Great and terrible things happened in the year that COVID-19 struck, and for those people filing taxes as the owner of a business, or a freelancer working as a contractor, the unprecedented circumstances make for an unprecedented tax season.

Perhaps you spent all of last year working from home as a freelancer and now are contemplating, for the first time in your life, trying to claim the den as a workspace deduction. Perhaps you took up a second source of income in the form of being a Lyft driver and now need to incorporate that ride-sharing income into your other business earnings. Perhaps you had to pay for employees who were suddenly only working part of the time because they were caring for a loved one with the coronavirus.

Perhaps you put half your company’s capital into Bitcoin, as a hedge against the chaos of the pandemic. How are you supposed to account for crypto?

For all of these needs and more, software makers such as Intuit and FreeTaxUSA are ready, willing, and eager to offer you their packages designed for either self-employed situations or small businesses. Here is a rundown of the best five tax packages we evaluated.

Best for wanting broad software compatibility

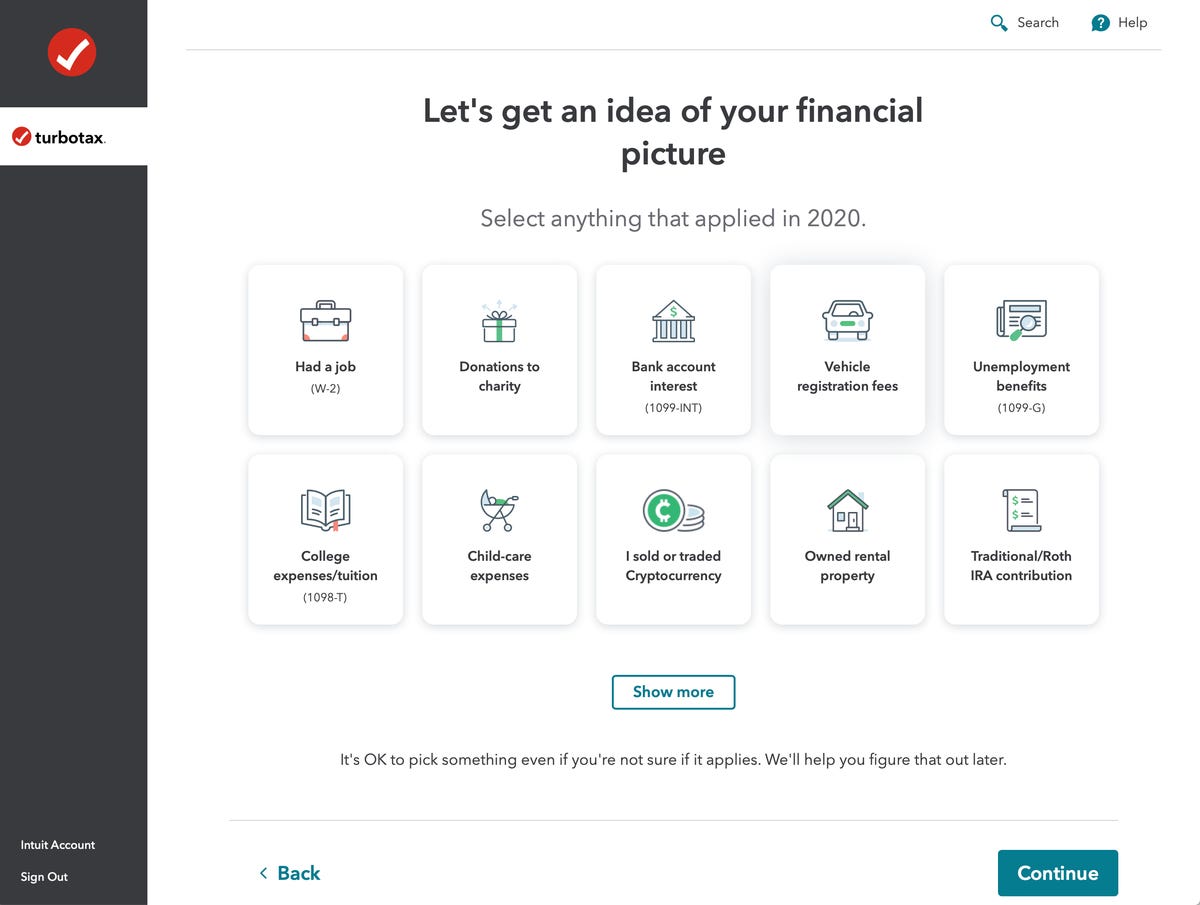

Perhaps the most recognizable name in tax software, TurboTax, owned by Intuit, proposes the Self Employed version for both those who are actually self-employed and for those who run a small business. The package is $90 for your federal filing and $40 for each state, if you choose to use it for state taxes.

As with most offers, you can start working on Self Employed for free; you only pay once you’re ready to file.

Among the primary differentiators for Self Employed is the inclusion of support for Schedule C/C-EZ, the main form for profit and loss from a business. In addition, home business expenses, health coverage, and small employer pension forms are included.

TurboTax boasts functions for industry-specific deductions, such as for real estate, construction, or even ride-sharing.

Intuit emphasizes the fact that it is ready for the new 1099-NEC form, the form you either use to pay your sub-contractors or the form you receive as a contractor from your client. You can snap a picture of your 1099-NEC with your phone and have it automatically uploaded to the software. The software also pledges to make it “a breeze” to enter data on the money you’ve earned from Uber or Lyft ride-sharing jobs.

TurboTax also comes with a live service that will connect you with a human tax expert. The company emphasizes that this can be an advantage for preparing quarterly taxes, as you can draw upon these individuals on an on-demand basis, year-round.

TurboTax has the broadest platform support among software, with downloads available for Windows 7 through 10, Mac “Mavericks” through “Big Sur,” iOS, Android, and Chromebooks.

