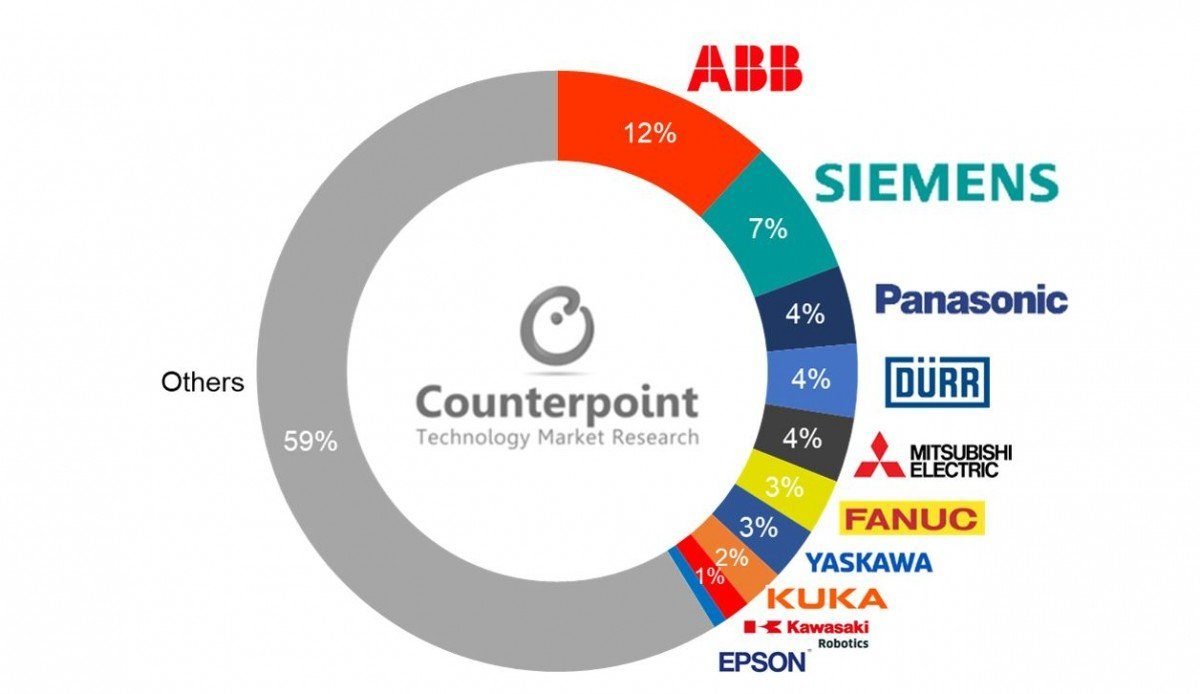

• ABB, Siemens, Mitsubishi Electric, Panasonic and Dürr to account for 34% of total cellular connected industrial automation machine shipments during 2018-25.

The global cellular connected industrial automation equipment market is expected to grow at 43% CAGR between 2018 and 2025, according to the latest research from Counterpoint’s IoT Devices Tracker Service. Industrial automation machines include control systems like PLC (Programmable Logic Controller), servo motors, drives, CNC (Computer Numeric Control) machines, HMI (Human Machine Interface), robots, and others.

Key players in this industry include ABB, Siemens, and Panasonic. Other players included in the study are Dürr, FANUC Robotics, KUKA, Yaskawa, Mitsubishi Electric, Kawasaki, and Epson. These industrial automation and robotics OEMs have introduced embedded modules with several sensors using wireless cellular communication technology to remotely monitor the machine’s health and efficiency. Moreover, most of these companies have their own Industrial IoT (IIoT) platform. ABB Ability, Dürr’s ADAMOS (ADAptive Manufacturing Open Solutions), FANUC FIELD (FANUC Intelligent Edge Link & Drive System), Siemens’ MindSphere, and KUKA Connect are some of the examples.

In 2018, ABB had the highest market share, followed by Siemens and Panasonic. ABB has been the clear market leader due to an early mover advantage both in robotics and factory automation. Since 2007, ABB has delivered more than 40,000 robots with embedded connectivity. ABB is expected to expand its focus on the Robotics and Automation division since they have sold their 80% of Power Grids division to Hitachi. It has recently partnered with Ericsson to accelerate its industrial automation segment. It will do so by combining Ericsson’s 5G technology with its Industry 4.0 products. Siemens is also focusing on software solutions in addition to products for IIoT. Factory automation products such as PLC, CNC, and others dominate their product portfolio.

Commenting on the findings of the study, Senior Analyst, Prachir Singh said, “Industrial equipment firms are increasingly showcasing new use cases that enable high-level process control, maintenance systems, and automated factories. In addition, these firms are leveraging big-data analytics platforms to achieve operational efficiency and cost optimization. The advent of 5G will bring innovation in use cases particularly in robotics-related applications. The low latency network will enable quick command-control mechanism, and boost innovation in manufacturing processes. Robotics firms, especially Japanese, are targeting large-scale manufacturing firms, particularly in China, as the cost of labor continues to go up.”

Adding his perspective, Senior Analyst, Hanish Bhatia said, “Overall, the industrial automation and robotics industry is very keen on adopting IoT enabled equipment due to multiple benefits such predictive equipment maintenance, increasing production quality, and optimization. This results in a reduction in costs, increasing efficiency, and workplace safety. Due to these benefits, we expect the overall industrial landscape to readily adopt the IIoT equipment. However, cellular penetration will be higher only in mobile robots and remote factories. Stationary machines will continue to rely on wireline or Wi-Fi networks.”

Key IIoT specific developments in Industrial Equipment segment:

- ABB has finalized acquisition of General Electric Industrial Solution (GEIS) division for US$2.6 Billion to expand its presence in North America.

- KUKA’s joint venture with Midea group in China is expected to give a surge in its robotics division. KUKA has set very high targets to take up their production capacities to 75,000 robots per year in China by 2024.

- FANUC has a huge presence in Chinese markets. It is expected to grow its robotics segment by expanding its presence in the automotive industry in addition to smartphone manufacturing, pharmaceuticals, and food packaging industries.

- Dürr is looking to expand its geographical reach to include South East Asia. Recently, Dürr has built a paint shop for VinFast in Haiphong, Vietnam with smart technologies for IIoT.

- Yaskawa has setup Yaskawa Solution Factory at its Iruma Plant in Japan and will serve as a state-of-the-art IoT validation plant that will visualize manufacturing and operation status leveraging artificial intelligence (AI).