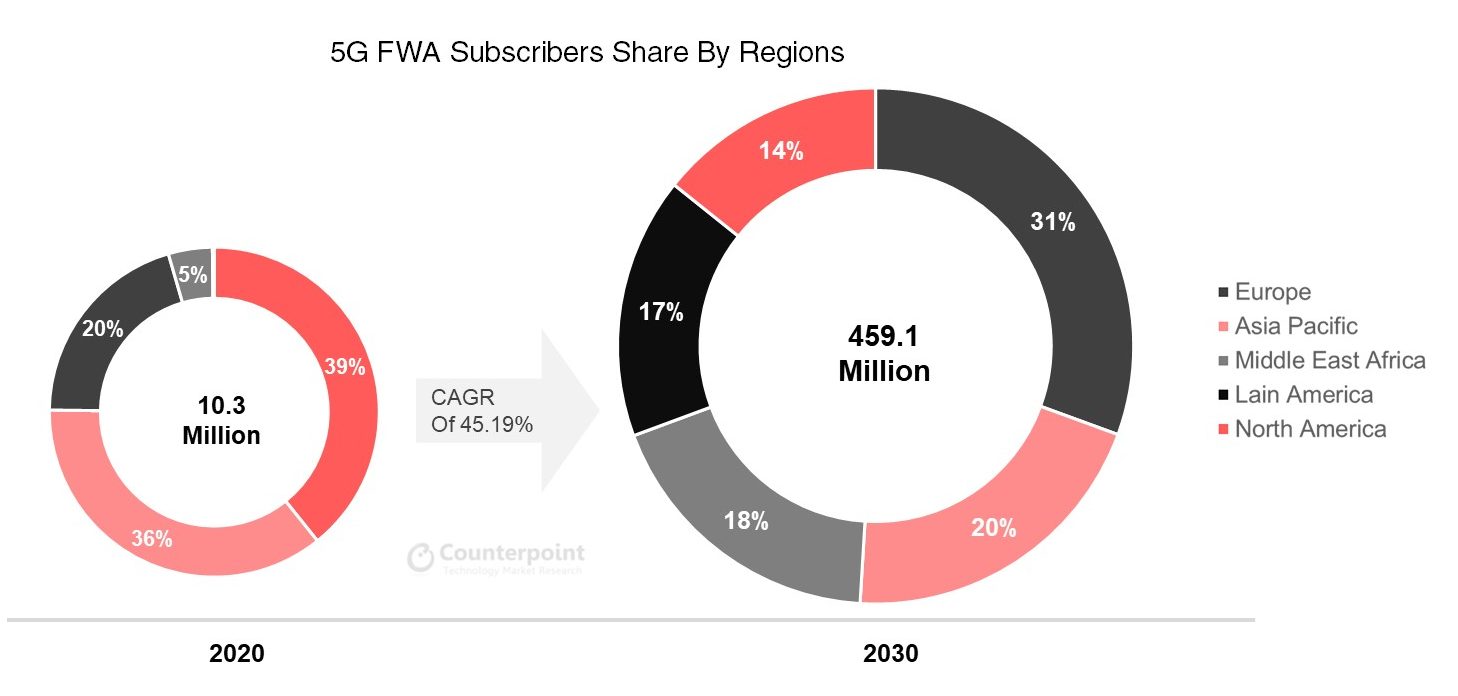

- 5G FWA will account for almost 90% of FWA connections by 2030

- Europe will be the top region in terms of 5G FWA subscriptions

Fixed wireless access (FWA) is emerging as one of the leading use cases for 5G New Radio (NR) architecture, rapidly gaining momentum as a scalable alternative to fixed broadband, according to the latest research from Counterpoint Research’s Emerging Technology Opportunities (ETO) Practice. Counterpoint Research predicts that FWA (4G+5G) subscriptions will rise from a 4% share of the consumer broadband market today to account for nearly a third of the household broadband market and cross half a billion subscriptions by 2030.

