The IEA report “Batteries and Secure Energy Transitions” looks at the impressive global progress, future projections, and risks for batteries across all applications. 2023 saw deployment in the power sector more than double. Strong growth occurred for utility-scale batteries, behind-the-meter, mini-grids, solar home systems, and EVs. Lithium-ion batteries dominate overwhelmingly due to continued cost reductions and performance improvements. And policy support has succeeded in boosting deployment in many markets (including Africa). Further innovations in battery chemistries and manufacturing are projected to reduce global average lithium-ion battery costs by a further 40% by 2030 and bring sodium-ion batteries to the market. The IEA emphasises the vital role batteries play in supporting other clean technologies, notably in balancing intermittent wind and solar. New successes include the fact that solar PV plus batteries is now competitive with new coal-fired power in India and, in the next couple years, should become competitive with new coal in China and new natural gas-fired power in the U.S. Looking ahead, deployment must increase sevenfold by 2030. The prospects are good: if all announced plants are built on time this would be sufficient to meet the battery requirements of the IEA’s net-zero scenario in 2030. And although, today, the supply chain for batteries is very concentrated, the fast-growing market should create new opportunities for diversifying those supply chains.

Batteries are an essential part of the global energy system today and the fastest growing energy technology on the market

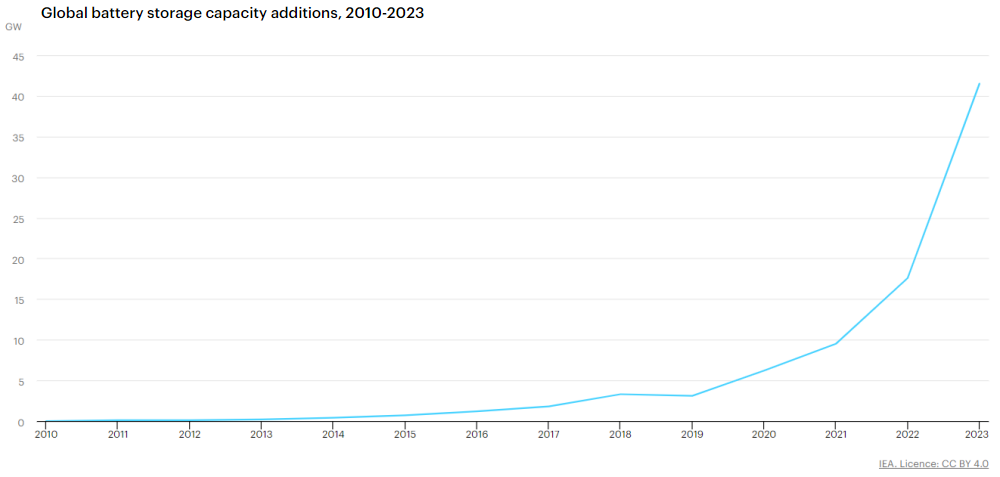

Battery storage in the power sector was the fastest growing energy technology in 2023 that was commercially available, with deployment more than doubling year-on-year.