Best for wanting to maximize value for dollar

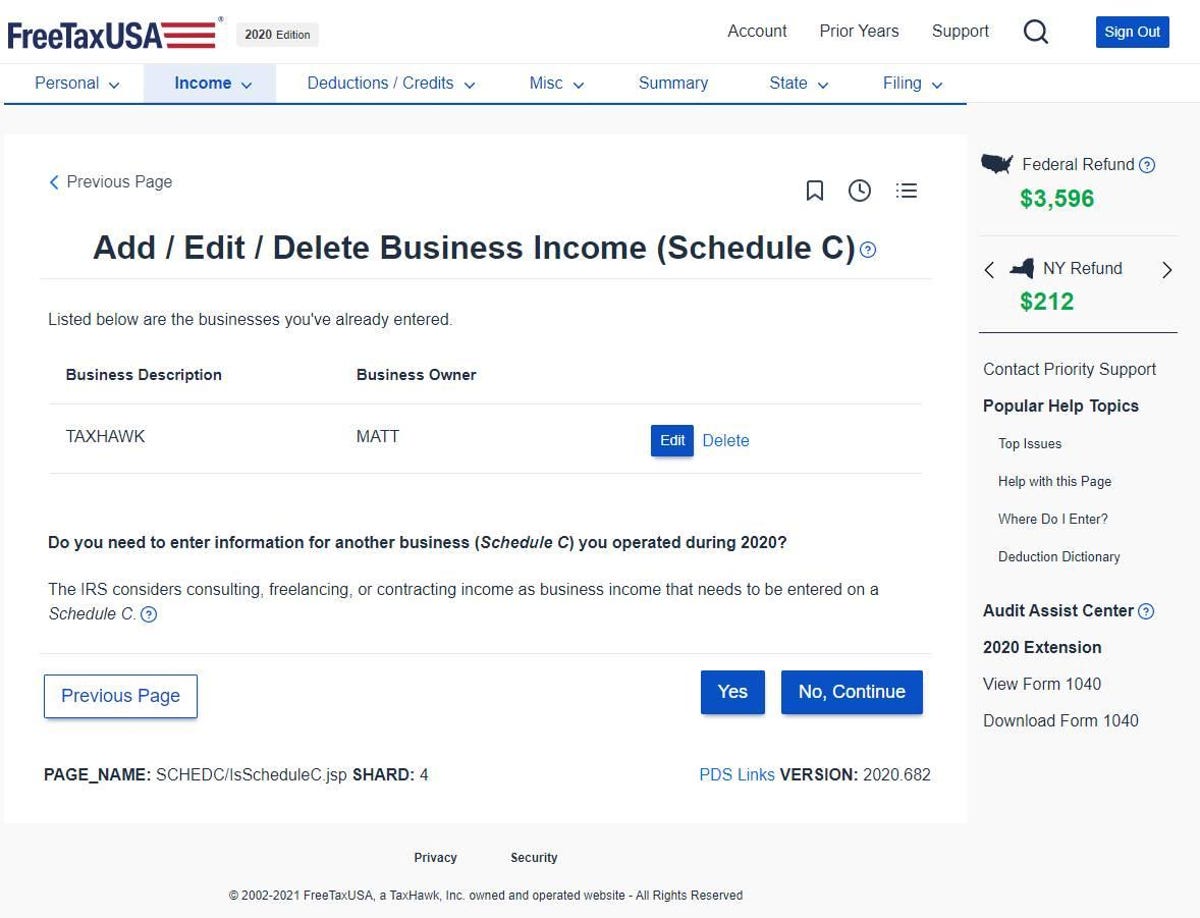

FreeTaxUSA emphasizes the value provided for free federal filings, including Schedule C and 1099 income and deductions, which it contrasts to the need to purchase upgrades from TurboTax and others. State form filing is $12.95 per state. The company promises that “customers get the same business write-offs, the same calculations, and the same tax refund as more expensive services.”

The web-only online forms completion task guides users through a narrative set of questions about their business, such as “Do you need to enter information for another business?” when filling out business income.

FreeTaxUSA will import prior-year returns from TurboTax or H&R Block rather than users having to key those in.

Similar to other services, TaxFreeUSA offers guarantees. They include refunding your fees and giving you a credit to future service if you can show another online service is able to get you a larger refund. The company also pledges to pay penalties and interest if any are incurred via the service.

FreeTaxUSA also offers a Deluxe add-on option, for $6.99, that adds the ability to get priority in a chat queue for online support, and assistance with audits, and unlimited amended returns.

