SUMMARY

RBI’s recent ban on Paytm Payments Bank has disrupted the best laid plans of India’s fintech startups, highlighting regulatory challenges and concerns over clamping down on innovation

Many believe that regulatory headwinds in the fintech landscape — epitomised by the massive impact on Paytm — will hold back inflow of foreign and domestic investments

Fintech stakeholders call for a balanced approach and more transparency from regulatory authorities to prevent value or investment erosion

On January 31, 2024, the Reserve Bank of India notice related to actions on Paytm Payments Bank all but crippled one of the most celebrated startups in the country. The notice, which effectively banned PPB from operations, not only came as a rude shock to Paytm, but the fears are trickling down to the entire fintech industry in India.

However, Paytm somehow took control of the situation by shifting its nodal account to Axis Bank. In the detailed FAQs issued on February 16, the RBI clarified that Paytm QR codes, soundboxes and card machines will continue to be operational after the revised March 15 deadline (earlier February 29) only if the merchants migrate to other banks.

Undoubtedly, Vijay Shekhar Sharma-led Paytm Payments Bank has faced a tumultuous period in the last 20 days. However, it’s essential to note that this isn’t the first instance of the RBI rattling the Indian fintech realm.

More recently, the central bank directed an unnamed card network to halt all card-based business payments made via payment intermediaries to entities that do not accept card payments with immediate effect.

For the past two years, dozens of startups have borne the brunt of the RBI’s policies, which has now snowballed into an industry-wide debate. Concerns and questions are being raised about whether the compliance burden is worth it, especially because it takes up so much of the focus away from running the business.

Founders and investors are also questioning the RBI’s regulatory action in connection to Paytm, which means others in the fintech sector are left in the dark about whether they need to change their operations.

The Heavy Hand Does Not Justify The Grounds Of Proportionality

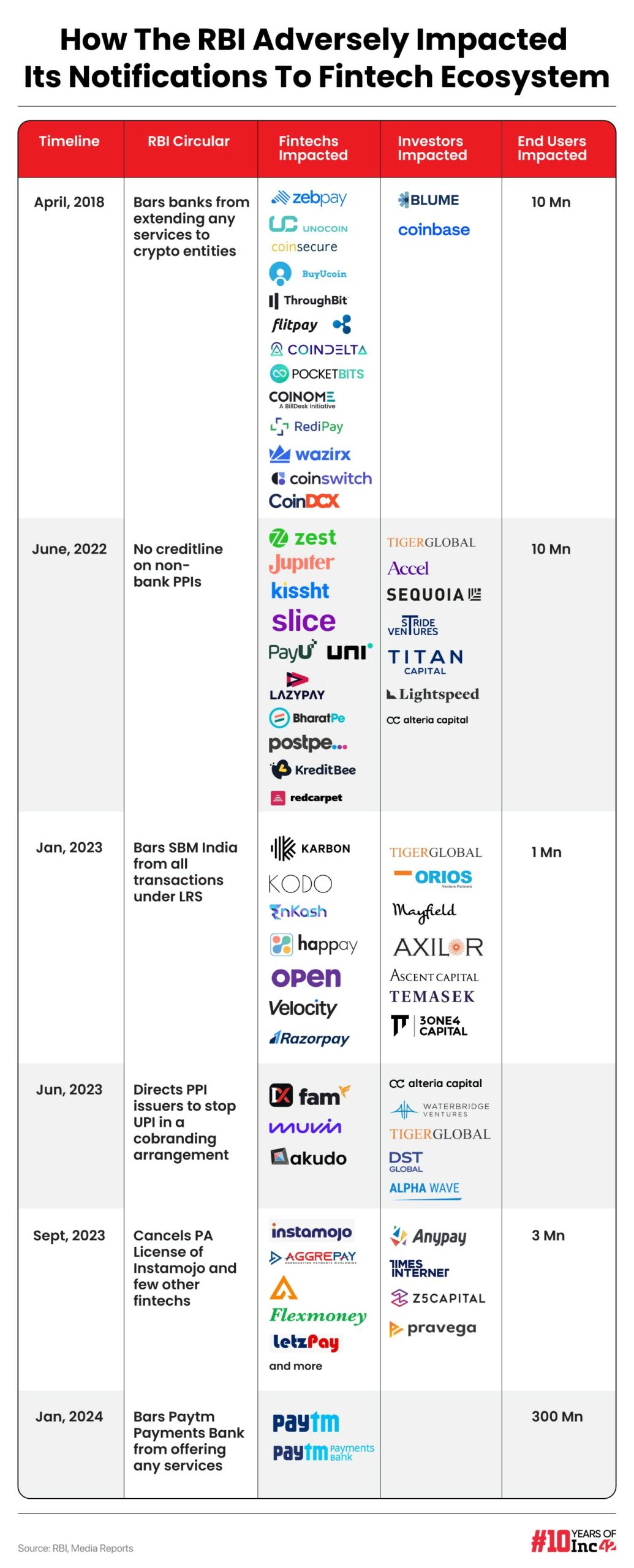

Some believe that various RBI’s regulatory measures (listed below) could have hampered over INR 2 Lakh Cr (a conservative estimate) worth of digital transactions and led to dozens of fintech startups shutting down, and millions of end-consumers losing their money.