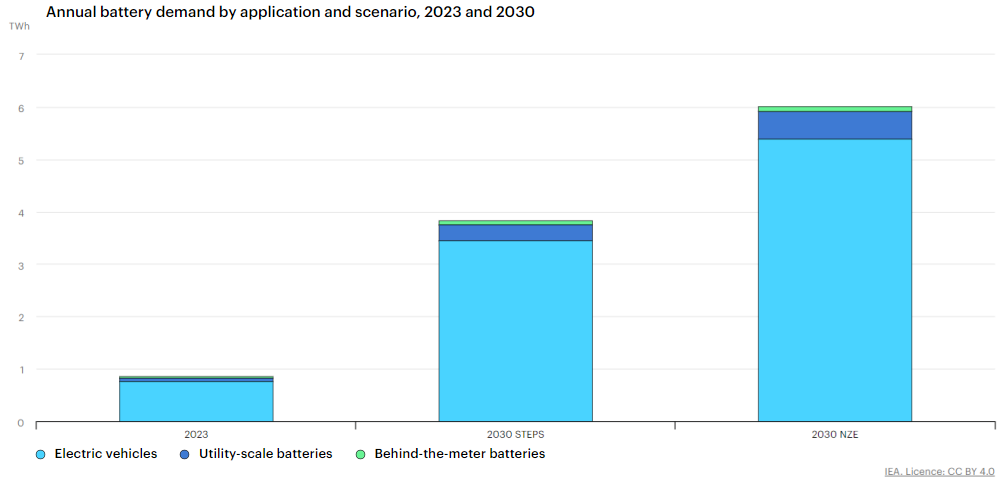

Strong growth occurred for utility-scale battery projects, behind-the-meter batteries, mini-grids and solar home systems for electricity access, adding a total of 42 GW of battery storage capacity globally. Electric vehicle (EV) battery deployment increased by 40% in 2023, with 14 million new electric cars, accounting for the vast majority of batteries used in the energy sector.

Despite the continuing use of lithium-ion batteries in billions of personal devices in the world, the energy sector now accounts for over 90% of annual lithium-ion battery demand. This is up from 50% for the energy sector in 2016, when the total lithium-ion battery market was 10-times smaller. With falling costs and improving performance, lithium-ion batteries have become a cornerstone of modern economies, underpinning the proliferation of personal electronic devices, including smart phones, as well the growth in the energy sector. In 2023, there were nearly 45 million EVs on the road – including cars, buses and trucks – and over 85 GW of battery storage in use in the power sector globally.

Lithium-ion batteries dominate battery use due to recent cost reductions and performance improvements

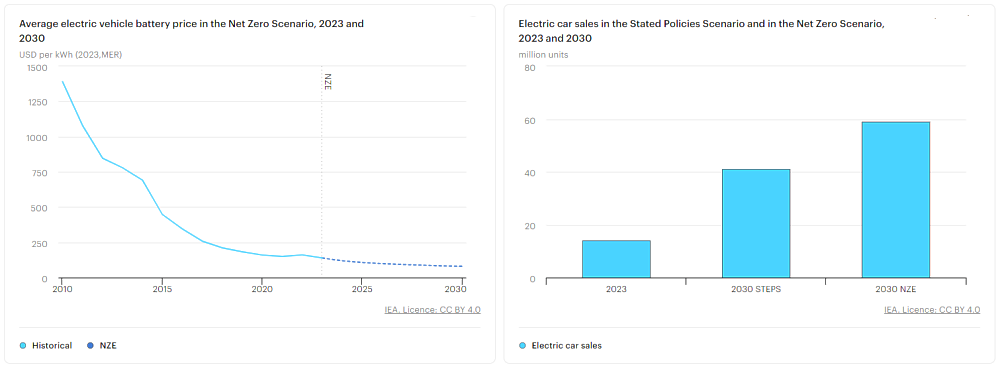

Lithium-ion batteries have outclassed alternatives over the last decade, thanks to 90% cost reductions since 2010, higher energy densities and longer lifetimes. Lithium-ion battery prices have declined from USD 1,400 per kilowatt-hour in 2010 to less than USD 140 per kilowatt-hour in 2023, one of the fastest cost declines of any energy technology ever, as a result of progress in research and development and economies of scale in manufacturing. They have also achieved much higher energy densities than lead acid batteries, allowing them to be stacked in much lighter and more compact battery packs.

Lithium-ion batteries dominate both EV and storage applications, and chemistries can be adapted to mineral availability and price, demonstrated by the market share for lithium iron phosphate (LFP) batteries rising to 40% of EV sales and 80% of new battery storage in 2023. Lithium-ion chemistries represent nearly all batteries in EVs and new storage applications today. For new EV sales, over half of batteries use chemistries with relatively high nickel content that gives them higher energy densities. LFP batteries account for the remaining EV market share and are a lower-cost, less-dense lithium-ion chemistry that does not contain nickel or cobalt, with even lower flammability and a longer lifetime. While energy density is of utmost importance for EV batteries, it is less critical for battery storage, leading to a significant shift towards LFP batteries.