Best for complex returns needing professional input

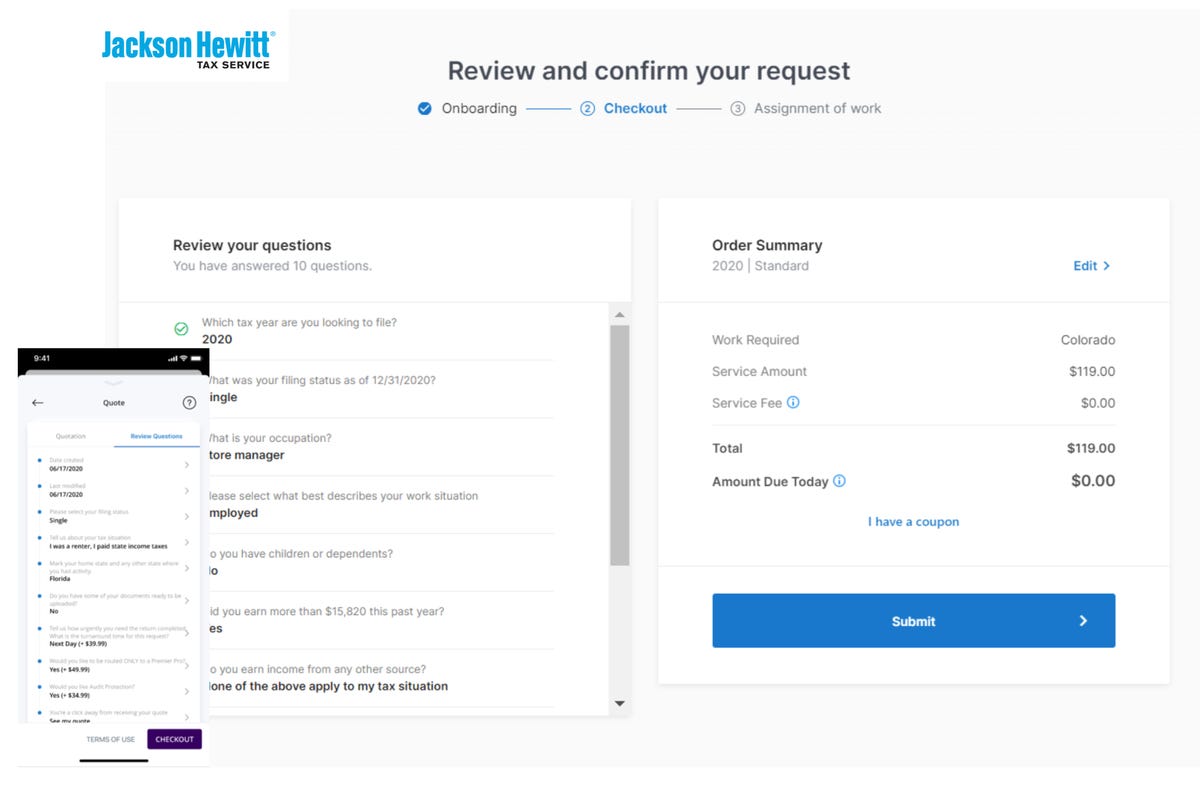

Unlike most online tax offerings, Tax Pro from Home, either as a web form or a mobile app, gives you a real, live human being to assist you via telephone or a secure chat channel, for an unlimited number of sessions, rather than leaving you in a do-it-yourself process.

The premise that the company is operating on is that you still want an office visit, but you can’t get there because of the pandemic. “This year, prepare your taxes from the comfort of your own home without the office visit,” says the company.

Jackson Hewitt emphasizes the time savings, the certainty, and the flexibility of the human element.

Pro from Home has three tiers of pricing: Standard, for $69, plus $50 per state return; Deluxe, for $179 plus $50 per state; and Premier for $249 plus $50 per state.

The top tier, Premiere, is the one recommended for small businesses. It adds capabilities for handling complex return situations, such as where there’s more than one self-employed source of income, dividend income, daycare expenses, and all manner of itemized deductions.

The company offers a “lifetime accuracy guarantee,” with reimbursement for penalties and interest in the case of a preparation error; and a “maximum refund guarantee,” refunding the fees plus $100 if another preparer can show you deserve a higher refund.

In addition to the web version, you can use the mobile app for iOS or Android to step through the process.

