“There is no business strategy without a cloud strategy,” said Gartner VP Milind Govekar, ahead of the analyst firm’s November 2021 IT Symposium/Xpo. “The adoption and interest in public cloud continues unabated as organizations pursue a ‘cloud first’ policy for onboarding new workloads,” Govekar added.

Gartner estimates that over 85% of organisations will embrace the cloud-first principle by 2025, with over 95% of new workloads being deployed on cloud-native platforms (up from 30% in 2021). Over the next few years, the analyst firm predicts that cloud revenue will exceed non-cloud revenue for ‘relevant enterprise IT markets’. “Anything non-cloud will be considered legacy,” Govekar noted.

SEE: Having a single cloud provider is so last decade

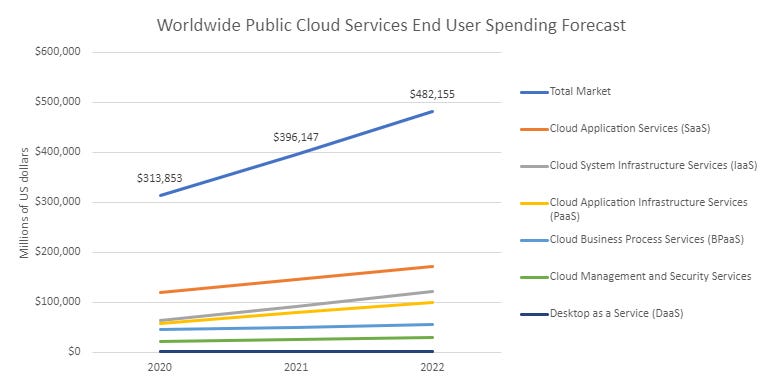

What are the headwinds that are pushing these clouds across the landscape of business IT? In August, Gartner identified four trends that it forecast would propel spending on public cloud services to exceed $480 billion in 2022:

Cloud ubiquity – “Hybrid, multicloud and edge environments are growing and setting the stage for new distributed cloud models”

Regional cloud ecosystems – Driven by “geopolitical regulatory fragmentation, protectionism and industry compliance”

Sustainability and ‘carbon-intelligent’ cloud – “Cloud providers are responding to this growing focus on sustainability by instituting more aggressive carbon-neutral corporate goals”

Cloud infrastructure and platform services (CIPS) providers’ automated programmable infrastructure – “Gartner expects the broad adoption of fully managed and artificial intelligence (AI)-/machine-learning (ML)-enabled cloud services from hyperscale CIPS providers”

Gartner’s forecast saw total spending on public cloud services growing 21.7% year on year to reach $482 billion in 2022. The fastest-growing sectors were infrastructure services (IaaS, 32.9% to $122bn), desktop as a service (DaaS, 30.4% to $2.7bn) and application infrastructure services (PaaS, 25.8% to $101bn).

So, the cloud is growing and evolving on several fronts. In this article, following on from a mid-2021 look at the market, we’ll examine some recent surveys and analyst research to flesh out the picture of where it’s going next.

IBM: Cloud’s next leap

IBM’s Institute for Business Value, in collaboration with Oxford Economics, surveyed 7,164 C-suite executives from enterprises covering 29 industry sectors and 44 countries for its October 2021 report, Cloud’s next leap: How to create transformational business value. The average revenue for the companies surveyed was $805m.

The report’s main aim was to examine the current state of cloud-powered digital transformation. To this end, the authors identified four “progressively more powerful” stages of cloud adoption:

Cloud v1 – Buying infrastructure as a service, paying only for services actually consumed;

Cloud v2 – Purchasing cloud services with a credit card swipe from hyperscale cloud providers;

Cloud v3 – The current enterprise movement to cloud as the default model for application, compute, and networking infrastructure;

Cloud v4 – An emerging version that becomes the default operational infrastructure for business transformation.

Applying Geoffrey A Moore’s classic technology adoption model, IBM noted that version 1 of the cloud has already ‘crossed the chasm’ between early adopters and early majority “as a solution to the high cost and cumbersome processes associated with conventional on-premises data centers”. Cloud v2 has also made the same journey, IBM argued, as business units experimented with software development by purchasing cloud services directly — albeit with the downside that this ‘shadow IT’ resulted in “high rates of outages and security breaches”.

