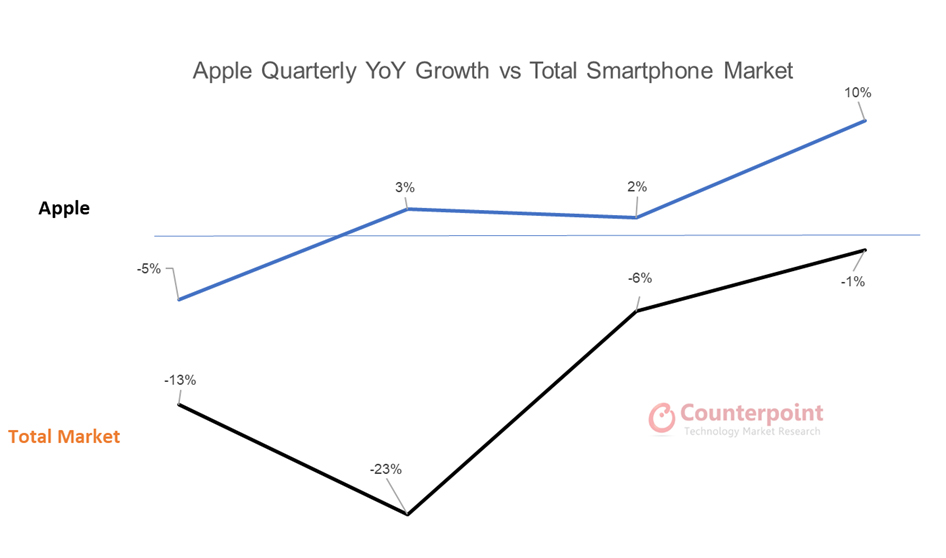

- Counterpoint Research expects Apple sell-in volumes to grow 4% YoY in 2020.

- The global smartphone market will retract by 10% in 2020.

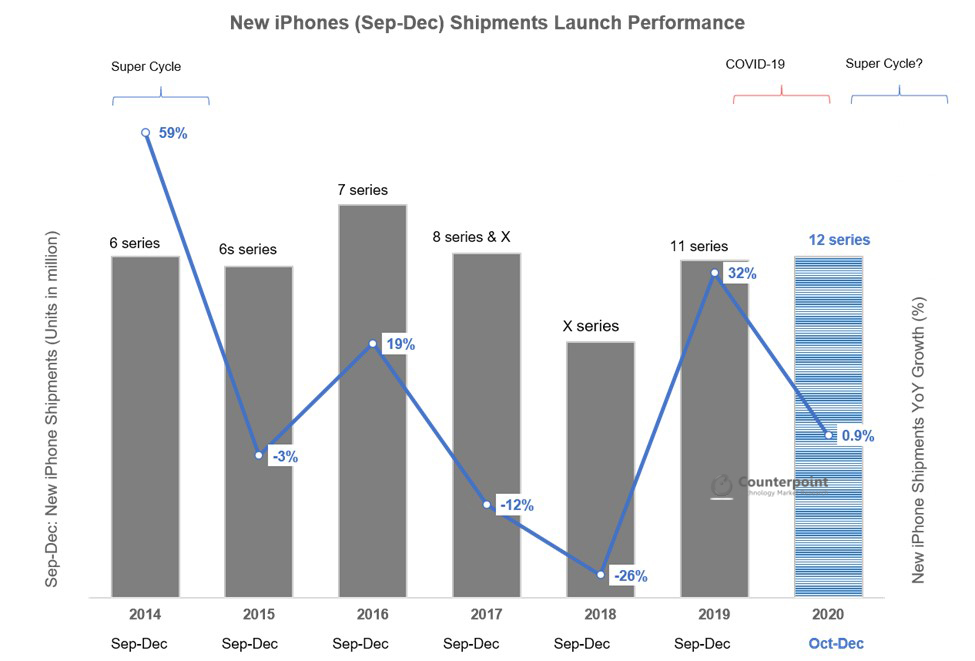

- iPhone 12 family sell-in is expected to be larger than the iPhone 11 opening year sell-in despite launching a month later.

Apple is set to announce its new line-up of iPhones on October 13. This will mark a significant moment in the rollout of 5G and will be an opportunity for Apple to have a large upgrade cycle.

Commenting on Apple sales in 2020, Research Director Tom Kang said, “Apple has done a great job outperforming the global smartphone market. During the COVID-19 low point in Q2 2020, Apple was helped by the timely launch of the iPhone SE, which created a new, low price point for iPhones at $399. It helped Apple get through the worst months of COVID-19 and its lockdown periods. In addition, the iPhone 11 has proved to have great longevity, still selling over one million devices per week on the brink of a refresh. The SE and iPhone 11 helped maintain momentum through Q3 as the general market remained negative.” COVID-19 has hit the market hard in 2020 but some parts of the market proved to be more resilient than others. Online channels were one segment of the market that actually benefited from the pandemic. Apple dominated online sales in developed markets (link). The premium market also showed less decline in the overall pandemic situation during Q2. The overall market declined 23% but the premium segment just declined 8% during the period (link). Apple is the largest player in the premium market and was again unscathed. We expect Apple to show an above-average growth rate this year.

COVID-19 has hit the market hard in 2020 but some parts of the market proved to be more resilient than others. Online channels were one segment of the market that actually benefited from the pandemic. Apple dominated online sales in developed markets (link). The premium market also showed less decline in the overall pandemic situation during Q2. The overall market declined 23% but the premium segment just declined 8% during the period (link). Apple is the largest player in the premium market and was again unscathed. We expect Apple to show an above-average growth rate this year.

The iPhone 7 and iPhone 11 family launches saw large upgrades. The iPhone 8 family and XR family saw lower upgrade levels as holding periods grew through these launch cycles. The iPhone 11 family opening sales for September-December 2019 saw their first YoY growth since the September-December 2016 sales of iPhone 7. Counterpoint Market Outlook forecasts that Apple’s October-December 2020 line-up sales will exceed the iPhone 11 family’s September-December sales by 1%. This growth is despite a delayed launch in 2020 where Apple’s new line-up will see zero sales in September and also miss much of October sales.

Research Director Jeff Fieldhack said, “There is significant pent-up demand from iOS subscribers putting off upgrades until these 5G devices launch. In addition, options for display sizes and price points will help drive sales. Also benefitting Apple this smartphone refresh will be greater efforts by global mobile operators to upgrade the iOS installed base to 5G. In countries where 5G has begun to roll out, operators will have a significant monetary incentive to migrate LTE iOS subscribers to their near-empty 5G networks. Look for significant promotional offers, especially in 5G rollout countries. The US is likely to see its most competitive marketing wars in years, which will benefit Apple. European carriers will also see elevated levels of marketing. But China is not expected to be as aggressive.”

Research Director Jeff Fieldhack said, “There is significant pent-up demand from iOS subscribers putting off upgrades until these 5G devices launch. In addition, options for display sizes and price points will help drive sales. Also benefitting Apple this smartphone refresh will be greater efforts by global mobile operators to upgrade the iOS installed base to 5G. In countries where 5G has begun to roll out, operators will have a significant monetary incentive to migrate LTE iOS subscribers to their near-empty 5G networks. Look for significant promotional offers, especially in 5G rollout countries. The US is likely to see its most competitive marketing wars in years, which will benefit Apple. European carriers will also see elevated levels of marketing. But China is not expected to be as aggressive.”