Best for business owners needing hand-holding

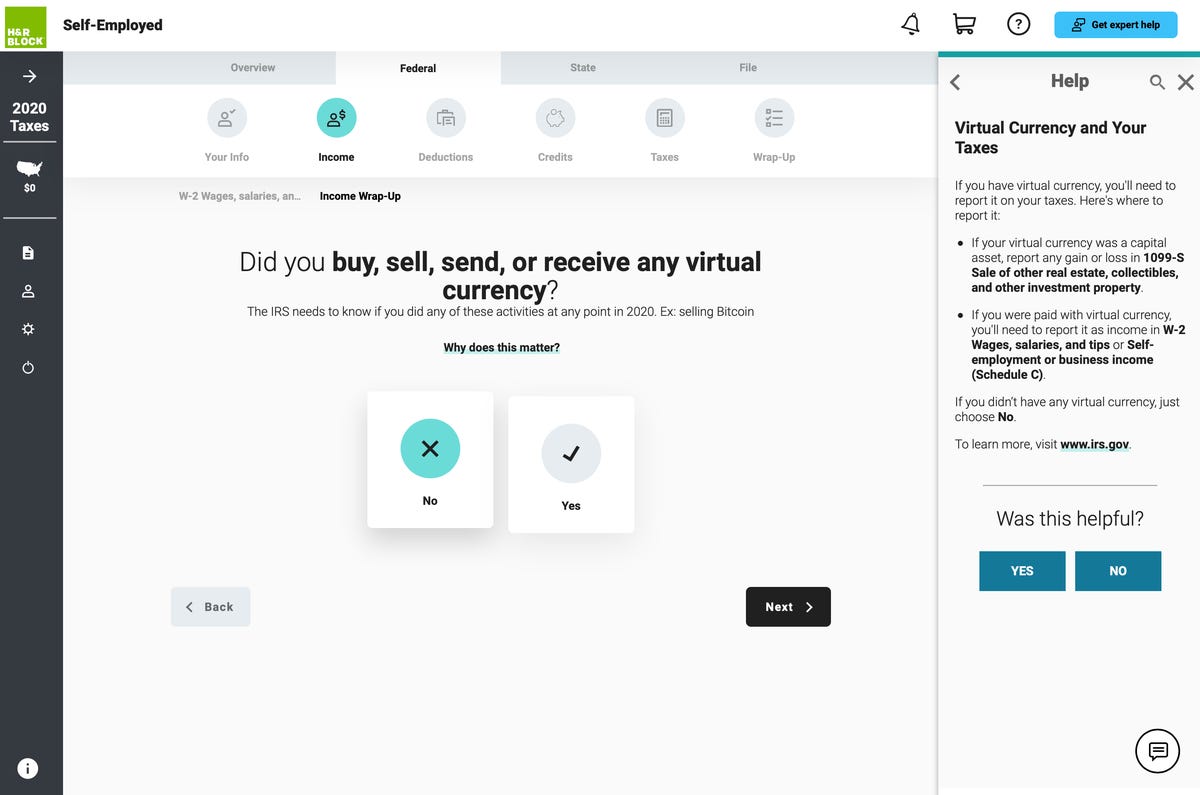

H&R Block may be known best for its in-office tax professionals, but the company stresses you can both file and even run your payroll using its software.

Self Employed is the top of Block’s online filings option, costing $84 for federal filings plus $36.99 for each state filing. As with TurboTax and others, you can start free and pay when you file.

The primary differentiator here from other Block offerings is the itemization of business expenses and depreciation of assets. Block emphasizes both the breadth of its deductions expertise encoded in the software, as well as tax classifications pertaining to businesses, such as non-profit or trust.

The user interface of the web forms is nicely laid out in terms of annotating each step of the way with additional information in a fairly easy-to-read format.

If you decide you want to add in human participation, you can pay $39.99 to add online help from a live tax expert.

As an alternative to the web version, Block offers downloads. Premium and Business software for Windows is the version it recommends for small businesses. That package has additional capabilities, such as the option to manage your payroll year-round.