SEE: IBM says the single-vendor approach to cloud computing is dead

Cloud v3, which involves “migrating existing workloads to the cloud, modernizing applications, and assembling cloud ‘estates’ composed of cloud service providers and styles of cloud computing”, is currently en route to early majority status, according to IBM’s report. But this complex mix — involving app modernisation, containers and microservices, design thinking, agile and DevSecOps — can become messy and expensive, IBM warns: “Workload migration plans can get confused with cloud strategies, digital transformation initiatives often proceed with no clear integration with cloud, and cloud tech can get implemented without the changes to cloud operations required to take advantage of what they offer”.

Cloud v4, which is still rooted in the early adopter phase, is “the active operational infrastructure for business transformation” and represents a clear change of direction, according to IBM’s report: “It recasts the entire enterprise as the object of cloud-enabled software development…And it blurs conventional boundaries between ‘the business’ and IT”. If they’re prepared to tackle the high barrier to entry, early adopters of this advanced cloud deployment model can reap a “sustained first-mover advantage”, IBM notes.

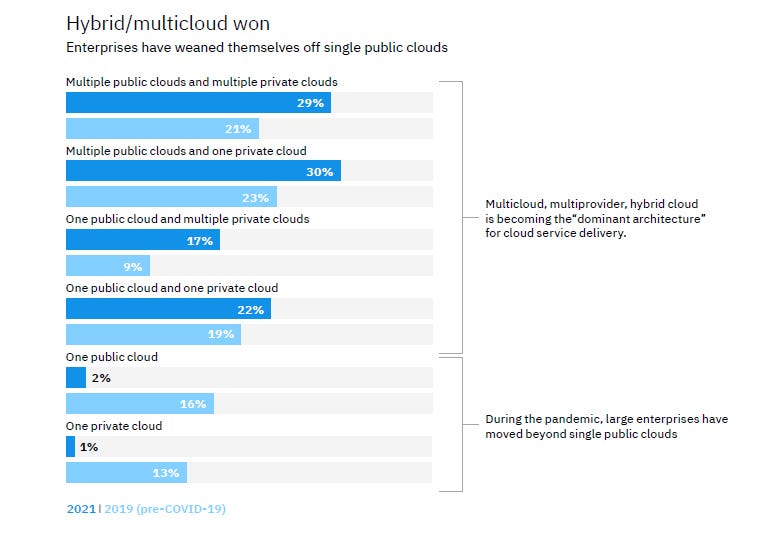

IBM’s report tested a number of hypotheses against the survey data, one of which was that “Hybrid cloud/multicloud won and has become the dominant architecture for enterprise cloud estates”. Here’s what the respondents reported:

During the pandemic, the percentage of respondents using a single public cloud dropped from 16% to 2%, while the percentage using a mix of multiple private and public clouds rose from 44% to 59%.

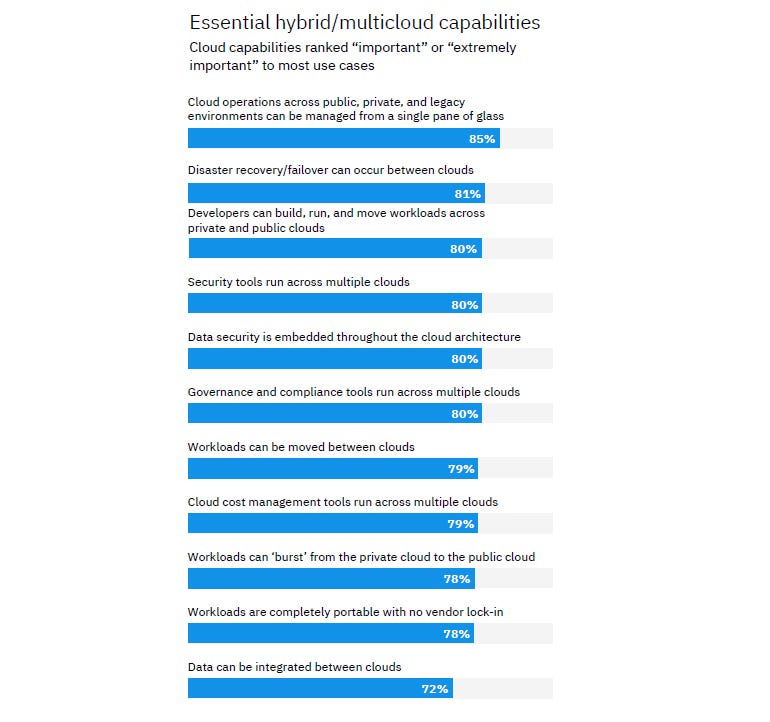

Given that hybrid/multicloud architectures are becoming the norm, the success of such deployments will depend on the capabilities of the available management tools. Here’s a shopping list from IBM’s respondents:

