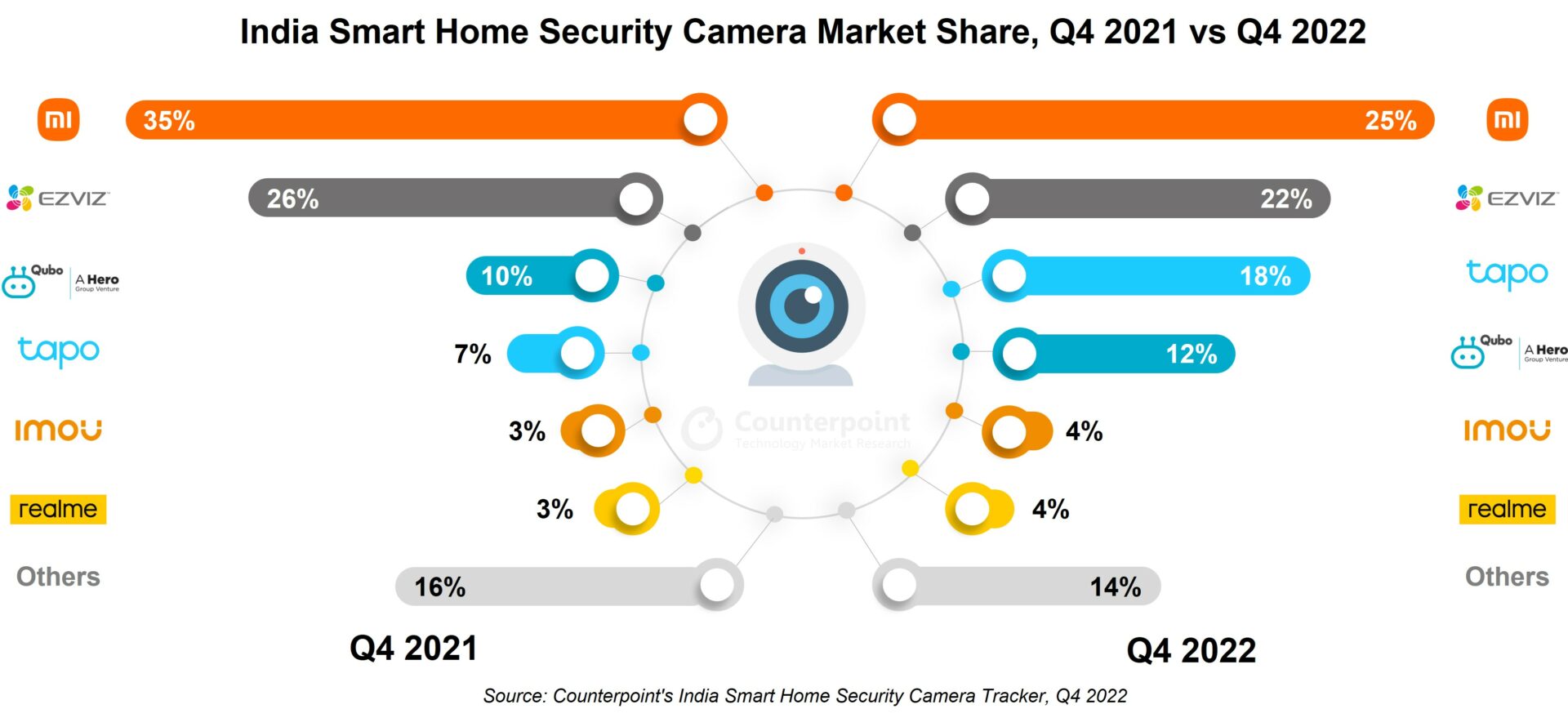

- The market’s shipments grew 44% YoY in 2022 but its Q4 2022 (October-December) performance was closer to Q4 2021.

- Shipments in the INR 1,500-INR 2,500 price band remained the highest in 2022, capturing 64% share.