Policy support has given a boost for batteries deployment in many markets but the supply chain for batteries is very concentrated

Strong government support for the rollout of EVs and incentives for battery storage are expanding markets for batteries around the world. China is currently the world’s largest market for batteries and accounts for over half of all battery in use in the energy sector today. The European Union is the next largest market followed by the United States, with smaller markets also in the United Kingdom, Korea and Japan. Battery use is also growing in emerging market and developing economies outside China, including in Africa, where close to 400 million people gain access through decentralised solutions such as solar home systems and mini-grids with batteries in order to achieve universal access by 2030.

While the global battery supply chain is complex, every step in it – from the extraction of mineral ores to the use of high-grade chemicals for the manufacture of battery components in the final battery pack – has a high degree of geographic concentration. Battery manufacturers are dependent on a small number of countries for the raw material supply and extraction of many critical minerals. China undertakes well over half of global raw material processing for lithium and cobalt and has almost 85% of global battery cell production capacity. Europe, the United States and Korea each hold 10% or less of the supply chain for some battery metals and cells today.

Achieving COP28 targets will hinge on battery deployment increasing sevenfold by 2030

Batteries are key to the transition away from fossil fuels and accelerate the pace of energy efficiency through electrification and greater use of renewables in power. In transport, a growing fleet of EVs on the road displaces the need for 8 million barrels of oil per day by 2030 in the Net Zero Emissions by 2050 (NZE) Scenario, more than the entire oil consumption for road transport in Europe today. In the power sector, battery storage supports transitions away from unabated coal and natural gas, while increasing the efficiency of power systems by reducing losses and congestion in electricity grids. In other sectors, clean electrification enabled by batteries is critical to reduce the use of oil, natural gas and coal.

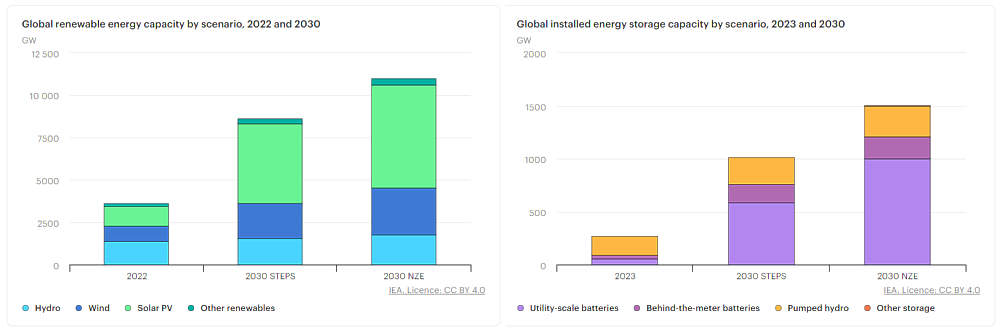

To triple global renewable energy capacity by 2030 while maintaining electricity security, energy storage needs to increase six-times. To facilitate the rapid uptake of new solar PV and wind, global energy storage capacity increases to 1,500 GW by 2030 in the NZE Scenario, which meets the Paris Agreement target of limiting global average temperature increases to 1.5 °C or less in 2100. Battery storage delivers 90% of that growth, rising 14-fold to 1,200 GW by 2030, complemented by pumped storage, compressed air and flywheels. To deliver this, battery storage deployment must continue to increase by an average of 25% per year to 2030, which will require action from policy makers and industry, taking advantage of the fact that battery storage can be built in a matter of months and in most locations.