Nikhil Pahwa, a tech policy expert and the founder of the news platform MediaNama, told Inc42, “Startups are inherently designed to exploit grey areas to scale rapidly. Excessive compliance greatly hinders their growth potential. In the fintech sector, a significant portion of the capital injected into companies to fuel rapid expansion and market capture has unfortunately been squandered due to certain RBI policies rendering their operations unviable or untenable from an investor perspective.”

Pahwa was one of the signatories to an open letter sent by noted investors and startup founders urging the RBI to explain its actions and revoke the bar on the Paytm Payments Bank.

Their feedback to the regulator has come after hundreds of fintech startups suffered significant setbacks due to RBI regulations. Several startups such as Coinome, Throughbit, Koinex, and Muvin were forced to cease operations following notices from the RBI, while others such as Slice, Jupiter, PayU, and Instamojo had to face business slowdowns due to one or the other reason.

As seen below, startups across stages and revenue scales, have had to bear the brunt of adverse regulatory action.

Many of these notices were issued by the RBI based on concerns and speculation in the market, leading to drastic measures.

For example, in April 2018, the RBI prohibited banks from providing services to crypto-based entities, citing speculation about how cryptocurrencies could potentially impact the Indian Rupee and end users negatively. This circular resulted in the closure of over 12 crypto entities within a year.

Two years later, the Supreme Court overturned this circular on the grounds of proportionality. In the subsequent circulars too, multiple founders argued that the RBI often lacks proportionality when dealing with fintech startups.

Another instance came on June 20, 2022, when the RBI directed all non-bank prepaid payment instruments (PPI) issuers to cease loading their payment instruments through credit lines.

This decision stemmed from concerns that many non-bank PPI issuers were competing with credit cards without meeting credit card compliance requirements. The RBI is said to have been monitoring this for about 18 months, but the final notice came all of a sudden, leading to many users being left helpless.

While there may be merits in the RBI’s arguments, what doesn’t sit well with fintech companies is the RBI’s unilateral approach, fintech founder said preferring to remain anonymous. “There were numerous ways the RBI could have acted without causing harm to many startups,” founde said about the past actions by the central bank.

Understandably, there’s a fear about talking openly against regulations, as this results in unwanted questions about whether a startup is indeed running afoul of the rules.

In the case of the PPI ruling, the belief is that the RBI could have allowed limited credit lines for existing players while prohibiting new players from issuing them.

Subsequently, the credit lines could have been gradually reduced. This approach would have enabled founders to explore other product options without being severely impacted by existing products, the founder added.

The Paytm Row Lacks Transparency

To be frank, everyone agrees that regulation is a must and all fintech startups must abide by the regulation. Inc42 spoke to over a dozen fintech founders, investors and tech policy experts and this was one of the key consensus points.

Early-stage VC firm Prime Venture Partners’ Sanjay Swamy said, “I have always maintained that there is no grey area in compliance, especially in fintechs – so the focus on compliance will be a lot more strict from now on; it’s simply non-negotiable.”

Paytm’s KYC measures, the payments bank’s association with Paytm, related party transactions, and opacity of wallet ownership have been questioned by many, but the fact is that RBI did not stop these before it became such a big issue, few highlighted.

For instance, Sucheta Dalal, a journalist who exposed the Harshad Mehta scam in the 1990s, said that the annual report of Paytm Payments Bank is not available separately, since it is a subsidiary or associate of One97 Communications (Paytm).

“SEBI disclosure rules don’t help. 58% held personally by the founder Vijay Shekhar, so how was it allowed to deal with such large public funds? Will the RBI and SEBI put out info for analysis even now or should we ONLY rely on pressers and leaks?” she asked.

The episode has hit the industry hard with investors rethinking their fintech investment strategy in the short-term or medium-term.

One of the biggest issues that fintech founders pointed out is the lack of transparency. “We are not questioning why the RBI took these measures, but how and for what exactly,” said a payments startup founder.

“Also, if a certain bank fails to meet the compliance within the given deadline. The RBI needs to interject with other instruments first such as a change of the directors, and appointing its director to make sure the bank becomes compliant among many other corrective measures. Why should the end consumers always suffer for the RBI’s regulatory inefficiencies?” asked the founder.

Besides publishing the circular, the RBI has been shying away from discussing the matter in detail. “Paytm Bank was given so much time. In our case, having initially secured a PA licence, it was later cancelled without any adequate time to find alternatives,” said another payments startup founder.

