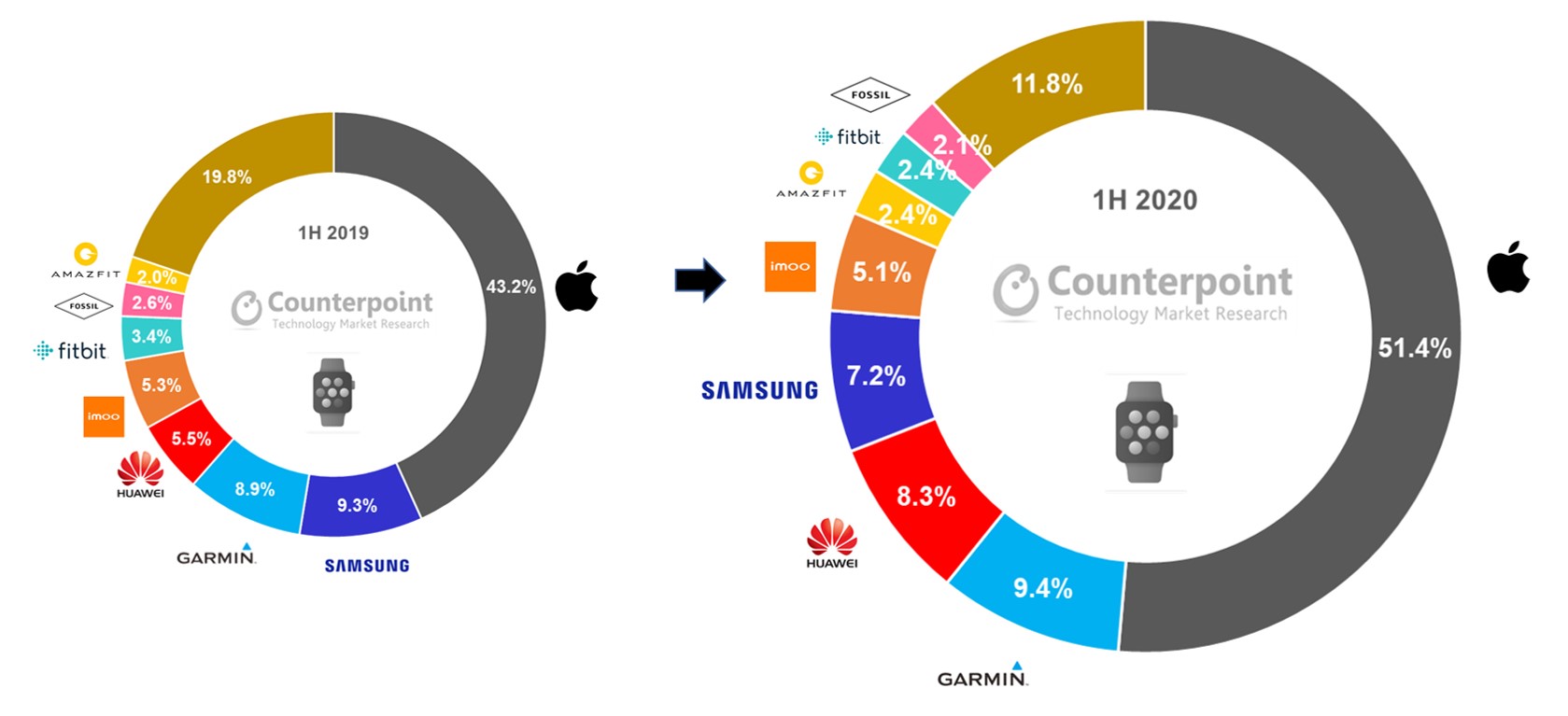

- The top three brands contributed more than 69% of the total market revenue in H1 2020.

- The global smartwatch market posted a healthy 20% revenue growth despite the COVID-19 pandemic and shipments remaining flat in the first half of 2020 compared to the same period last year, according to the latest research from Counterpoint’s IoT service.

Commenting on the smartwatch market dynamics, Senior Analyst Sujeong Lim said: “The smartwatch space remains a popular consumer device segment, compared to the downturn seen in smartphone demand and many other segments in the first six months of 2020 due to the devastation caused by COVID-19. Close to 42 million smartwatches were shipped in the first half of 2020 as wearables continue to see greater demand with consumers becoming more health-conscious. India (+57% YoY), Europe (+9% YoY) and the US (+5% YoY), the most affected regions of COVID-19, saw healthy growth in smartwatch shipments which offset the decline in other markets.”

Exhibit 1: Global Smartwatch Shipment Revenue Share % in H1 2020 vs H1 2019

Lim added: “Apple continued to dominate the smartwatch market both in volume and value. Apple captured a record half of the market in terms of revenue due to strong demand for the Apple Watch S5 models. In terms of shipment volumes, Apple Watch grew 22% globally with Europe and North America being the fastest-growing markets in the first half of 2020.”

Commenting on the competitive landscape, Vice President Research Neil Shah said: “Huawei saw healthy volumes (+57% YoY), jumping to the second spot globally in the first half of 2020. Huawei benefitted from significant demand for its smartwatches, especially the Watch GT2 series in its home market China and Asian markets, with shipment volumes growing 90% in both the regions. Garmin, the second-largest brand in terms of revenue globally, continued to make strides cornering the sports enthusiast and athlete market. The brand saw healthy demand (+31% YoY) for its Forerunner and Fenix line, making up one of the broadest portfolios of smartwatches in the market. Europe and North America remain the key markets for Garmin.”

Talking about fast-growing brands, Shah said: “Amazfit (+51% YoY) and Xiaomi (+47% YoY) made healthy strides during the first half with expanding portfolios and better geographic reach. China, India and the rest of Asia remain central to these brands’ growth story. Samsung faced some headwinds during the first half, but the launch of Galaxy Watch 3 in the second half could drum up some demand for the Korean vendor. Fitbit, Ticwatch and Suunto faced some tough competition from Garmin and Apple during the first half and will thus look forward to ramping up initiatives to ignite the demand during the holiday season.”

Exhibit 2: Global Smartwatch Best-Selling Models by Shipment Volumes, H1 2020

Commenting on other smartwatch trends, Research Director Jeff Fieldhack said: “Google WearOS continues to account for 10% of the total smartwatch market, behind Apple WatchOS. Huawei’s Lite OS and Amazfit’s Amazfit OS are growing fast. Further, the cellular-capable smartwatch is becoming more popular and accounts for more than one in four smartwatches shipped, benefitting the likes of Qualcomm. Heart rate monitoring now is featured in almost 60% of the smartwatches. Fall detection and SPO2 are features that should see mass-adoption in future models. Square form-factor accounts for almost two-thirds of the smartwatches globally as the form factor is helping to better fit additional sensors and needed battery footprint. The massive leaps in battery life and processing power are helping to better track overall health as continual heart rate, sleep and other monitoring can be done instead of the device sitting on a charger. The leaps in solar charging technology will also help OEMs concentrate on better monitoring. We expect to continue to see a focus on fitness and wellness applications.”