Top of the list at 85% is a requirement that’s likely to occupy software vendors for some time: ‘Cloud operations across public, private, and legacy environments can be managed from a single pane of glass’.

As well as the need for management tooling, skills shortages are often cited as a barrier to more sophisticated cloud deployments. However, in IBM’s survey a majority (54%) of respondents reported that leadership talent was ‘Not a significant obstacle in our cloud estate’, while just under half (47%) had no problem finding people with the right skills or experience.

HashiCorp: State of Cloud Strategy

One software vendor offering multi-cloud infrastructure automation products is HashiCorp, which was founded in 2012. In August 2021, the company released its first State of Cloud Strategy report, based on a survey of 3,205 IT professionals in North America (39%), Europe (34%), APAC (30$%) and Latin America (6%). Company sizes ranged from under 100 employees (28%) to over 5,000 (30%), with the leading industry being software/services (51%), followed by financial services (15%).

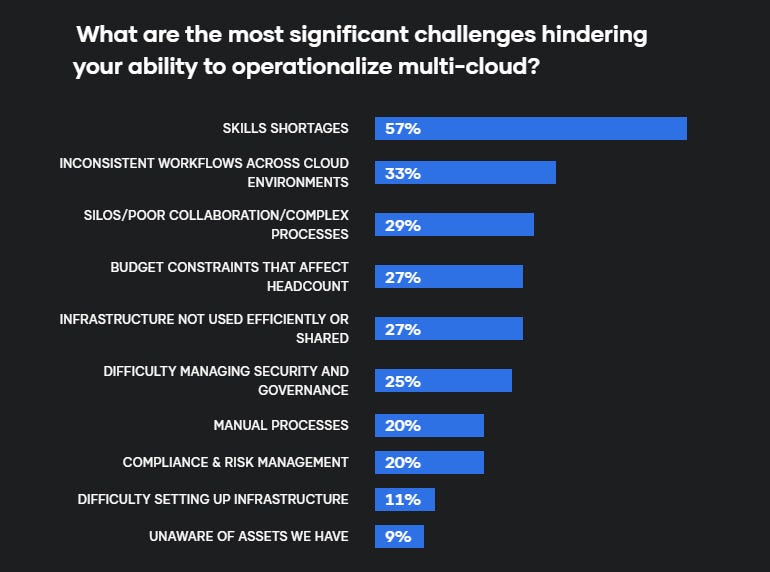

“The era of multi-cloud is here, driven by digital transformation, cost concerns and organizations wanting to avoid vendor lock-in. Incredibly, more than half of the respondents of our survey have already experienced business value from a multi-cloud strategy,” said Armon Dadgar, co-founder and CTO, HashiCorp in a statement. “However, not all organizations have been able to operationalize multi-cloud, as a result of skills shortages, inconsistent workflows across cloud environments, and teams working in silos.”

The survey found that 76% of respondents already employ a multi-cloud architecture, a figure that’s expected to rise to 86% in two years’ time. Enthusiasm for multi-cloud was highest among large enterprises (>5,000 employees) at 94%, dropping to 84% for mid-size companies (101-5,000 employees), and 79% for small businesses (<100 employees).

