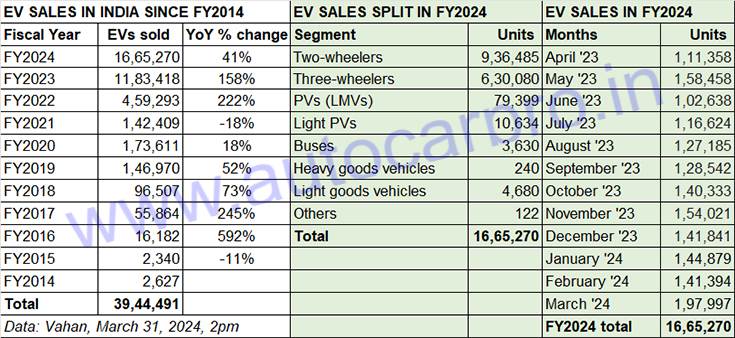

FY2024 has ended on a very strong note for the Indian electric vehicle (EV) industry, setting a new benchmark for sales across vehicle segments as also delivering the best-ever 12-month sales for the electric two-wheeler, three-wheeler and passenger vehicle sub-segments. At 1.66 million units retailed, FY2023 numbers are a handsome 41% year-on-year increase (FY2023: 1.18 EVs). And sales in March 2024 have marched to a new monthly high – over 197,000 units.

As per retail data published on the government of India’s Vahan website, between April 1, 2023 and March 31, 2024, a total of 16,65,270 EVs were bought in India – that’s 4,562 EVs sold every day in FY2024 compared to 3,242 EVs in FY2023. They point to the sustained demand throughout FY2024 in consumer and market demand for EVs, in the face of stiff petrol and diesel prices as well as CNG (which were marginally reduced in early March 2024 after a long hiatus).

Ninety-five percent – 37,70,971 units – of the 3.94 million EV sales have come in the past six fiscals (FY2019 to FY2024) with 1.66 million in FY2024.

MEGA MARCH PUMPS UP THE VOLUME

March 2024 was a mega month for India EV industry. At 197,000-plus units, the last month of FY2024 capped off a strong performance by the domestic EV industry and helped power overall numbers to a record 1.66 million units.

What has helped accelerate sales last month was rapid buying, particularly in the two- and three-wheeler domains. With the FAME II subsidy scheme coming to an end on March 31, 2024, and industry urging the government to continue the EV subsidy, a new scheme called Electric Mobility Promotion Scheme 2024 (EMPS) was unveiled on March 13. With a total outlay of Rs 500 crore, it will continue subsidies for electric two- and three-wheelers and is valid for four months from April 1 to July 31, 2024. There is no mention of subsidies continuing for either buses or e-passenger vehicles.

EMPS is outlined to subsidise 372,000 EVs including 333,000 two-wheelers and 38,828 three-wheelers (25,238 L5 category EVs and 13,590 rickshaws and e-carts). While e-two-wheelers get a subsidy of Rs 5,000 per kilowatt-hour (kWh) with a maximum limit of Rs 10,000 per unit (capped at Rs 333 crore). Likewise, e-rickshaws and carts get a subsidy of Rs 5,000 per kWH with a limit of Rs 25,000 per unit (capped at Rs 33.97 crore).

As a result of the reduced subsidy, prices of both e-two- and three-wheelers are expected to rise from April 1, 2024 which clearly has led to the flood of retail sales in March.

Leading the charge for FY2024 are the two low-hanging fruit of the industry – two- and three-wheelers. Two-wheelers, with 936,485 units, saw YoY growth of 29% (FY2023: 728,201 units) and accounted for 56% of total EV sales in India in FY2024. Three-wheelers, comprising passenger- and cargo-transporting models, sold 630,080 units, up 57% YoY (FY2023: 402,098 units) and accounted for 38% of total EV sales in FY2023. Thus, combined two- and three-wheeler EV sales comprise an overwhelming 94% of the record EV industry sales (see data table above).

Meanwhile, retail sales of electric passenger cars and SUVs, at 90,033 units in FY2024, were up 89% on FY2023’s 47,544 units.

