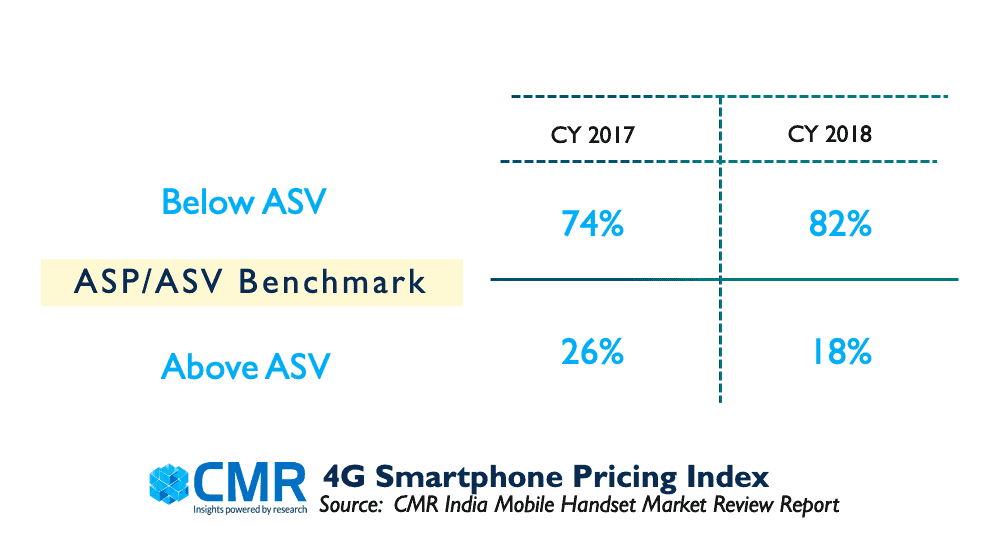

New Delhi / Gurugram, India, April 28, 2019 : CMR recently released the “CMR India Mobile Pricing Index 2018”, which highlights that 4 out of 5 smartphone brands are selling their handsets below the average price of Smartphones in India.

In a hyper-competitive smartphone market, consumers are more demanding than before, and seek much more from their smartphone than before. Whether it be the latest specs, or overall experience, consumers seek the best. These consumers are driving the smartphone upgradation cycles, which in turn, contributes to increased average sales value of smartphones.

As per recent studies undertaken by CMR via its on-demand intelligence platform, Just in Time Insights, when consumers look for a smartphone upgrade, an overwhelming majority gives due consideration to smartphone camera experience. Besides Camera, smartphone brands also give consideration to RAM, battery life and internal memory, among others.

In CY2018, the India market was one of the few major smartphone markets that grew by around 10%, with similar expectations for CY2019.

According to Narinder Kumar, Lead Analyst -IIG CMR, “CY2018 witnessed growth in ASV of Smartphones largely due to upgradation. A majority of the current smartphone shipments are essentially upgrades, driven by consumers seeking more from their smartphones.”

Indian and Chinese brands contributed the most to below industry average ASV, whereas every three out of five brands in above ASV segment were global brands. Global brands like Apple, Google and Samsung were the major premium brands in this segment.

“The decline in above ASV percentage can be attributed to increasing market consolidation. There was around 10% decline in numbers of brands operating in the 4G Smartphone space. With top 10 players contributing 80% – 85% of market, there is stiff competition for rest of brands,” stated Narinder.

Going forward, CMR anticipates growth in ASV in CY2019, driven primarily by increasing consumer demand.