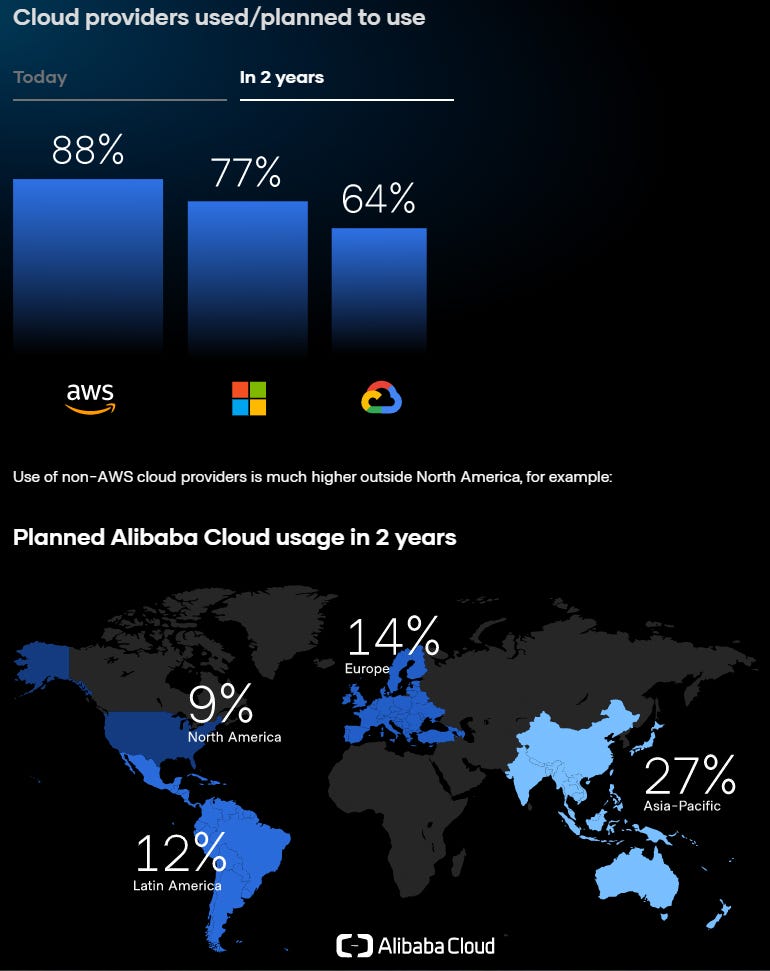

AWS was the leading cloud provider among the Big Three at 88%, both at survey time (February 2021) and as planned for two years’ time. Microsoft Azure and Google Cloud were both expected to add 3% to their current usage, reaching 77% and 64% respectively in 2023. Meanwhile, the survey reported increasing planned usage of Alibaba Cloud, especially in the APAC region:

As noted earlier, over half (53%) of HashiCorp’s survey respondents felt that multi-cloud adoption had helped them achieve their business goals. This is another metric that increases with organisation size: 42% of small businesses; 50% of mid-size companies; 64% of large enterprises.

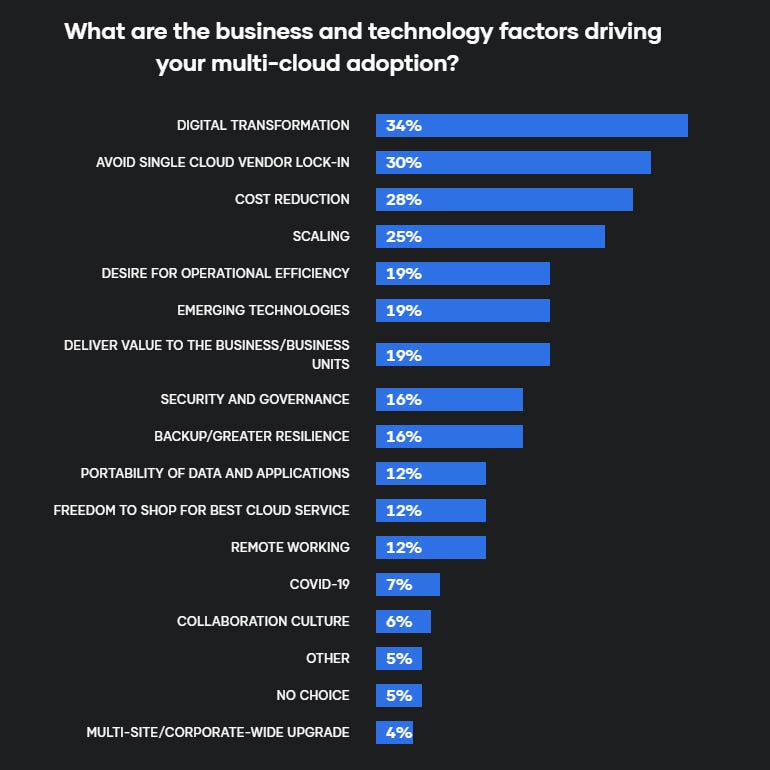

When it comes to the drivers of multi-cloud adoption, digital transformation led the way (34%) followed by single-vendor lock-in avoidance (30%), but there’s a long list of other factors:

Note that the COVID-19 pandemic was cited by just 7% of respondents as a significant driver of multi-cloud adoption.