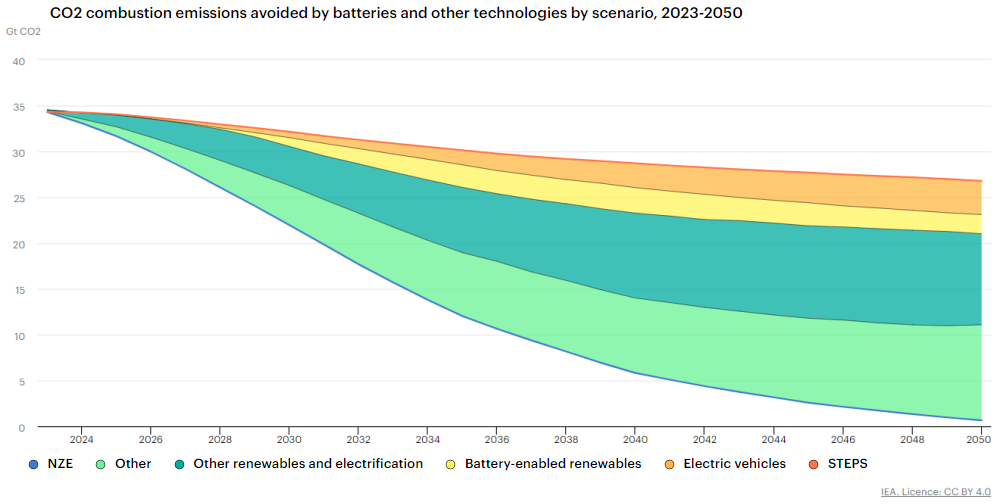

In the NZE Scenario, about 60% of the CO2 emissions reductions in 2030 in the energy sector are associated with batteries, making them a critical element to meeting our shared climate goals. Close to 20% are directly linked to batteries in EVs and battery-enabled solar PV. Another 40% of emissions reductions are from electrification of end-uses and renewables that are indirectly facilitated by batteries.

Batteries bolster multiple aspects of energy security

Battery storage helps to strengthen electricity security in all markets. As the nature of electricity demand and supply changes, with more electrification and more variable generation from wind and solar PV, battery storage is well placed to provide short-term flexibility for periods of 1-8 hours continuously, and thus to help power system operators ensure there is enough supply to meet peak demands. Its fast and accurate responses to market signals, in a matter of seconds, make battery storage ideal for providing support for grid stability, and it is already being used for this purpose in many markets. Battery storage can also serve as critical back-up generators in case of grid outages or emergencies, ensuring uninterrupted power supplies to critical facilities such as hospitals, emergency response centres and infrastructure like grid substations and communication networks.

Batteries in EVs and storage installations reduce the need for imported fossil fuels, increasing self-sufficiency in many countries. EVs reduce the need for oil imports in many countries, including China, Europe, India, Japan and Korea. The need for natural gas and coal imports is reduced directly by battery-enabled renewables displacing natural gas-fired and coal-fired power, and indirectly by the electrification of industry and buildings where the use of electricity replaces fossil fuels.

Further cost declines for batteries improve their affordability in all applications and make them a cost-effective part of energy systems

Further innovation in battery chemistries and manufacturing is projected to reduce global average lithium-ion battery costs by a further 40% from 2023 to 2030 and bring sodium‑ion batteries to the market. In the NZE Scenario, lithium-ion chemistries continue providing the vast majority of EV batteries to 2030. Further innovation both reduces the upfront costs of lithium-ion batteries and brings about additional improvements in their performance, notably in the form of higher energy densities and longer useful life.

Sodium-ion batteries provide less than 10% of EV batteries to 2030 and make up a growing share of the batteries used for energy storage because they use less expensive materials and do not use lithium, resulting in production costs that can be 30% less than LFP batteries. Beyond 2030, battery costs are likely to decline further, and solid-state batteries are on track to be commercially available, with the potential to bring massive performance gains.