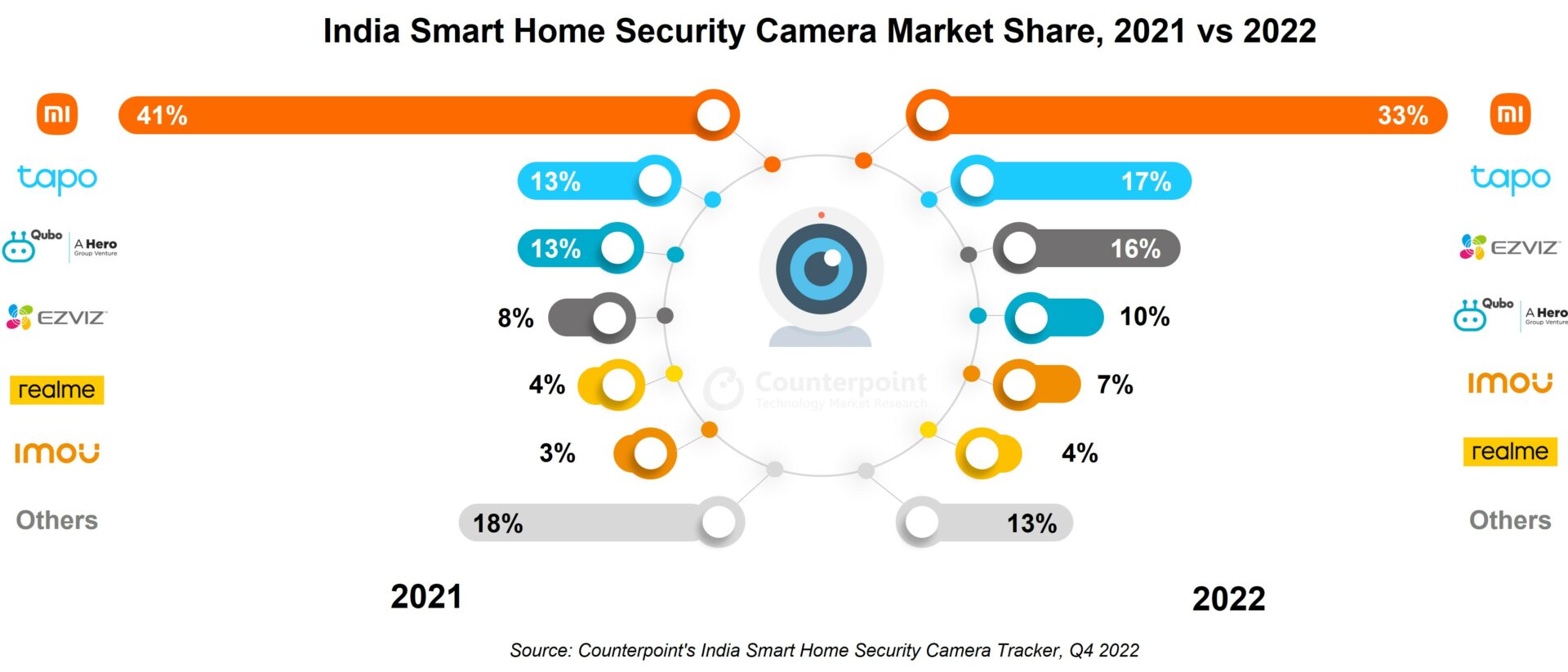

- Xiaomi led the market in 2022 with a 33% share.

- Tapo registered 88% growth and maintained its second position in 2022 with a 17% share.

- EZVIZ jumped to the third spot with a 16% share as its shipments almost tripled.

India’s smart home security camera market shipments experienced 44% YoY growth in 2022, according to the latest research from Counterpoint’s Smart Home IoT Service. In the first three quarters of 2022, the market saw a surge in demand, which resulted in strong YoY growth. However, the market slowed down in Q4 2022 (October-December) after Diwali due to seasonality and weaker demand, which brought the market closer to what it was in Q4 2021.

