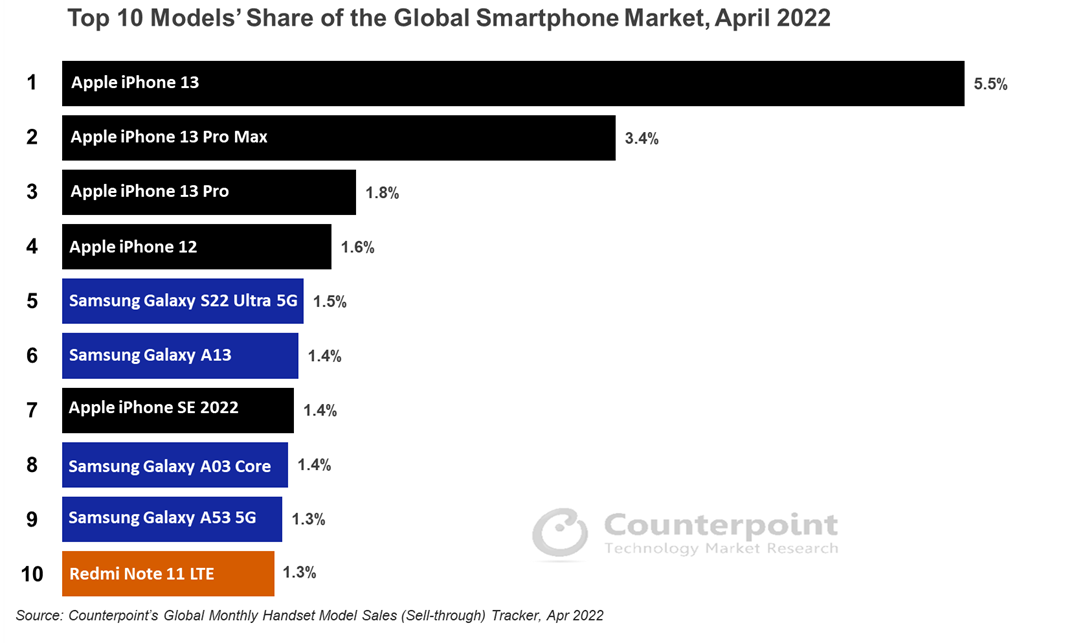

Apple led the global best-selling smartphone list with five models, followed by Samsung and Xiaomi with four and one smartphone respectively, according to Counterpoint’s Global Monthly Handset Sales Tracker for April 2022. The top 10 models captured 21% of the total smartphone market.

The Apple models in the top 10 accounted for 89% of its total sales for the month. Owing to its slim portfolio, Apple has always had multiple models in the best-sellers list. With a broader and more diverse portfolio, Samsung’s top models made up just 22% of its total sales.

The month’s best-sellers list saw an increase in the number of 5G-enabled smartphones, rising to a new high of seven models and up from four in the same month last year. The 5G smartphones on the list represent a third of the total 5G smartphone sales. 5G capability has become a standard offering in flagships and its presence is increasing in lower price bands as well.

Apple:

Apple continues to do well with three of its latest iPhone 13 models capturing the top three spots. Unlike its last generation, the non-Pro iPhone 13 model has maintained a lead every month since launch and has done better than the Pro variants in terms of sales in most large markets.

The recently launched iPhone SE 2022 saw triple-digit MoM growth, entering the top 10 list. The model has done particularly well in Japan where it topped the sales chart for April and captured 18% of the nation’s smartphone market share. It is doing less well in the USA, however.

iPhone 12 captured the 4th spot with increased sales in Japan and India. It is the sole model in the list which was present in the best-sellers list in April 2021.

Samsung:

Samsung captured four spots in the list, and its latest flagship, the Galaxy S22 Ultra, took the fifth spot overall. The successor to the Galaxy Note series after a gap of two years has become the go-to device for existing Galaxy Note smartphone users.

Galaxy A-series devices, positioned at different price points and targeting different customers, helped Samsung capture another three spots. The newly launched Galaxy A13 looks to be replicating the success that the Galaxy A12 series had last year. Over 50% of its sales come from India and LATAM combined. It registered the highest MoM growth among the smartphones in the list.

The entry-level Galaxy A03 Core captured the eighth position and was the best-selling smartphone under $100 wholesale price. CALA contributed almost two-thirds of its sales in April.

Xiaomi:

Despite flat sales in April, the Redmi Note 11 LTE, which contributed 11% to Xiaomi’s total sales, retained a spot on the top 10 list in April. With a quarter of all Note 11 LTEs having been sold in CALA in April, the region is emerging as one of Xiaomi’s key growth drivers. The brand has been facing supply issues and its overall sales declined by around 25% compared to April 2021.