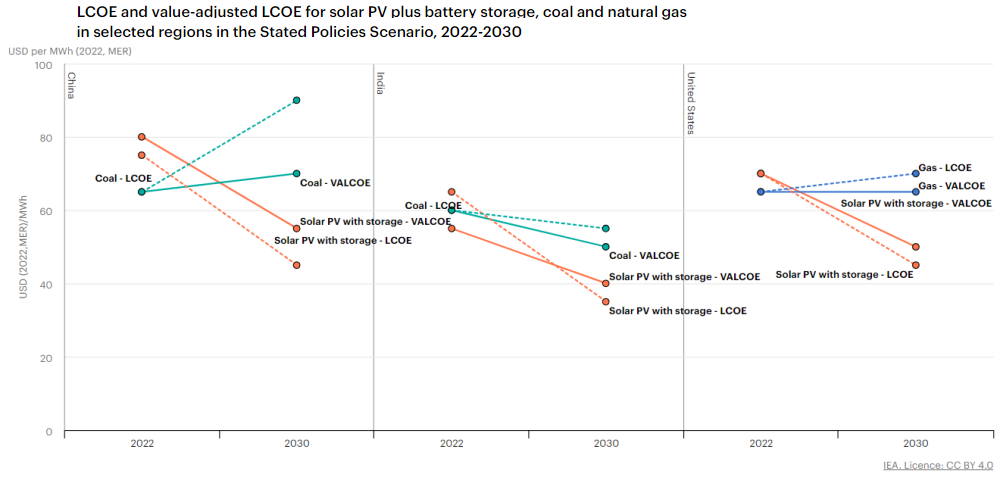

Solar PV plus batteries is competitive today with new coal-fired power in India and, in the next couple years, become competitive with new coal in China and new natural gas-fired power in the United States. Even in the Stated Policies Scenario (STEPS), which is based on today’s policy settings, the total upfront costs of utility-scale battery storage projects – including the battery plus installation, other components and developer costs – are projected to decline by 40% by 2030. This makes stand-alone battery storage more competitive with natural gas peaker plants, and battery storage paired with solar PV one of the most competitive new sources of electricity.

The amount of battery storage capacity added to 2030 in the STEPS is set to be more than the total fossil fuel capacity added over the period. A significant part is behind-the-meter battery storage paired with rooftop solar PV, including many individual batteries aggregated into virtual power plants, as it becomes an increasingly attractive option for consumers in a world of broadly stable or rising retail electricity prices. For electricity access, the average electricity costs of mini-grids with solar PV and batteries halve by 2030.

Falling battery costs are set to raise the share of cost-competitive electric cars in the market from around 50% today. Currently, the least expensive EV models are available in China, with lower sticker prices than comparable gasoline or diesel cars. In advanced economies, there is still a price gap for electric cars that takes years to recover through lower fuel and maintenance costs. Battery price cuts and intense competition among car makers are set to make more types of EVs in more markets competitive. A growing number of EVs will have lower sticker prices than gasoline or diesel cars directly, and many others will cost slightly more to buy but save money for consumers over a few years.

Scaling up the global battery market creates new opportunities for diversifying supply chains

