Finance leaders, challenged to improve decision support and still reduce costs, should do more to leverage robotic process automation.

The COVID-19 pandemic has upended the finances of most organizations and created new urgency for finance leaders to provide data-driven decision support to the business as strategies reset. To free up bandwidth for such high-value activities, finance leaders could deploy robotic process automation (RPA) more widely to repeatable finance function activities, but they will first have to show the value of RPA investments in today’s cost-constrained environment.

When RPA is successfully applied to automate tasks such as accounts payable and budgeting and forecasting, it frees up employees to focus on the most impactful decision-support aspects of their jobs.

But adoption of process automation in finance overall is still limited, often due to RPA implementation roadblocks. In today’s resource-constrained environment, it is even more important for finance leaders to build buy-in for RPA investments by proving the value of automation.

“To secure ongoing investment, finance leaders will need to articulate the operational efficiency and productivity benefits, schedule and prioritize RPA activities to maximize their business impact, and generally prioritize or reprioritize RPA investments in line with the organization’s post-pandemic business priorities and strategy,” says Melanie O’Brien, VP, Gartner.

4 keys to getting buy-in for finance RPA investments

RPA is system-agnostic software that seeks to mimic the human role in processes and make those processes more automatic, repeatable, faster or less error-prone. So far, finance teams have most often used RPA to capture efficiencies and reduce costs, and have realized value in areas such as financial reporting.

To position RPA investment programs more strategically, finance leaders need to justify investments in part by showing they have a plan to realize the benefits. They will need to deal with these four issues in particular:

1. How to fund and staff RPA

Many large-scale finance transformation initiatives have been postponed or canceled amid ongoing cost pressures, so finance leaders need to fence off RPA to protect it from broader cost-containment measures.

“RPA initiatives can be relatively low cost and the technology is mature so, if it is implemented well, it can yield benefits quickly,” says O’Brien. “Try to structure these investments as cost-neutral, where the cost is offset by measurable efficiency gains.”

“The most successful case studies of RPA adoption have leveraged internal staff to become citizen developers”.

A practical way to limit the cost is to use a flexible staffing model that doesn’t rely on outside consultants but instead is led by finance and supported by IT. Finance leadership ensures maximum business impact, but IT expertise is critical to identify requirements, select vendors and set up infrastructure.

The most successful case studies of RPA adoption have leveraged internal staff to become citizen developers, which has lowered the cost of and reliance on external support and also kept the RPA-technology expertise within the organization. This has also led to further utilization of automation beyond the original project scope, as internal staff are encouraged to highlight activities and tasks that should be next on the list to automate.

2. Overcome the finance capacity challenge

One of this biggest challenges to RPA adoption is a lack of resources or staff time — a situation exacerbated by COVID-19 because finance departments are in crisis mode dealing with the volatility. But smooth RPA adoption requires proper staffing, so justify that by focusing on the payoffs.

“Give the finance team confidence to invest time in RPA’s success by positioning RPA as critical to business process efficiency and linking it to wider corporate objectives,” says O’Brien.

Also find ways to leverage citizen developers and any broader network of individuals with an interest in automation.

3. Catch the second wave of automation opportunities

The COVID-19 crisis has exposed the inability of many finance teams to provide insights to business decision-makers. Finance leaders may not see RPA as part of the solution because it is an efficiency- and productivity-focused technology, but it can contribute.

Finance leaders should be asking whether RPA can automate any of the tasks that currently keep the finance team from focusing its time on delivering great insights. For example, RPA can automate the process of extracting customer information from an internal system and entering it into a spreadsheet for analysis.

4. Rebuild goals and metrics

Devise a continuous performance management methodology to ensure the project continues to meet expectations, taking into account the maturity of the RPA program and company priorities.

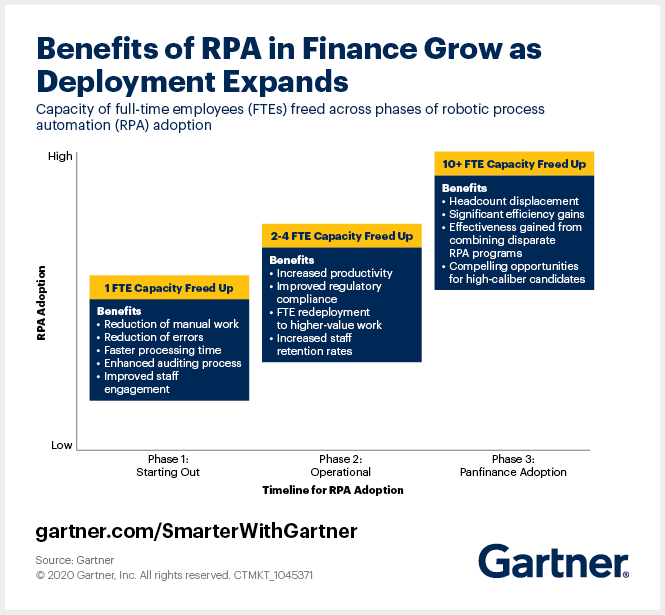

Most businesses will see three waves of benefits from RPA throughout the different phases of deployment. The capacity of full-time employees (FTEs) is increasingly freed as maturity increases across three phases:

- Phase 1: About 1 FTE’s worth of time is freed as RPA reduces manual errors and increases processing time.

- Phase 2: As more bots are operationalized, RPA starts to enable FTE redeployment to high-value work, increased productivity and regulatory compliance.

- Phase 3: Ten or more FTEs are displaced and significant efficiencies are gained as adoption widens.

But to assess the benefits of an RPA solution more broadly, employ performance metrics that account for company priorities, ideally using a balanced scorecard approach aligned to the key metrics of business success. For example, if the organization is growing rapidly and needs to scale across support functions, finance leaders may look to weight productivity more heavily. If the organization is more focused on improving internal culture, these leaders might favor metrics relating to employee engagement.