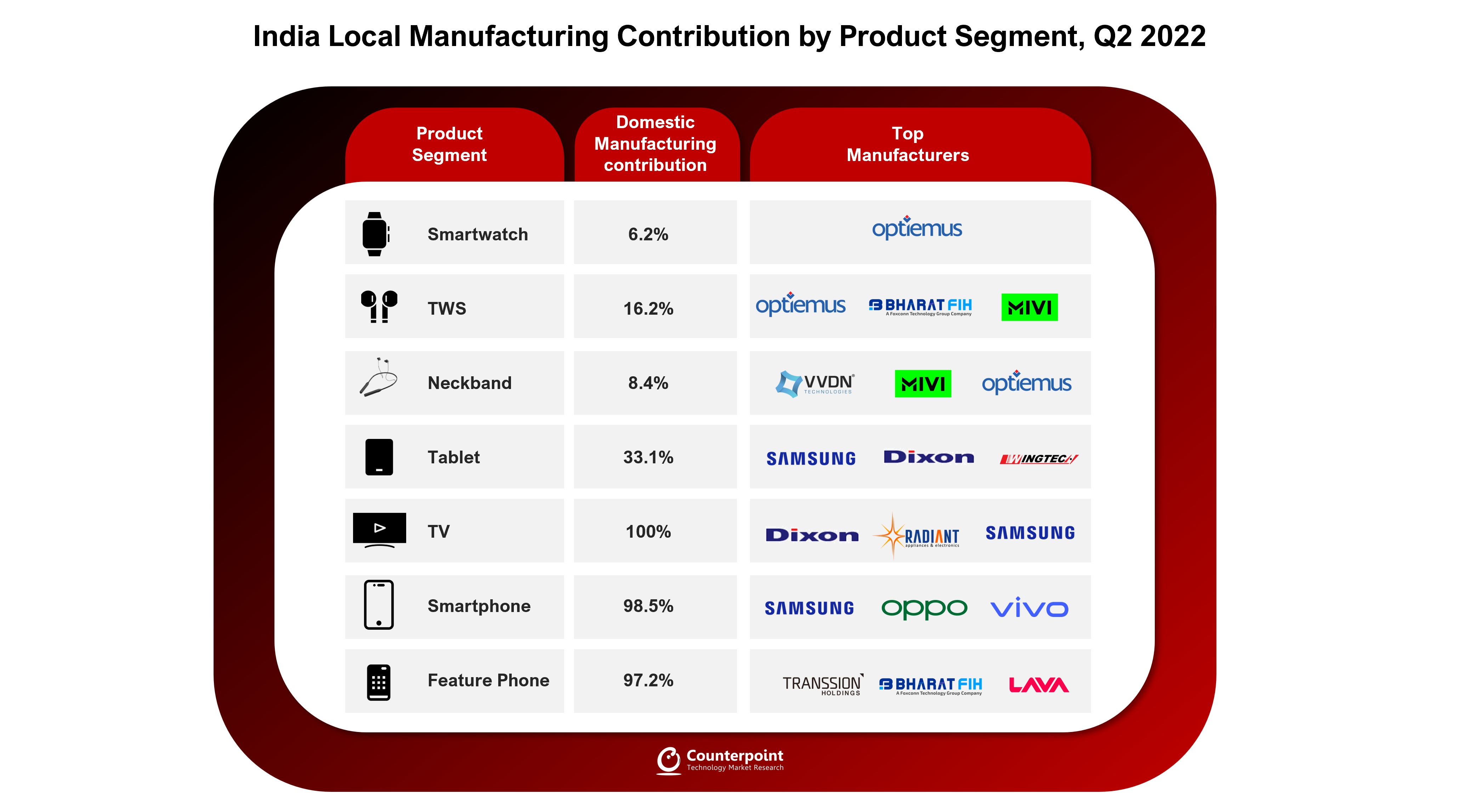

- In the wearable segment, TWS led in terms of domestic manufacturing with a 16% contribution, followed by neckbands and smartwatches.

‘Made in India’ smartphone shipments grew 16% YoY in Q2 2022 (April-June) to reach over 44 million units, according to the latest research from Counterpoint’s Made in India service. This was the first quarter of the new financial year and the companies pushed for higher output to meet the criteria for PLI incentives.

Commenting on the local manufacturing ecosystem, Senior Research Analyst Prachir Singh said, “The Made in India smartphone shipments grew as compared to last year. During the quarter, we witnessed increasing investments in the Indian manufacturing ecosystem with new plants being set up as well as existing ones being expanded. Recently, OPPO announced the Vihaan initiative under which it plans to invest $60 million in the next five years to empower the local supply chain. Samsung also increased its manufacturing with the premium segment smartphones, especially the Galaxy S series. Going forward, the upcoming festive season will further drive the Made in India shipments due to the expected increase in local demand.”

On the manufacturing landscape and strategies, Singh said, “In the smartphone segment, in-house manufacturing contributed to almost 66% of the total Made in India shipments in Q2 2022, while the rest of the 34% shipments came from third-party EMS players. OPPO led the Made in India shipments with a 24% share, followed by Samsung and vivo. Among the third-party EMS players, Bharat FIH, Dixon and DBG were the leading players during the quarter. Padget Electronics (396% YoY), Wistron (137% YoY) and Lava (110% YoY) were the fastest growing smartphone manufacturers during the quarter in terms of shipments. Also, we may see disbursement of PLI incentives during Q3 2022, which will further boost the local manufacturing sentiments. In the feature phone segment, Lava led the Made in India shipments, capturing more than 21% share. Lava is also the leading mobile phone player among the Indian brands in terms of shipments. It is the only company that is designing its products in India. Going forward, Lava is expected to expand its product portfolio as well as manufacturing capabilities.”

Note: Figures may not add up to 100% due to rounding

The local manufacturing push is now impacting other product segments as well, particularly the CIoT segments. The Indian government’s push with multiple PLI schemes has been showing a positive impact and we saw increased local manufacturing share in product segments like smartwatch, TWS, neckband and tablet. Optiemus leads the Made in India shipments for smartwatches with more than 75% share. In TWS, Optiemus, Bharat FIH and Padget are the top three manufacturers. In the neckband category, VVDN and Mivi have a 90% share in the Made in India shipments. In the tablet category, Wingtech, Samsung and Dixon are the top players while in the TV category, Dixon, Radiant, Samsung and LG have a 50% share in the Made in India shipments.

On the Indian government’s focus, Research Analyst Priya Joseph said, “The government aims to make India an electronics manufacturing hub in the next four to five years. In its vision document released earlier, the government considers consumer electronics segments like smartphones, laptops, tablets, TVs, TWS and electric components as among the most promising for India’s transformation as an electronics hub. To help drive more initiatives under the themes of Make in India and Digital India, the government, in its last budget, pushed the total allocation to $936.2 million. This step not only aims to incentivize India-based manufacturing but also catalyse investments in the sector to support job creation, ease of doing business, import reduction and export promotion.”

Going forward, with the Indian government’s additional focus on building an overall ecosystem for semiconductors in the country, the country will witness a rapidly expanding electronics manufacturing and innovation ecosystem. By doing so, it does not only aim to become an important destination for manufacturers and investors but also ensure its strategic position in the global value chain.