Global cellular IoT module shipments reduced by 4% YoY and 28% QoQ during Q1 2020 due to the negative impact of COVID-19 outbreak, according to the latest research from Counterpoint Global Cellular IoT Module and Chipset Tracker. However, IoT module shipments based on the Low Power Wireless Access (LPWA) technology increased by 51% during this quarter, offsetting the decline in automotive and other mobility applications. The falling prices, lower power consumption and extended coverage are the major reasons for growing popularity of LPWA modules among other cellular technologies.

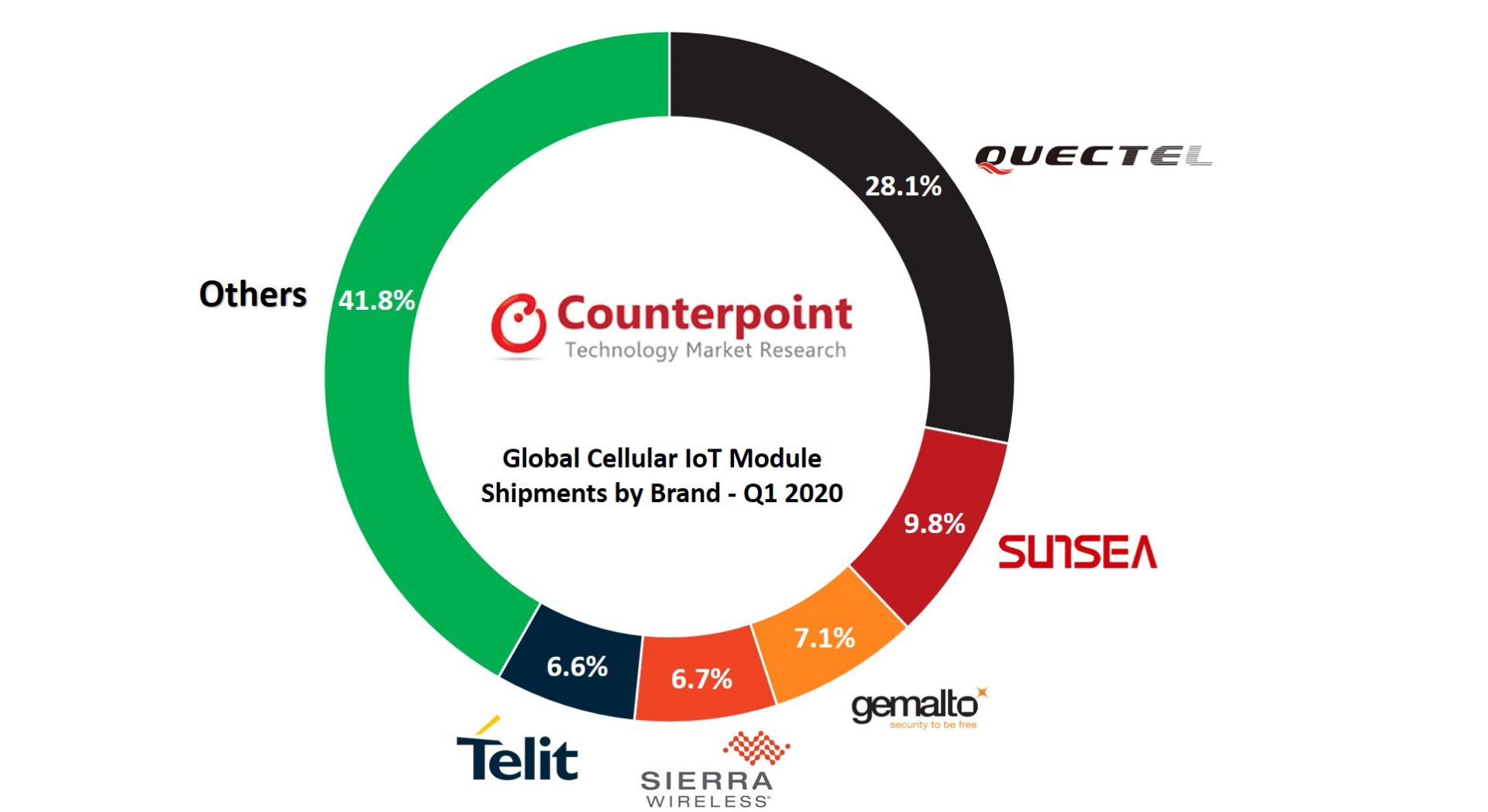

Research Associate Soumen Mandal said: “Driven by a wider geographic reach, faster time-to-market, excellent IoT application support, aggressive marketing and a broader portfolio, with the MC, M and BC series modules performing well, Quectel managed to retain top spot in the global cellular IoT module market. However, SLM152, ME909 and SIM868 modules from Meig, Huawei and SIMCom, respectively, did well to help these brands compete with Quectel. Further, cost-effectiveness is helping other Chinese players like Fibocom, MobileTek, Lierda and Neoway to increase share in the global cellular IoT module market. International vendors such as Gemalto, Sierra, Telit and u-blox continued to maintain top rankings behind Sunsea IoT and Quectel with strongholds in North America, Europe and other developed markets.”

Exhibit 1: Global Cellular IoT Module Shipments by Brand – Q1 2020

Research Associate Anish Khajuria said: “The average price of IoT modules decreased by 12% YoY in Q1 2020. The rising demand for low-cost LPWA modules such as NB-IoT, LTE-M and LTE Cat-1 has been driving the overall IoT module ASP down. Quectel, Sierra Wireless, Gemalto, Telit and Fibocom are top five players in terms of IoT module shipment revenues globally. However, the rise of long-tail but region-focused brands like Cheerzing, Cavli Wireless, AM Telecom, Kyocera and Yuge is witnessing good traction.”