Part of the reason that a higher percentage of large enterprises report business success from their multi-cloud usage may be because these organisations also tend to implement correlated initiatives such as infrastructure as code, application delivery automation, container orchestration and secrets management (i.e. digital authentication credentials), the survey found. “Adoption of many of those correlated technologies is expected to almost double in the next year,” the report said.

SEE: Cloud security in 2021: A business guide to essential tools and best practices

In contrast to IBM’s survey, which found skills shortages to be less of an obstacle than expected, HashiCorp’s respondents put this issue top of the list of challenges hindering their ability to ‘operationalize’ multi-cloud, by some distance:

Staff and skilling issues also topped the challenges list when different components of cloud deployments were considered – provisioning, networking, security and application deployment.

Multi-cloud is expensive, the survey found, with a third (33%) of respondents spending over $2 million a year and 6% topping the $15m mark on multi-cloud initiatives. Only half (49%) of organisations remained within their 2020 budgets, with 39% overspending and just 12% underspending. The biggest drivers of overspend were shifting priorities (29%) and COVID-19 (21%), followed by a lack of guardrails to manage resources (14%) and a lack of standardised tooling (13%).

When it comes to infrastructure automation tools — which is HashiCorp’s core business — respondents reported that building on open-source software and running it themselves was the most popular option across all cloud components. However, the security sector saw less of this DIY approach and more use of commercial tools as a service than provisioning, networking or application deployment. Nearly all (94%) respondents regarded infrastructure automation tools as ‘important’ or ‘extremely important’, with the widest usage in provisioning and application deployment.

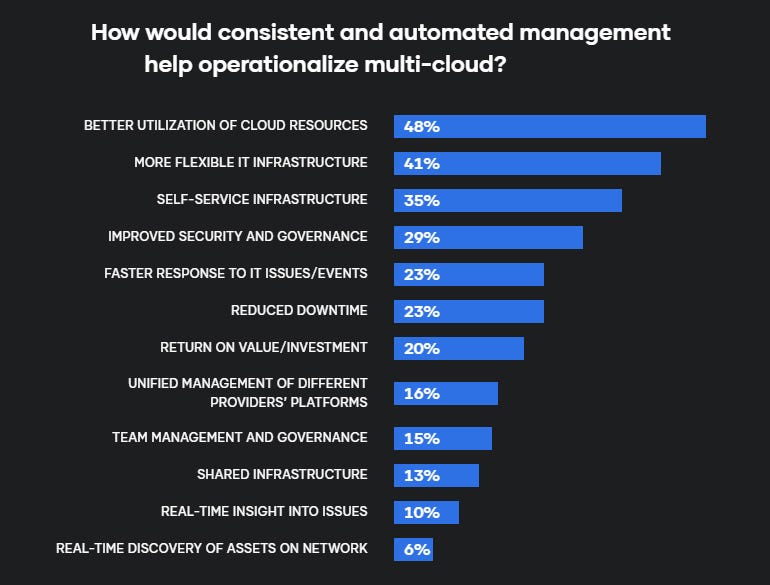

Better utilisation of cloud resources and more flexible IT infrastructure were seen as the main advantages of these automation tools:

Summary & outlook

The cloud is the preferred destination for most organisations’ new workloads, while the modernisation and migration of legacy applications continues apace. Hybrid or multi-cloud is the dominant cloud architecture, for various reasons, including single-vendor lock-in avoidance and the need to find the best ‘home’ for different digital transformation initiatives.

The focus is now on overcoming the various barriers to successful multi-cloud deployment, which include skills shortages and workflow differences between cloud environments. Cloud spend management is a continuing issue, while infrastructure automation tools are becoming increasingly important, particularly when it comes to provisioning and application deployment.

In five years’ time, we won’t be talking about the pros and cons of hybrid/multi-cloud architecture. Instead, the discussion will be all about enterprises as efficient developers of industry-specific cloud-native apps, and automatic, optimised and AI-driven workload deployment.