INDIA’S EV GROWTH STORY PICKS UP PACE SINCE FY2019

A deep dive into retail sales numbers for the past 10 fiscal years reveals just how demand has grown for EVs in India, particularly in the past three years. The charge of the EV brigade can be gleaned from the fact that sales the monthly shift to six-figure sales, which began in festive October 2022 has continued for 18 months on the trot (see retail sales table for FY2024 above).

A dep dive into Vahan-sourced 11-year EV retail sales data (also detailed above) reveals that a total of 39,44,491 units or 3.94 million units have been sold in India since FY2015. An overwhelming 95% – 37,70,971 units – of these EV sales have come in the past six fiscals (FY2019 to FY2024), which indicates just how rapidly demand has escalated for EVs in the country.

As per Vahan, a total of 24.52 million vehicles (2,45,26,468 across all categories were sold in India in FY2024. This means EV penetration at 1.66 million units is currently at 6.78 percent. The government has outlined a strategic shift to e-mobility, and has targeted EVs to account for 30% of its mobility requirements by 2030.

Growing consumer awareness about the need to use eco-friendly transport and the wallet-friendly nature of EV cost of ownership over the long run is proving to be a big catalyst to adoption of electric mobility. What’s more, there’s fast-paced demand coming in from the e-commerce industry and logistics players for EVs on two and three wheels, and from taxi fleet operators for electric passenger vehicles.

Meanwhile, recognising the huge business potential, component manufacturers are also upping the ante on localising EV parts, either through full ground-up development or through technology licences. This will lead to enhanced optimisation of costs and in turn EV affordability. All in all, a win-win scenario for the EV industry and consumers.

EV-OLUTION OF THE INDIAN EV INDUSTRY

India, which is the third-largest automobile market in the world, is among the global markets which are aggressively driving awareness and adoption of EVs as a countermeasure to its serious air pollution problem. As is known, India is home to over 20 most polluted cities in the world. By 2030, the government has targeted EVs to account for 70% of commercial vehicle sales, 30% of passenger vehicles, 40% of buses and 80% of two-wheelers and three-wheelers.

The past four-odd years have shown how India EV Inc has evolved when it comes to the overall electric mobility ecosystem. From the growing number of new EVs being launched, the enhanced level of R&D, significant investment from component manufacturers in making EV parts and creating a robust supply chain, gradual expansion of EV charging infrastructure through to exclusive EV retail showrooms from OEMs and both the Central and most State governments rolling out EV-friendly policies for EV manufacturing as well as EV buyers, the EV market dynamic is here to stay in India.

Initial cost of an EV compared to a conventional internal combustion engine remains 25-30% higher mainly due to the battery cost but as technology evolves, localization levels increase and OEMs benefit from economies of scale, EV costs are bound to rationalise and EV-ICE vehicle price parity could be foreseen in the not-so-long-term future in India.

What’s more, e-mobility is no longer an urban India phenomenon and has now spread to town and country as scores of vehicle users recognize the wallet-friendly nature of EVs while also contributing to eco-mobility. At present, over 30 lakh EV users are celebrating their independence from fossil fuels and helping reduce the carbon footprint. Uttar Pradesh, Maharashtra and Karnataka are the top three Indian states in terms of EV ownership, followed by Rajasthan, Delhi and Tamil Nadu.

As Shailesh Chandra, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, said at Autocar Professional’s EV Conclave in Chennai on November 21, 2023, ”The long-term story of BEVs is not a choice. It is an imperative because all the nations have signed for net carbon zero. The same pressure is on all the OEMs. There is no choice. It is only a matter of how fast this is going to happen.”

Nevertheless, what India EV Inc is confident about is the growing adoption of electric mobility by both individual buyers and also industry, along with the considerable potential of exports of both made-in-India EVs and EV components.

ALSO READ:

Electric 2-wheeler retails in India hit highest level in FY2024: 935,000 units

Electric 3-wheeler sales in India scale a record 650,000 units in FY2024

Electric car and SUV sales jump 90% to 90,000 units in FY2024