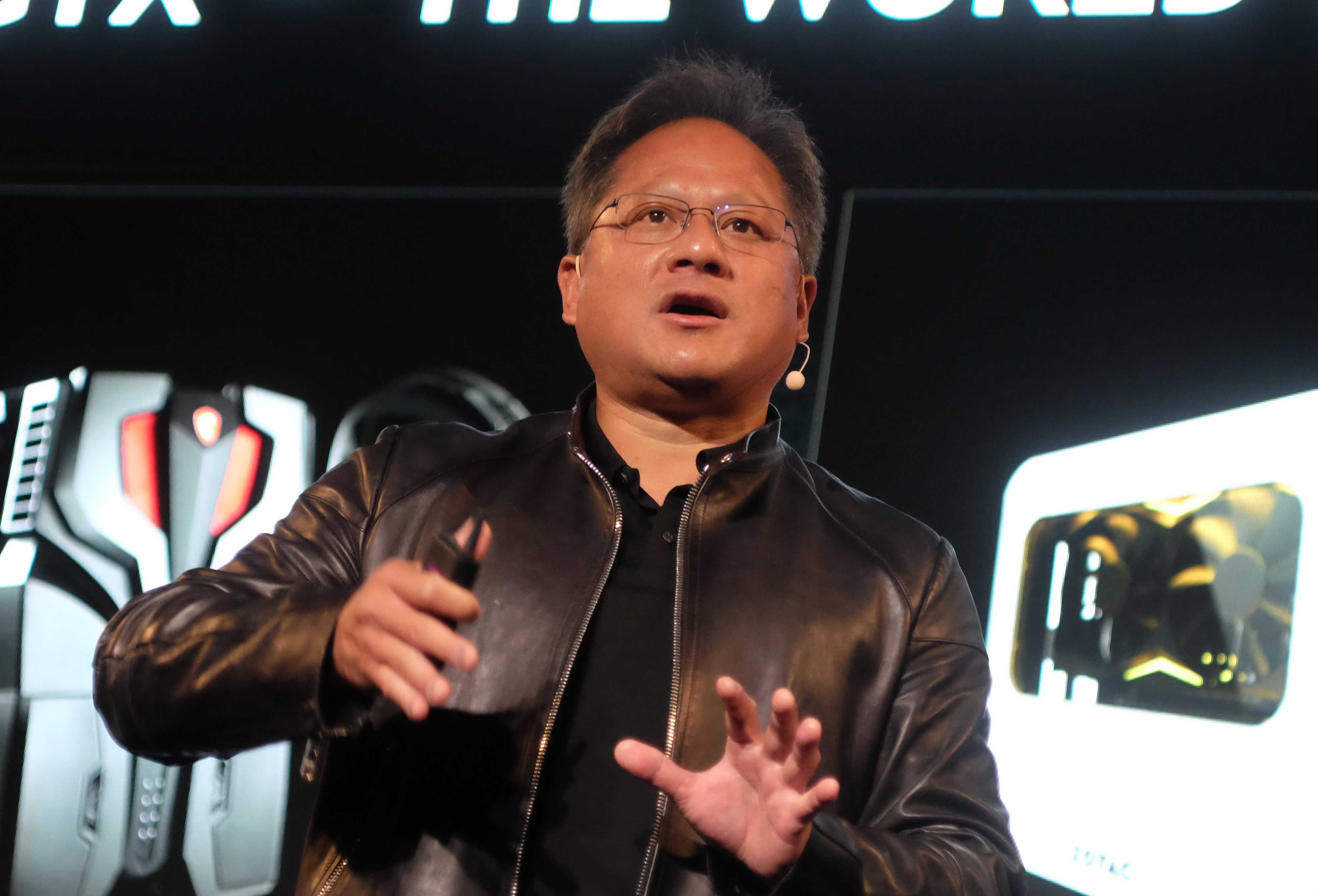

Jensen Huang, president and CEO of Nvidia, speaks during the Computex Show in Taipei on May 30, 2017.

SAM YEH | AFP | Getty Images

LONDON – Nvidia’s $40 billion acquisition of chip designer Arm will most likely be blocked, according to two technology investors and artificial intelligence experts.

In the “State of AI” report published Thursday, Nathan Benaich and Ian Hogarth list eight predictions for the industry over the next 12 months.

One of those predictions is: “Nvidia does not end up completing its acquisition of Arm.”

The U.S. chip giant announced earlier this month that it intends to buy Arm from SoftBank but the acquisition has been criticized by British lawmakers, Arm co-founder Hermann Hauser and others. Two of the main concerns from critics are that Nvidia will destroy Arm’s business model and make Arm staff redundant in the U.K.

Nvidia insists Arm will remain headquartered in Cambridge under the deal. It also says it will create more jobs in the U.K. and build a new supercomputer in the U.K.

Hogarth, who sold his start-up Songkick to Warner Music Group before becoming an angel investor, told CNBC: “We wouldn’t be surprised at all if it was blocked by somebody.”

That’s because there’s been a lot more discussion about “technological sovereignty” in the last few years, Hogarth said, before adding governments seem “a lot less afraid” about having those kinds of conversations.

Benaich, general partner at venture firm Air Street Capital and founder of AI meet-up group London.AI, said: “There’s definitely a non-zero, maybe a high non-zero, chance it doesn’t happen.”

NVIDIA has previously stated that “this combination has tremendous benefits for both companies, our customers, and the industry. For Arm’s ecosystem, the combination will turbocharge Arm’s R&D capacity and expand its IP portfolio with NVIDIA’s world-leading GPU and AI technology.”

With 6,000 staff globally and 3,000 in the U.K., Arm is widely regarded as the jewel in the crown of the British tech industry. Its chips are used by companies around the world to power millions of electrical devices. Apple uses them in iPhones and iPads, Amazon uses them in Kindles, and car manufacturers use them in vehicles.

The U.K.’s opposition Labour party has said an Arm takeover is not in the public interest and criticized the ruling Conservative Party for failing to protect the British chip designer.

On Sept. 21, Labour lawmaker Daniel Zeichner, member of parliament for Cambridge, called on the government to place clear conditions on the takeover of Arm. He wants legal guarantees on jobs, Arm’s Cambridge headquarters, and its business model. Zeichner also said it’s important to ensure the U.K.’s tech sovereignty is defended.

The deal could be blocked by either the U.K. government or the Competition and Markets Authority (CMA), which is responsible for regulating competition in the U.K.

“We’re not making a call on which actor does it,” Hogarth said.

People at the heart of the Cambridge tech scene have questioned Nvidia’s commitment to a new artificial intelligence lab in the city that was announced at the time of the Arm deal.

In the State of AI report, Hogarth and Benaich also predict Alphabet-owned DeepMind will make a major new breakthrough in structural biology and drug discovery and that a wave of Chinese and European defense-focused AI startups will collectively raise over $100 million in the next 12 months.