Research Analyst Varun Gupta said, “The market grew significantly in 2022 as more consumers are becoming aware of smart cameras. In a price-sensitive market such as India, the entry-level price point of smart cameras (INR 1,500 or ~$18) also creates a big demand pull. Shipments in the INR 1,500-INR 2,500 price band remained the highest in 2022, capturing 64% share. The discount offers around Diwali further pushed the sales in 2022. As safety remains a prime concern among consumers, the market is expected to perform well in 2023. Smart cameras are gaining more popularity among small and medium retailers as they are less expensive and easy to install.”

Note: Figures may not add up to 100% due to rounding

Commenting from the brands’ perspective, Gupta said, “We expect the market to remain consolidated till H1 2023, even though the top three brands currently capture a combined share of 66%. However, we saw the entry of newer brands into the Indian market in 2022, which increased the competition and brought down the average selling price. In terms of features, the 2MP camera remains popular among users, but we expect the 3MP camera to gain more traction as it is becoming more affordable. Though the market remains online driven, the offline market has started to gain traction in the past year through efforts from major brands.”

“The market remains dominated by Chinese players, with the Indian brands accounting for 23% of total shipments in 2022. The domestic production during the year stood at 12%, still very low for an emerging market. However, we expect domestic manufacturing to pick up in the coming period as more Indian brands look to foray into this market, such as Airtel.”

Looking at the market segmentation, Senior Research Analyst Anshika Jain said, “The indoor smart security camera accounted for more than 80% of the total shipments mainly driven by increased awareness and importance of indoor home security. Even residential developers are increasingly installing smart camera devices due to the hybrid work model.

Note: Figures may not add up to 100% due to rounding

India Smart Home Security Camera market summary

- Xiaomi grew 15% YoY in 2022 to lead the market with a 33% share. It launched a new 3MP 2K camera in Q3 to offer a more premium experience to its customers.

- Tapo by TP-Link continued to be at the second spot in 2022 with an impressive 88% annual growth and a 17% market share. Tapo dominated online marketplaces such as Amazon and Flipkart. Its growth can also be attributed to the diversified range of products along with aggressive pricing. The C200 remained the brand’s bestseller smart camera in 2022.

- EZVIZ by Hikvision rose to the third position with a 16% market share. The brand experienced strong demand for its indoor and outdoor cameras. It offers a diverse portfolio and banks on its expertise and dominance in the surveillance market.

- Qubo by Hero Electronix saw a 10% YoY rise in shipments in 2022 with a 10% market share. It is the only Indian brand among the top five players and has a focus on local manufacturing. Qubo performed well on the online channels during the festive season. The Home Cam 360 Indoor camera was one of its bestsellers.

- Imou by Dahua Technologies was the fastest-growing brand in 2022 with a 7% market share. Its Ranger series of cameras has been performing well on online platforms. It offers the lowest entry price point for 3MP and 4MP cameras.

- realme ended 2022 with a 4% market share and 38% YoY growth. It only offers one model as of now, but given its rising popularity as a brand, it is expected to offer more SKUs in the future to cater to different audiences.

Other emerging brands

- CP Plus is a well-known Indian brand in the surveillance industry and is taking big strides in the smart camera market as well. It ended 2022 with a top-10 position and 2% market share. The brand, which has been focused on the domestic production of smart cameras, is gaining popularity in the online market.

- Zebronics experienced a decline of 24% YoY in 2022 and ended up in the top 10 with a market share of 2%. The lack of consumer awareness around its offerings and its products not being updated with the latest features were the key reasons for this decline.

- D-Link recorded 17% growth to reach the top 10 with a 2% market share. It is the second networking giant to focus on smart cameras in the Indian market. The brand, which has positioned itself in the entry-level space, offers a couple of devices.