LONDON: Slow uptake for interactive displays in key Western European countries proves to be a short-term drag on demand, with 2Q23 shipments falling 5.3% year-over-year (YoY), but the outlook remains strong according to Omdia’s latest Public Displays Market Tracker 2Q23.

“Despite a dip in volume for Western European interactive displays in 2Q23, there remains many avenues for growth over the next few years,” said Matthew Rubin, Principal Analyst at Omdia. “Countries like France, Italy and Spain still need to digitize many of their classrooms, while large enterprises are in the beginning stages of adopting interactive displays for hybrid meeting room environments.”

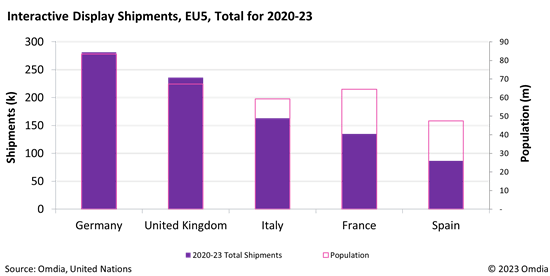

Interactive display shipments in Western Europe fell to 96k in 2Q23, down from 102k in the same time period last year. The biggest driver for this fall was a major slowdown in demand from Italy, with shipments there falling 27k, as government initiatives to boost education technology spending struggle to consistently fulfil their potential. Similar challenges are seen in Germany, with its Digitalpakt spending program needing a reboot, and in France, where there is significant potential but limited impetus.

Despite these short-term struggles, there remains opportunities over the next few years for display vendors looking to grow interactive display sales volume in Western Europe, with yearly shipment totals set to increase 5% from 2023-27. This is expected to come from both the education vertical and increasingly the corporate space, which has thus far been slow to fully embrace meeting rooms curated around an interactive display. Part of the difficulty has been the lack of certainty around office and meeting room requirements. However, large enterprises are finally agreeing a position, usually involving a hybrid working balance.

Stability is an essential factor for encouraging technology spending in the corporate sector, but so is design. FlatFrog’s OLED interactive display, using an LG Display panel, which was on show at Infocomm in June, highlighted this push toward more aesthetically pleasing interactive displays to encourage corporate demand.

In the absence of significant demand coming from the corporate vertical in recent years it has been the education market that has fueled demand for interactive displays. The post-pandemic push to digitize classrooms was transformational, and this growth driver is set to continue, though at a slower pace.

The UK has been a long-time proponent of these displays going into classrooms, with Germany playing catchup thanks to major spending through the Digitalpakt program, however other major European countries have been comparatively slow to adopt the technology. Italy has had some recent success with its National Recovery and Resilience program, forming a combination of EU and national government funding, while France and Spain remain a long way from achieving their potential addressable market.

France, specifically, must be seen as a major opportunity for interactive display vendors, with a major variance in the number of installed devices compared to the UK, which is similar in terms of addressable market size. However, there are obstacles to this demand being fulfilled, many of which are likely to be similar to those faced in Germany, in the early days of Digitalpakt, a lack of infrastructure and technical skills in the education system. A common complaint in Germany from the display industry has been the lack of internet connectivity in schools, which severely limits the usefulness of interactive displays.

Taking these limiting factors into consideration, it means growth for interactive displays through to 2027 is not going to reach the post-pandemic highs. However, the outlook remains strong in Western Europe, with untapped education markets and a broad opportunity to continue developing the corporate hybrid meeting environment.