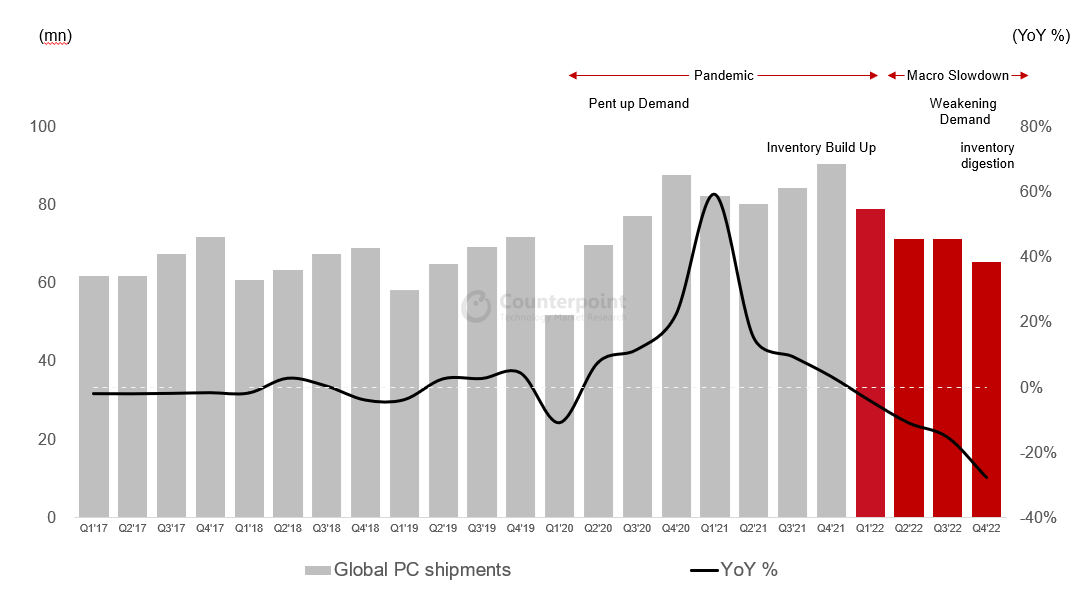

- Global PC shipments fell 27.8% YoY in Q4 2022 to reach 65.2 million units.

- For the full year of 2022, the shipments declined 15% YoY.

- Macroeconomic headwinds, increasing inflation pressure and frozen PC demand affected the global PC market in 2022.

- Soft demand in H1 2023 will cause heavy pressure on shipments. Therefore, we do not see annual shipment growth in 2023.

Global PC shipments left Q4 2022 with a record-high YoY decline of 27.8% to reach 65.2 million units, according to Counterpoint Research’s data. Although inventory levels of several OEMs and ODMs likely peaked in Q3 2022, the year-end season failed to accelerate the PC shipment momentum in Q4. At 286 million units, the total PC shipments for 2022 also reflect a muted global PC demand with four consecutive quarters of YoY shipment declines. Therefore, we are not expecting a decent rebound in H1 2023.

Macroeconomic headwinds, increasing inflation pressure and frozen PC demand affected the global PC market in 2022, with shipments declining 15% YoY. Besides, consumers who bought new PCs were still enjoying the latest models, whereas enterprises were working more carefully on their budgets. Also, the lack of appealing functions and financial support could not bring in incremental demand in 2022, not to mention the aggressive inventory digestion target of OEMs since H1 2022.