Less than half of households globally have access to fixed broadband and there is a lot of pent-up demand for fixed broadband at home. Counterpoint estimates that 45.1% of households worldwide had dedicated broadband access by the end of 2019. If we exclude China and the US, this penetration drops to 28%, indicating a lot of room for growth.

Commenting on this emerging trend, Senior Analyst Tina Lu notes: “A lot of the pent-up demand for broadband comes from the “Next Billion” segment, which comprises large parts of the population across both developed and emerging markets that are still not connected to the internet. Further, COVID-19 has accelerated the need for consumers to acquire fast and stable broadband access beyond smartphones. Besides, the existing broadband users also need to upgrade to faster networks capable of stable download and upload connections. The fiber and other fixed wired broadband connectivity remain elusive for many of these consumers. Hence, the increased availability of FWA will enable the Communication Service Provider (CSP) community to offer broadband services over the 5G NR spectrum and network architecture to different corners of the world, adequately addressing this need”.

5G Consumer Household FWA Subscribers by Region

Source: Counterpoint Research Broadband Subscribers Tracker by Technology and Regions, July 2020

Source: Counterpoint Research Broadband Subscribers Tracker by Technology and Regions, July 2020

Lu further adds: “Global consumer 5G FWA will reach more than 50 million connection in 2025 and increase to more than 450 million in 2030. North America and Asia are leading the 5G FWA subscription base in 2020, representing more than 75% of total connections. Deployment of mmWave in metro areas and CBRS in the rural and remote areas is driving FWA growth in the US. However, by 2030, Europe will have the largest 5G FWA installed base, mainly upgrade from its massive DSL subscriber base.”

There are several CSPs around the world that have launched or are conducting trials of 5G FWA. Starting with the Verizon launch, several CSPs have begun trialing FWA solutions to launch over the next 12 to 15 months with broader and denser coverage. The US and Europe are seeing most of the activity with countries like the US, Germany, UK, Italy, France, and Switzerland among the leading markets for prospective FWA launches. There is also activity in markets as far apart as South Africa, Turkey, and Canada. In the Asia-Pacific region, Australia, New Zealand, the Philippines, Sri Lanka, and Thailand among others have launched FWA services.

However, a CSP should consider some key points when planning to deploy 5G FWA. Consulting Director and lead author Shiv Putcha note: “New spectrum availability is one of the primary drivers for FWA momentum around the world. Most of the FWA activity taking place in EMEA and Asia is in the sub-6 GHz frequency bands while the US is focused on the mid-band mmWave spectrum. CSPs can now leverage their licensed spectrum assets more efficiently for offering alternatives to fixed broadband, thereby opening up a new segment for mobile CSPs in particular. This will especially be true for the mmWave frequencies which offer significantly higher channel widths and much higher capacity. The increased availability of FWA will also enable CSPs to offer broadband over one network, as opposed to building fixed and mobile networks side by side. That said, CSPs need to have focus and identify the correct revenue model to ensure that the business case holds up. Once they finalize their strategy, CSPs will need to carefully dimension their networks to ensure adequate resource availability to their installed base of (Customer Premises Equipment) CPEs.”

The global migration to LTE has laid an excellent foundation for the viability of FWA and will become an early and viable use case for 5G. However, there are challenges, particularly on the implementation side, which will be addressed as we progress towards the next decade of 5G rollouts and better network planning.

Commenting on 5G FWA network infrastructure best performance, Associated Research Director Gareth Owen said: “Using more plentiful high-frequency mmWave spectrum and leveraging beamforming and lower latencies, 5G FWA will be able to provide much higher performance than 4G FWA. It will also offer guaranteed service levels, making FWA competitive with fiber-based broadband networks.”

FWA as one of the early use cases for 5G is already well established. So, much of this growth will be built on the new capabilities that CSPs are building in terms of network architecture as they upgrade to 5G, first in the NSA mode, and ultimately to the SA mode in a few years. While Counterpoint has projected nearly half a billion FWA subscriptions by 2030, this only covers the consumer segment. Significant potential exists for CSPs in other areas.