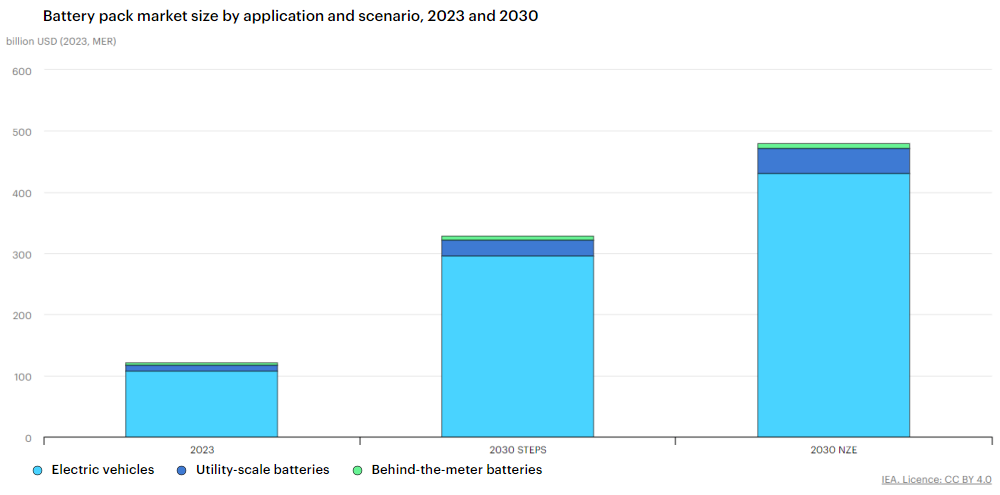

The global market value of batteries quadruples by 2030 on the path to net zero emissions. Currently the global value of battery packs in EVs and storage applications is USD 120 billion, rising to nearly USD 500 billion in 2030 in the NZE Scenario. Even with today’s policy settings, the battery market is set to expand to a total value of USD 330 billion in 2030. Booming markets for batteries are attracting new sources of financing, including around USD 6 billion in battery start-ups from venture capital in 2023 alone.

Batteries are a “master key” that can unlock several much bigger transformations and much bigger industrial prizes. The global car market is valued at USD 4 trillion today, and leadership in it will depend on battery technology. Batteries also support more wind and solar PV, which capture USD 6 trillion in investment in the NZE Scenario from 2024 to 2030, by balancing out their variations and stabilising the grid.

Battery manufacturing is a dynamic industry and scaling it up creates opportunities to diversify battery supply chains. Battery manufacturing capacity is set to expand rapidly and, if all announced plants are built on time, would be practically sufficient to meet the battery requirements of the NZE Scenario in 2030.

While China is set to expand its battery manufacturing significantly, announced plans imply that its share of the global market will decrease to about two-thirds of the global total in 2030 as other regions scale up.

Both Europe and North America have announced plans to boost their domestic battery manufacturing capacity, each set to grow their market share to about 15% in 2030 and able to provide almost all their domestic demands for batteries.

There are important risks for batteries that could hinder their growth and contributions to energy transitions, energy security and affordability

Scaling up critical minerals supply in time to meet rising needs is essential to the success of batteries and requires action to address policy and regulatory barriers. In the NZE Scenario, demand for critical minerals for batteries expands rapidly by 2030, with manganese, lithium, graphite and nickel increasing at least sixfold, and cobalt more than tripling. While this requires new mining and refining, innovation on chemistries, enhanced recycling and “right-sizing” of batteries can cut demand for critical minerals by about 25% by 2030.

Failing to scale up battery storage in line with the tripling of renewables by 2030 would risk stalling clean energy transitions in the power sector. In a Low Battery Case, the uptake of solar PV in particular is slowed down, putting at risk close to 500 GW of the solar PV needed to triple renewable capacity by 2030 (20% of the gap for renewables capacity between the STEPS and NZE Scenario). If other low emission sources were not able to replace the lost solar PV, emissions reductions in the power sector would stall in the 2030s, putting the target of limiting the global average temperature rise to 1.5 °C out of reach.

The Low Battery Case would lead to prolonged use of coal and natural gas in the power sector and raise fuel import bills. Analysis indicates that import bills would be an average of USD 12.5 billion more per year from 2030 to 2050 in importing countries, with Europe and Korea as most exposed to this risk for natural gas imports and India for coal imports.

Recommendations for batteries to fulfil their roles

For batteries to scale up as necessary to support ambitious clean energy transitions, policy makers and regulators need to take action to support their deployment and minimise barriers and bottlenecks. Policy and regulatory frameworks need to ensure that batteries are able to participate in markets and are remunerated appropriately for the services they provide to the power system. The large-scale adoption of EVs calls for wider availability of affordable models and the rollout of charging infrastructure. Promoting smart charging will be vital to integrate rising numbers of EVs into power systems and reduce the need for grid reinforcements.

Policy makers and regulators need to work with national and international partners and with industry to support the development of battery supply chains that are secure, resilient and sustainable. Building supply chains requires a comprehensive approach that encompasses all stages from raw material extraction, refining and manufacturing through to end-of-life product management and recycling, minimising their carbon footprint. Battery recycling has the potential to be a significant secondary source of supply of critical minerals that is more sustainable and less geographically concentrated than primary supply. Targeted policies such as minimum recycled content requirements and tradeable recycling credits can foster its growth in the short term, especially if international standards can be established.

***

This article is taken from the IEA Newsroom and is published with permission