Record YoY Shipment Decline in Q4 2022

Source: Counterpoint Research

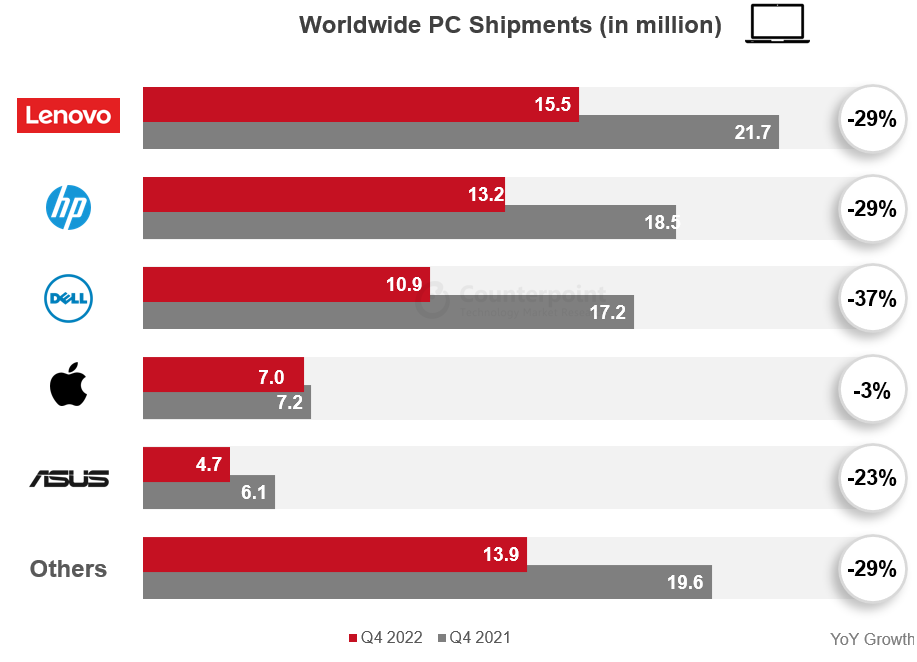

Lenovo continued to lead the market in Q4 2022 but with a flattish 23.7% share. Mild inventory correction dragged the company’s performance amid a lackluster holiday season. Its shipments declined 17% YoY in 2022 to take a 23.7% market share. We expect Lenovo’s shipment decline to normalize along with demand revival in the Chinese market in 2023.

HP secured its second place in Q4 2022 with a 20.3% share. Its shipments declined 29% YoY during the quarter but it was the only major PC OEM to report positive sequential shipment growth in Q4, thanks to improving shipment performance in North America and a lower base in Q3. HP had the largest shipment pullback in 2022 due to weak consumer demand across the globe. The company ultimately recorded a below 20% market share in 2022. But we expect a meaningful share rebound in 2023.

Dell’s 16.7% market share was the lowest in the past seven quarters largely due to an enterprise demand slowdown. As the economic situation remains weak, the company is not expected to see rapid pick-up for commercial models in 2023, which is crucial for Dell to narrow the market share gap with HP. Therefore, we may see pressures on Dell’s share (17.4% in 2022) and shipment performance in 2023.

Apple’s comparatively tiny 3% YoY shipment decline in Q4 2022 helped the company close the book with a flattish shipment volume performance for 2022. Apple kept gaining market share at the expense of x86-based vendors and recorded a double-digit share in the second half of 2022 and 9.4% in the full year. Arm-based M-series models helped the company weather the slump cycle in both consumer and commercial devices in 2022.

Global PC Shipments by Vendor, Q4 2022

Source: Counterpoint Research

Windows on Arm a key focus in 2023

Despite near-term headwinds, we could still see global PC shipment volumes higher than pre-COVID levels in the coming years, thanks to the continuous work environment and lifestyle changes and delayed procurement from both consumer and commercial sectors after H1 2023. Consumer demand will likely see gradual rebound in H2 2023 followed by a slower warm-up in enterprise procurement. Soft demand in the first half will cause heavy pressure on global PC shipments. Therefore, we do not see annual shipment growth in 2023.

Eying Apple’s M-series success, Qualcomm’s Arm-based Oryon CPU will likely enter the market and heat up Windows-on-Arm momentum in 2023. We see mid-single-digit YoY shipment growth for Arm-based laptops compared to the global laptop market’s high-single-digit shipment decline in 2023.