Best for a low-cost do-it-yourself approach

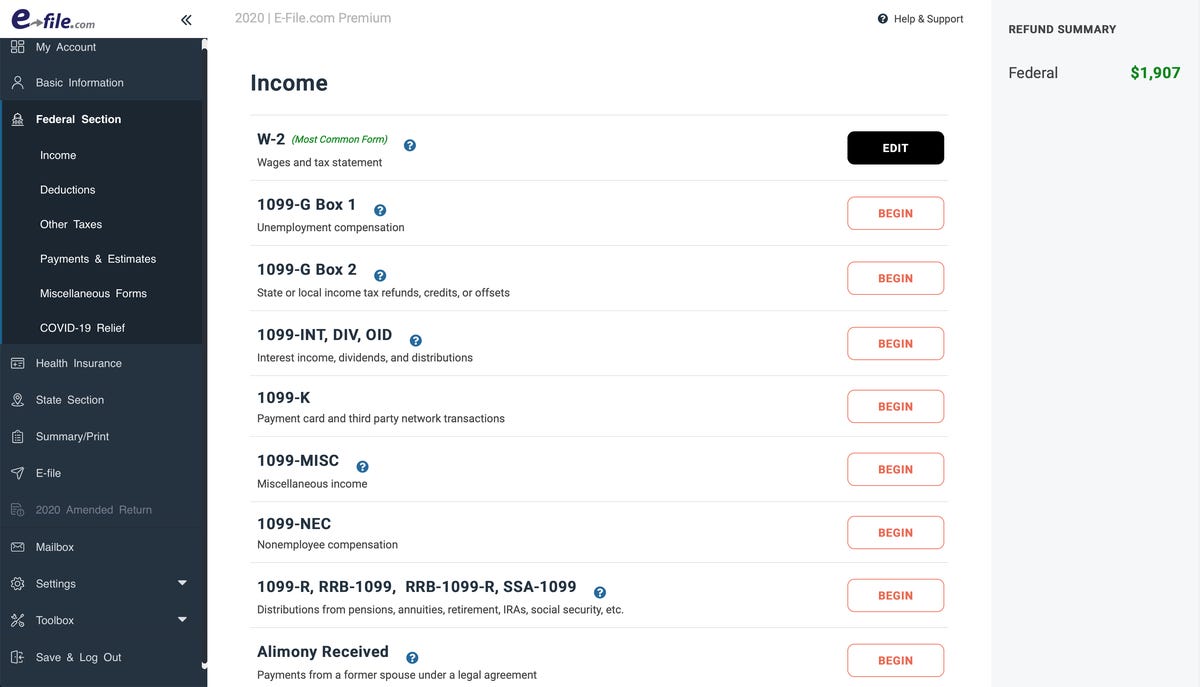

eFile emphasizes the economy of its approach relative to TurboTax and H&R Block: The Premium edition, which is the one most suited to a business owner, is $39.95, plus $28.95 per state.

The package includes not just straight business income but also investment income, rental property income, and the myriad of income from partnerships encoded in the IRS’s Schedules K-1.

The Premium version offers live assistance via phone, webchat, and email. These are tax support specialists, as the company puts it, not CPAs. The company will also step in with human assistance in the event of an audit.

The software is web-only.

How we evaluated

To evaluate the various offerings, ZDNet started from the self-evident fact that for many business owners, 2020 was an extraordinary year. That means new situations for tax considerations.

For example, self-employed workers who were suddenly working entirely from home may have made the den or the unused bedroom exclusively a place of business. And that means it may be deductible. Businesses will get new tax credits, called the Credit for Sick Leave and Family Leave and Employee Retention Credit, if they had employees out sick with COVID-19 or employees having to take time off to care for family members who were sick, part of a number of relief measures for which businesses may qualify.

How the various software packages handle those situations was top of mind as we looked at the software.

In addition to new events and situations, the Internal Revenue Service introduced all sorts of wonderful new processes. The IRS finally offered up new guidelines about cryptocurrencies, which means that itemizing crypto holdings is a new thing you’ll be doing this year, if you have any.

Also: Cryptocurrency 101: What every business needs to know

For paying sub-contractors and other non-employees, there’s a switch-over this year to filling out form 1099-NEC instead of the prior option, form 1099-MISC. For the self-employed, a new form, 702, will let you claim tax credits for days unable to work, either because you were sick or you were caring for a family member.

How the software handles these new twists and turns was also top of mind.

Next, we looked at the economics of these packages, how much they cost. The pricing obviously ranges from free to several hundred dollars, and what is a good deal depends on how complex things are given the preceding two points, for each individual business.

The last factor is whether a business owner will be filing entirely on their own. Depending on your level of comfort filling out forms, a free service such as FreeTaxUSA may be all you need. On the other hand, the new offering from Jackson Hewitt, Pro at Home, is a neat way to get expert help remotely that is in a sense born of the pandemic.