Nearly exactly one month ago, digital real estate platform Loft announced it had closed on $425 million in Series D funding led by New York-based D1 Capital Partners. The round included participation from a mix of new and existing investors such as DST, Tiger Global, Andreessen Horowitz, Fifth Wall and QED, among many others.

At the time, Loft was valued at $2.2 billion, a huge jump from its being just near unicorn territory in January 2020. The round marked one of the largest ever for a Brazilian startup.

Now, today, São Paulo-based Loft has announced an extension to that round with the closing of $100 million in additional funding that values the company at $2.9 billion. This means that the 3-year-old startup has increased its valuation by $700 million in a matter of weeks.

Baillie Gifford led the Series D-2 round, which also included participation from Tarsadia, Flight Deck, Caffeinated and others. Individuals also put money in the extension, including the founders of Better (Vishal Garg), GoPuff, Instacart, Kavak and Sweetgreen.

Loft has seen great success in its efforts to serve as a “one-stop shop” for Brazilians to help them manage the home buying and selling process.

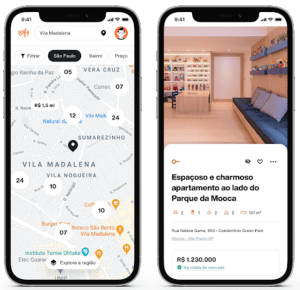

Image courtesy of Loft

In 2020, Loft saw the number of listings on its site increase “10 to 15 times,” according to co-founder and co-CEO Mate Pencz. Today, the company actively maintains more than 13,000 property listings in approximately 130 regions across São Paulo and Rio de Janeiro, partnering with more than 30,000 brokers. Not only are more people open to transacting digitally, more people are looking to buy versus rent in the country.

“We did more than 6x YoY growth with many thousands of transactions over the course of 2020,” Pencz told TechCrunch at the time of the company’s last raise. “We’re now growing into the many tens of thousands, and soon hundreds of thousands, of active listings.”

The decision to raise more capital so soon was due to a variety of factors. For one, Loft has received “overwhelming investor interest” even after “a very, very oversubscribed main round,” Pencz said.

“We have seen a continued acceleration in our market share growth, especially in São Paulo and Rio de Janeiro, the two markets we currently operate in,” he added. “We saw an opportunity to grow even faster with additional capital.”

Pencz also pointed out that Baillie Gifford has relatively large minimum check size requirements, which led to the extension being conducted at a higher price and increased the total round size “by quite a bit to be able to accommodate them.”

While the company was less forthcoming about its financials as of late, it told me last year that it had notched “over $150 million in annualized revenues in its first full year of operation” via more than 1,000 transactions.

The company’s revenues and GMV (gross merchandise value) “increased significantly” in 2020, according to Pencz, who declined to provide more specifics. He did say those figures are “multiples higher from where they were,” and that Loft has “a very clear horizon to profitability.”

Pencz and Florian Hagenbuch founded Loft in early 2018 and today serve as its co-CEOs. The aim of the platform, in the company’s words, is “bringing Latin American real estate into the e-commerce age by developing online alternatives to analogue legacy processes and leveraging data to create transparency in highly opaque markets.” The U.S. real estate tech company with the closest model to Loft’s is probably Zillow, according to Pencz.

In the United States, prospective buyers and sellers have the benefit of MLSs, which in the words of the National Association of Realtors, are private databases that are created, maintained and paid for by real estate professionals to help their clients buy and sell property. Loft itself spent years and many dollars in creating its own such databases for the Brazilian market. Besides helping people buy and sell homes, it offers services around insurance, renovations and rentals.

In 2020, Loft also entered the mortgage business by acquiring one of the largest mortgage brokerage businesses in Brazil. The startup now ranks among the top-three mortgage originators in the country, according to Pencz. When it comes to helping people apply for mortgages, he likened Loft to U.S.-based Better.com.

This latest financing brings Loft’s total funding raised to an impressive $800 million. Other backers include Brazil’s Canary and a group of high-profile angel investors such as Max Levchin of Affirm and PayPal, Palantir co-founder Joe Lonsdale, Instagram co-founder Mike Krieger and David Vélez, CEO and founder of Brazilian fintech Nubank. In addition, Loft has also raised more than $100 million in debt financing through a series of publicly listed real estate funds.

Loft plans to use its new capital in part to expand across Brazil and eventually in Latin America and beyond. The company is also planning to explore more M&A opportunities.