Interestingly, whether it’s the SBM India, Paytm Bank or in many other cases, the RBI has cited “Material Supervisory Concerns” to explain its actions.

In the latest Paytm row, the RBI had also added that the Comprehensive System Audit report and subsequent compliance validation report of the external auditors revealed persistent non-compliance and continued material supervisory concerns in the bank, warranting further supervisory action.

However, it didn’t reveal the magnitude of non-compliance that led to this scale of supervisory action to establish the very ground of proportionality.

This doesn’t help startups who want to abide by the compliances but often look confused and frightened when asked about regulatory issues and how they plan to tackle it, said an industry stakeholder.

Even Paytm founder and CEO Sharma could not delve into the exact issue in calls with analysts and claimed that the bank has been restricted from sharing more information with One97. It’s all a bit confusing at the moment, even for the company which has been hit the hardest.

Is Fintech Investible?

Investors are wary of the impact in the short and medium term.

As MediaNama’s Pahwa explained, “What’s happening in fintech is that after SaaS, this was the big bet for VCs in terms of trying to create a new industry and grow the market that now with a large number of companies faltering, and within ecosystem becoming very, very restrictive, because of RBI regulation, and especially with the scare that’s happening.“

Others claimed that VCs are going to be a lot more cautious about investing in highly regulated areas. It sends out a signal to founders about fintech having an entry barrier and it tells investors that exits and returns will not exactly come as expected.

“I think nobody will want to touch a domain where the RBI has a regulation,” Pahwa claimed.

The other worry is that this indicates that regulators are going to be very tight across sectors.

Despite the government’s claims, many believe that India has not really embraced ease of doing business. Dr. Somdutta Singh, serial entrepreneur, founder and CEO of Assiduus Global Inc, and angel investor, said, “These incidents prompt a reassessment of investment strategies, with a greater emphasis on due diligence and risk mitigation. While regulatory hurdles may necessitate adjustments in investment size and sector focus, the underlying potential of fintech remains compelling.”

Dr Singh added that prudent investors will seek opportunities in companies that demonstrate a commitment to compliance and resilience in the face of such regulatory challenges. It might result in VCs adjusting investment sizes or fine-tuning their sector thesis.

The fundamental role of a regulator is to safeguard consumer interests, setting guidelines that allow innovation to flourish without detrimental effects on the people that they aim to protect, believes Anirudh A Damani, managing partner, Artha Venture Fund.

“This understanding has been pivotal in our investment strategy, especially within the fintech sector, where rapid growth often treads a fine line with regulatory adherence. But recent actions serve as a reminder of the complexities inherent in navigating the fintech ecosystem. These instances highlight the essential nature of engaging with regulatory bodies, fostering an environment where innovation can proceed within the bounds of established rules.”

Among these cautionary tales, Swamy believes that there will be no slowdown in investments in the early stage fintech, because they can be more agile and adaptable.

Is RBI Even Equipped To Regulate Fintech?

MediaNama’s Pahwa believes that whatever growth has been seen by the fintech industry is in terms of lending or in terms of financial inclusion through wallets and UPI. He claims that a lot of this is not because of the RBI, but despite the RBI.

Kaushal Sampat, founder of risk management company Rubix Data Sciences, said that protecting consumers sometimes may seem contradictory to promoting financial innovation. Regulators have to constantly adapt their approach to reflect these diverse considerations and evolving markets.

The central bank is by design a regulator and it prefers to regulate banks and those entities that it can control tightly. Banks have a significant amount of compliance. And as such Paytm Payments Bank should also have had the kind of compliance that was required by the RBI, but fintech companies do not necessarily fall under the central bank’s purview.

Pahwa added that the RBI doesn’t like to regulate too many entities, such as thousands of fintech companies. “They would rather regulate a few banks, like maybe 50-100 banks, so they can keep tight control of this space. They don’t have the capacity or the willingness to really experiment or allow experimentation here. But that’s their basic nature. If companies struggle for licences and compliance, it makes it very expensive to start up in fintech.”

No one is claiming that the RBI’s focus on regulating the flow of money or anti-money laundering is not important, but there needs to be a middle ground and some ground of proportionality, say the stakeholders.

“To streamline their business processes, fintech companies are urged to use cutting-edge technology like cloud computing and data analytics. This helps them comply more easily and positions them to gain a competitive edge in the rapidly evolving market,” added Milan Sharma, founder and MD of Mumbai-based VC firm 35North Ventures.

While there is a fear currently of the regulatory hammer falling on the future of their business, startup founders are clear that creating the delicate equilibrium between safeguarding consumers and mitigating systemic risks is paramount.

The recent strategy adopted by the RBI focuses on licensing and heightened supervision, steering fintech products toward conventional regulatory channels. If this is the new reality then startups will find a way to innovate within this sandbox.

But it’s when actions come out of the blue, that fintech startups get spooked. And that’s why perhaps many believe that the RBI needs to share authority with new-age regulators to determine the future of fintech.