Trump Media & Technology Group shares continued to spiral Monday, putting the company’s stock on track close at its lowest level since listing on the Nasdaq exchange in late March.

In late-day trading the stock was down $4.15, or more than 10%, to $36.44. The company, whose largest shareholder is former President Donald Trump and which trades under the ticker symbol “DJT,” surged to a high of $79.38 after its market debut on March 26, valuing it at more than $9 billion.

Since that peak the stock has fallen 54%, with Trump Media’s market capitalization dropping to less than $5 billion.

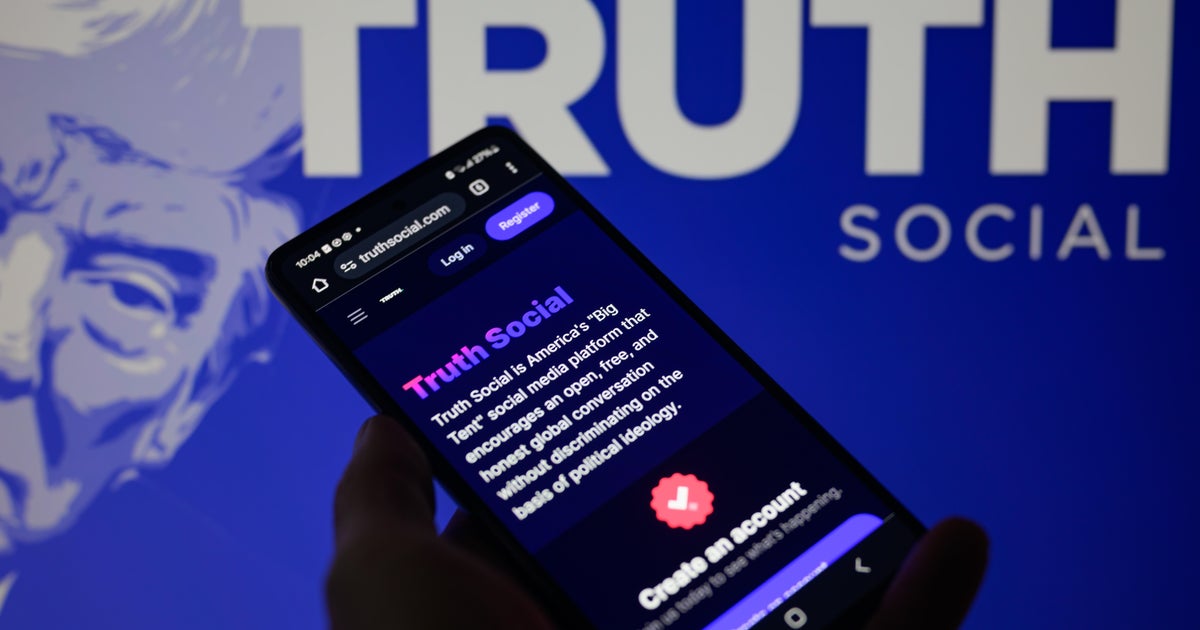

Trump Media, whose main asset is the social media service Truth Social, generated $4.1 million in revenue in 2023. The company disclosed mounting losses in a regulatory filing earlier this month, while noting its accountant had warned of “substantial doubt about its ability to continue as a growing concern.”

Trump Media has mostly captured the attention of supporters of the former president, as well as retail investors who wanted to cash in on the mania, rather than big institutional and professional investors.

“DJT has all the makings of a meme stock, given the Trump news factor,” noted Ben Emons, senior portfolio manager and head of fixed income at NewEdge Wealth, in a research note in late March.

In an April 5 statement to CBS MoneyWatch, a Trump Media spokesperson said the company foresees “numerous possibilities for expanding and enhancing” Truth Social. The company has no debt and over $200 million cash, she said.