LONDON: The cellular IoT ecosystem is poised for significant transformation over the next seven years, driven by the rise of 5G technologies as revealed by new Omdia research.

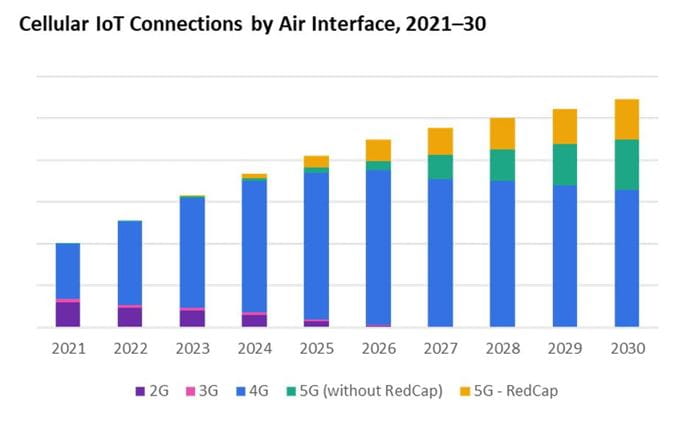

With a predominant focus on 5G RedCap, 5G Massive IoT, and 4G LTE Cat-1bis modules, the forthcoming shipments are anticipated to culminate in a substantial 5.4 billion cellular IoT connections (installed base) by the year 2030. This paradigm shift underscores the evolving landscape and increasing prominence of advanced cellular connectivity solutions.

The research also found that mass adoption of 5G RedCap is set to commence from 2024 onward with the technology establishing itself as a mid-tier connectivity solution for 5G devices that do not require such high specifications as Ultra-Reliable Low Latency Communications (uRLLC) and Enhanced Mobile Broadband (eMBB). It will also enable futureproofing of devices as the industry anticipates the eventual phase-out of 4G beyond the year 2030.

Source: Omdia

“2024 will be a pivotal year for 5G RedCap growth. This will begin in China, where most volume is expected and in due course subsidies will bring the module Average Selling Price (ASP) down to similar pricing as LTE Cat-1” commented Alexander Thompson, Senior Analyst for IoT at Omdia.

The forecast also finds that over 60% of IoT module shipments will come from the Asian & Oceania region, making up approximately 80% of IoT connections in 2023. Notably, the automotive sector emerges as a key driver, and is set to see the largest number of module shipments due to the growing demand for smart vehicles integrating 5G connectivity.

“Across the IoT value chain, Application Enablement Platforms (AEPs) continues to be the leading revenue generator. There remains a role for industry specific/pure-play AEPs despite the exponential growth of hyperscaler offerings and financial constraints for startups in the current economy” added Andrew Brown, Practice Lead for Omdia’s IoT group.

Omdia’s Cellular IoT Market Tracker 2023-2030 highlights the latest trends in the cellular IoT market, providing key analysis by region, air interface and application of module shipments, module revenues, connections (installed base) and connectivity revenues.