JAKARTA, Indonesia–(BUSINESS WIRE)–FICO (NYSE: FICO), a leading global provider of analytics software, today announced further findings from its consumer fraud survey exploring attitudes and preferences towards fraud checks. The study revealed that almost half of Indonesians are willing to commit fraud to obtain a loan or file an insurance claim. However, it also highlighted that financial institutions can generate increased revenue and drive sales through a successful fraud protection function.

More information:

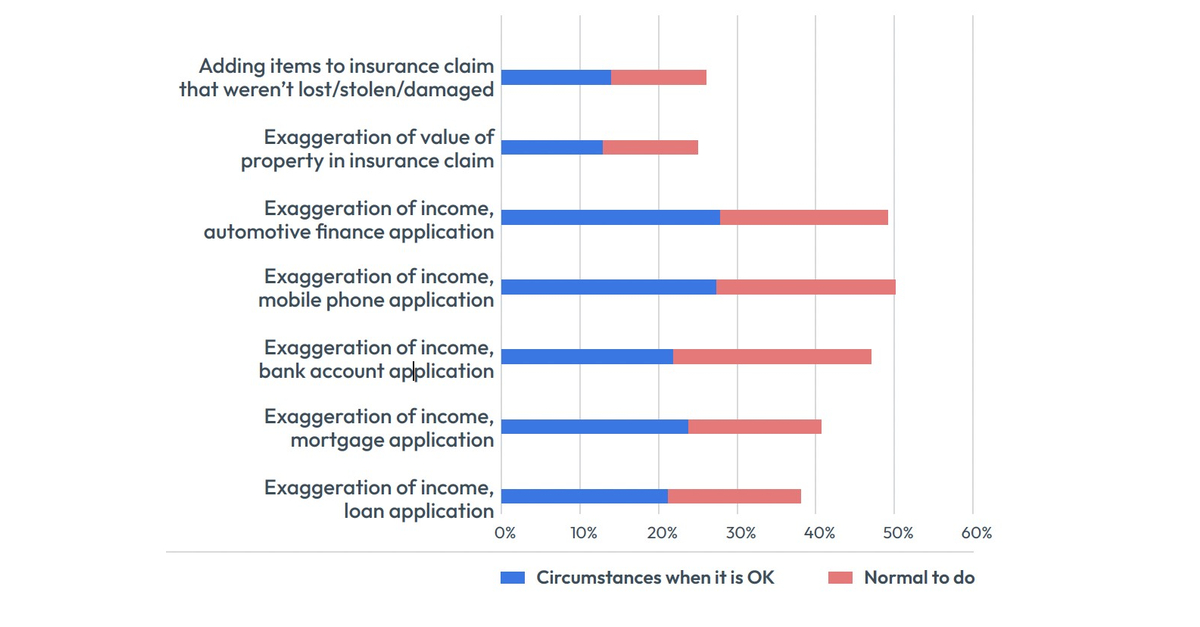

Giving false information is considered acceptable by many

When asked about their attitudes to giving false information for financial or material gain – known in banking as first-party fraud – half of Indonesians supported these behaviors. Around 25 percent of respondents said there are circumstances when it’s OK to exaggerate income on a loan or mortgage application, while 15 percent thought it was normal to do so. The survey revealed similar proportions of consumers would exaggerate an insurance claim or add items to a claim.

“Our findings underline the importance of robust fraud prevention strategies in safeguarding customers’ interests and strengthening the bottom line,” said C.K. Leo, FICO’s lead for fraud, security and financial crime in Asia Pacific. “With almost half of Indonesians show a willingness to commit fraud for monetary reasons, it should alert lenders to bolster their fraud defenses.”

This sentiment is consistent with Southeast Asian neighbors Thailand and The Philippines (50 percent), and interestingly even more pronounced in Malaysia where over 60 percent of the respondents said such behaviors are normal.

The results indicate that banks in Indonesia may be making inaccurate risk assessments as a result of false information on applications, potentially leading to financial losses from inflated insurance claims. Additionally, customers may not be aware that providing incorrect information on applications or claims is illegal.

“The rising costs of living and uncertain financial climate have driven some Indonesians to take drastic measures to obtain credit and other means to make ends meet,” said Leo. “However, misrepresenting information constitutes fraud. By enhancing their ability to identify overstated or false information, financial institutions can proactively protect themselves against losses caused by customers’ defaulting on repayments. In doing so, they can also support customers in avoiding regrettable outcomes.”

Fully leveraging data and analytics to drive fraud protection

Financial institutions frequently possess the evidence required to distinguish between fraudulent and legitimate applications. However, fraud teams are frequently unable to utilize this data because it is siloed. These inefficiencies result in inadequate fraud protection and compromise the customer experience. Banks prompt customers with arduous and time-consuming identity checks, resulting in increased costs and duplications that cause frustration for customers.

“In a highly competitive banking industry, a flawed fraud strategy can prove to be expensive,” said Leo. “A fraud team’s success hinges on balancing between strong protection and fulfilling the genuine needs of customers. With a holistic approach to an applicant’s data, fraud teams will be able to better separate fraudulent applications from legitimate ones. The application of analytics and machine learning models will further bolster a bank’s defenses while generating higher levels of customer satisfaction.”

Conducted in late 2022, the report surveyed 1,000 people each in 14 countries: Indonesia, the USA, Canada, Brazil, Mexico, Colombia, Peru, Malaysia, Thailand, The Philippines, South Africa, Germany, the UK and Sweden.

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive analytics, AI and data science to improve operational decisions. FICO holds more than 200 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, manufacturing, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in nearly 120 countries do everything from protecting 2.6 billion payment cards from fraud, to improving financial inclusion, to increasing supply chain resiliency. The FICO® Score, used by 90% of top US lenders, is the standard measure of consumer credit risk in the US and other countries, improving risk management, credit access and transparency.

Learn more at http://www.fico.com.

Join the conversation at https://twitter.com/fico & http://www.fico.com/en/blogs/

For FICO news and media resources, visit www.fico.com/news.

FICO is a registered trademark of Fair Isaac Corporation in the US and other countries.