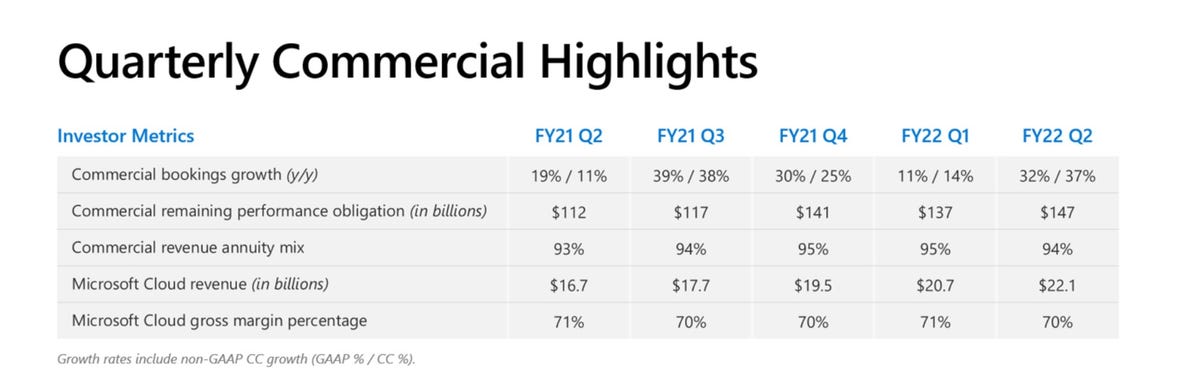

Microsoft’s commercial cloud revenues hit $22.1 billion, up 32 percent year-over year, in its second quarter for fiscal 2022. Revenue across the board was $51.7 billion, up 20 percent year-over-year, and net income was $18.8 billion, up 21 percent compared to 2021’s Q2.

Earnings per share were $2.48, up 22 percent. Wall Street was predicting Microsoft would come in at $50.9 billion for its fiscal second quarter, with profits of $2.31 a share.

This was the first time that Microsoft passed $50 billion in a quarter, officials said during its earnings report on January 25.

The company executed strongly across all its product groups. Office commercial products and cloud services were up 14 percent, with Office 365 commercial revenues up 19 percent. LinkedIn revenues were up 37 percent. Dynamics products and cloud services were up 29 percent, with Dynamics 365 revenues up 45 percent.

Windows OEM revenues were up 25 percent, in spite of ongoing PC component shortages, largely as a result of strong business demand. (Commercial licenses contribute more money than non-commercial ones.) Windows OEM revenue growth included positive impact from the Windows 11 revenue deferral as well.

Even Surface was up this quarter by eight percent, in spite of predictions by Microsoft officials that the Surface business would have a rough Q2. Surface growth was largely attributable to Surface Laptop sales, officials said.

Officials cited growth in “the number of larger, long-term Azure contracts” as contributing to strong commercial bookings (up 32 percent compared to a year ago). However, Microsoft Cloud gross margin was down slightly year-over-year, to 70 percent from 71 percent, due to a change in Microsoft’s accounting estimate for the useful life of server and network equipment.

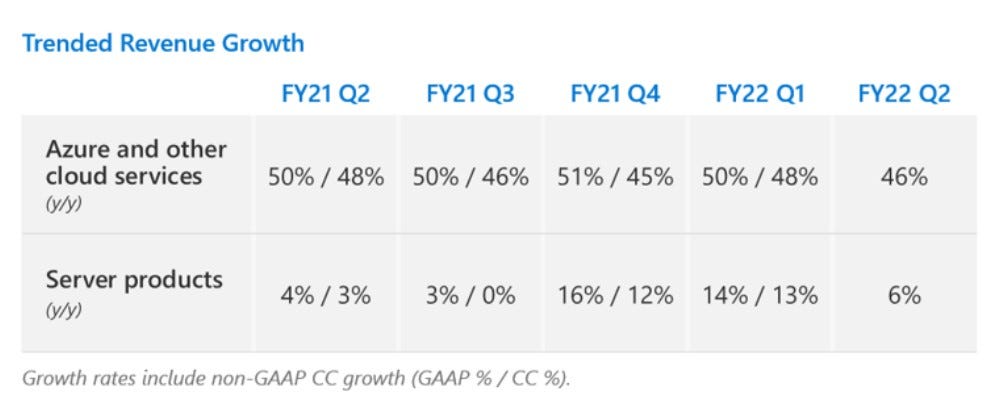

Azure and other cloud services grew 46 percent in the second quarter, which was down from the last several quarters, where growth was 50 percent or higher, which some are attributing for the fall in Microsoft’s stock price after hours.