“Industrial, enterprise and automotive are top application areas for cellular IoT modules. With the rising connectivity and autonomy in automobiles, demand for 4G and 5G modules will rise in coming years,” said Senior Analyst Aman Madhok.

Madhok added: “Again, smart manufacturing and smart industry applications in the age of Industry 4.0 will see increasing demand for cellular IoT modules to reduce power consumption, increase efficiency in the production process and connect machines to cloud for optimal business planning.”

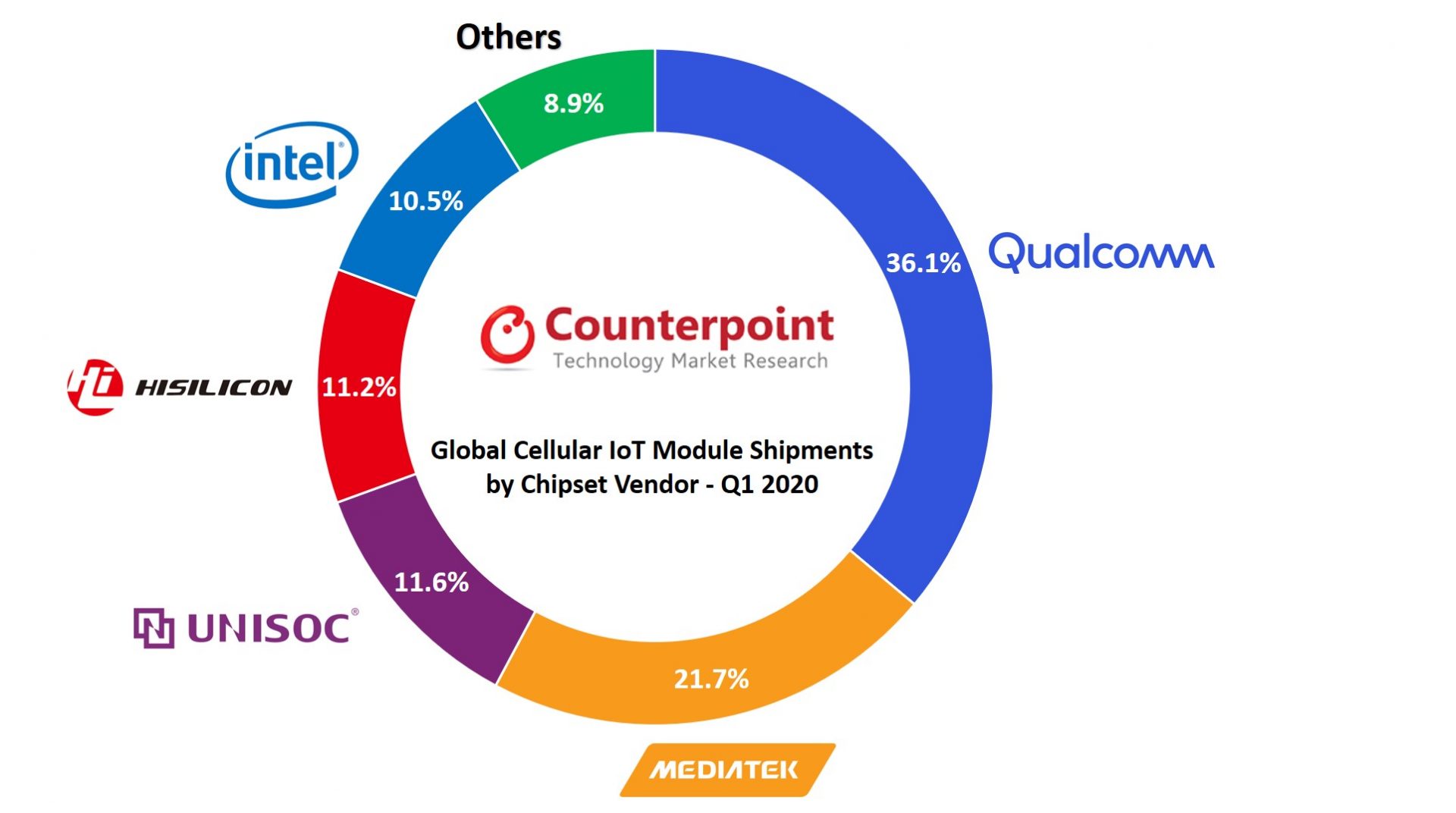

Vice-President Research Neil Shah noted: “Qualcomm is leading the share of chipset shipments powering the IoT cellular modules. Diversifying product offerings, robust supply chain network, innovation and price competitiveness have helped Qualcomm maintain collaboration with major cellular IoT module players. With the shift in focus for Intel away from the cellular modem business, coupled with significant growth in NB-IoT, LTE-M and LTE Cat-1 technologies in key markets such as China, US and Europe, growth opportunities open up for other chipset brands. MediaTek, UNISOC, Hisilicon, Sony (Altair Semi) and newer players such as ASR and Nordic Semi will look to increase their overall market share globally.”

Exhibit 2: Global Cellular IoT Module Shipments by Chipset Vendor – Q1 2020

Commenting on future deployments, Research Associate Fahad Siddiqui said: “China will dominate the global cellular IoT module market in coming years, with North America and western Europe emerging as important markets. With more deployments of 5G network around the world, the demand for 5G modules will increase. Connected vehicles, CPEs and routers for FWA, industrial robots and video surveillance will be some of the key 5G IoT module driven applications, especially in markets such as North America, China, Korea, Taiwan, Japan and UK initially.”