Huawei shipments in China increased, leading to a decline in Qualcomm market share

The tightening of restrictions on Huawei will hit HiSilicon shipments and help Qualcomm and MediaTek gain market share

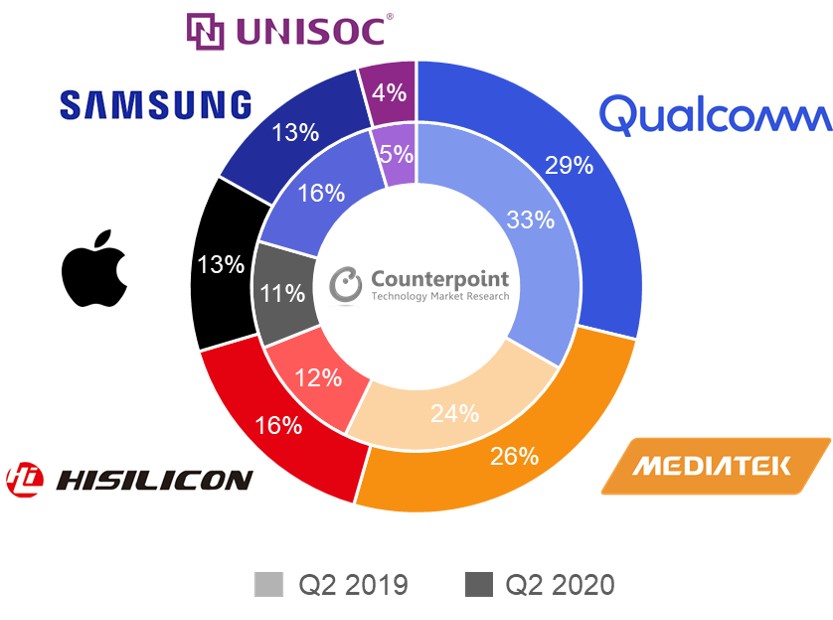

The smartphone application processor (AP) market declined 26% in the second quarter of 2020 as smartphone sales plummeted due to the COVID-19 pandemic and resulting restrictions. Qualcomm led the market with a 29% market share, a drop of 3 percentage points compared to last year.

Commenting on the decline in market share for Qualcomm, Neil Shah, VP of Research at Counterpoint, said: “While the overall smartphone market declined due to the ongoing pandemic, the decline in market share for Qualcomm was partly also due to Huawei, which increased the use of HiSilicon APs after US restrictions, and its growing share in China, the world’s largest smartphone market. Qualcomm’s share in Huawei (including HONOR) smartphones declined from 12% in Q2 2019 to 3% in Q2 2020.”

We are already seeing manufacturing picking up pace because of pent-up demand in major regions. However, more restrictions on Huawei’s (HiSilicon’s) ability to manufacture chipset at TSMC cast a major doubt on its future smartphone sales.

Shah added: “It is not all bleak for the smartphone segment. For example, 5G smartphone sales more than doubled (+126%) in Q2 2020 from just a quarter ago. This trend will try to offset the overall decline in the first half and fuel the growth back in 2021. This will also create significant opportunities for AP suppliers to increase the share of semiconductor content even if the overall market volumes remain lower this year. Furthermore, the restrictions on Huawei will drive the growth for Qualcomm, MediaTek, and Unisoc.”

Exhibit 1: Global application processor (AP) market share – Q2 2019 vs Q2 2020

Expanding on the potential shift in competitive dynamics due to Huawei restrictions, Research Analyst Shobhit Srivastava said: “OPPO, Vivo, Realme and Xiaomi will be the key drivers for Qualcomm and MediaTek as they look to fill the big gap which Huawei might leave behind in near- to mid-term. And this could be more beneficial for Qualcomm in the premium segment ($400+ wholesale), especially in China where Huawei dominates with over 40% market share, and in the mid- to high-tier segments in markets like Europe. In the mid and low segments, MediaTek with its affordable 4G and 5G solutions will gain popularity in markets such as China, Russia, and Middle East & Africa (MEA) as Realme and Xiaomi look to target Huawei’s market share.”

Exhibit 2: Smartphone AP market share by region – Q2 2019 vs Q2 2020

Highlighting new areas of growth for AP vendors, Srivastava said: The advent of 5G will drive cloud gaming as one of the killer use-cases, bringing newer experiences in the premium segment. Additionally, we are also seeing increasing demand for casual and advanced gaming at the mass-market level. Thus, the affordable smartphone segment with gaming capabilities is estimated to grow a massive 1011% in 2020.

He further added, Smartphone AP vendors are capitalizing on this opportunity by launching solutions with higher clocked GPUs and support for higher display refresh rates – 90 Hz, 120 Hz, and even 144 Hz elevating the gaming experience in the affordable segment. With 5G coming to lower price segments, mobile gaming is estimated to grow further due to its low latency connectivity. As a result, we are seeing OEMs working with AP vendors to add more models with gaming capabilities via solutions such as MediaTek G-series and Qualcomm G variants in the Snapdragon 6 series.