Coursera showed better-than-expected first quarter revenue and noted that education’s digital transformation is in the early innings.

The company reported a first quarter net loss of $18.66 million, or 45 cents a share, on $88.36 million, up 64% from a year ago. Non-GAAP loss for the first quarter was 32 cents a share.

Wall Street was looking for first quarter revenue of $82.32 million and a non-GAAP loss of 31 cents a share.

Coursera CEO Jeff Maggioncalda said “we believe the digital transformation of higher education is only in the early innings.” The COVID-19 pandemic has accelerated online learning and companies such as Coursera and Chegg have benefited.

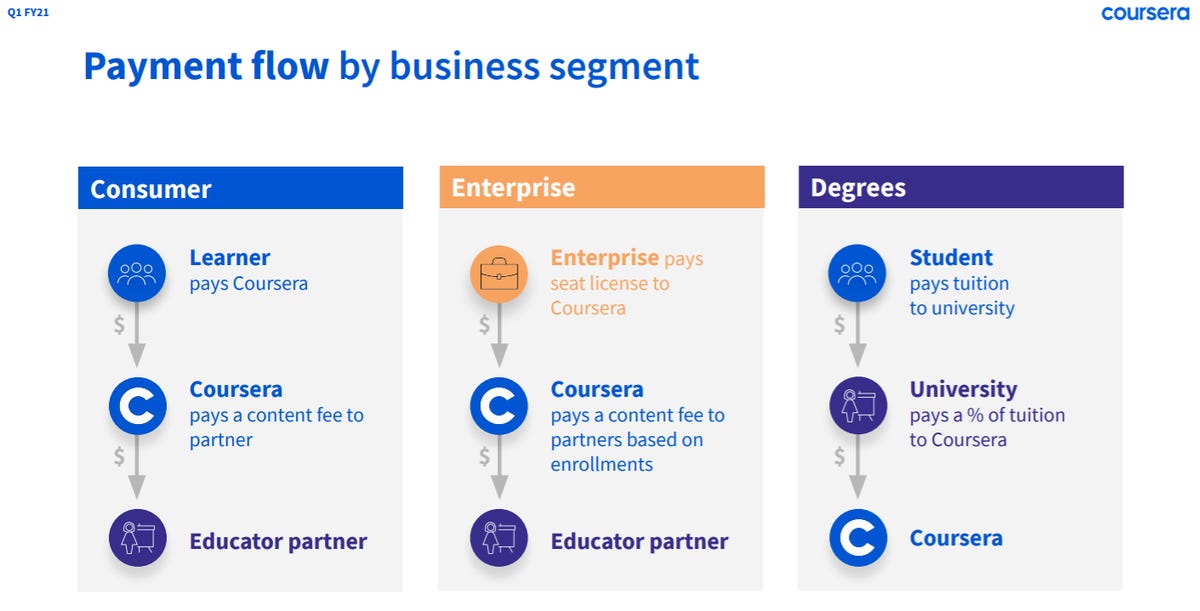

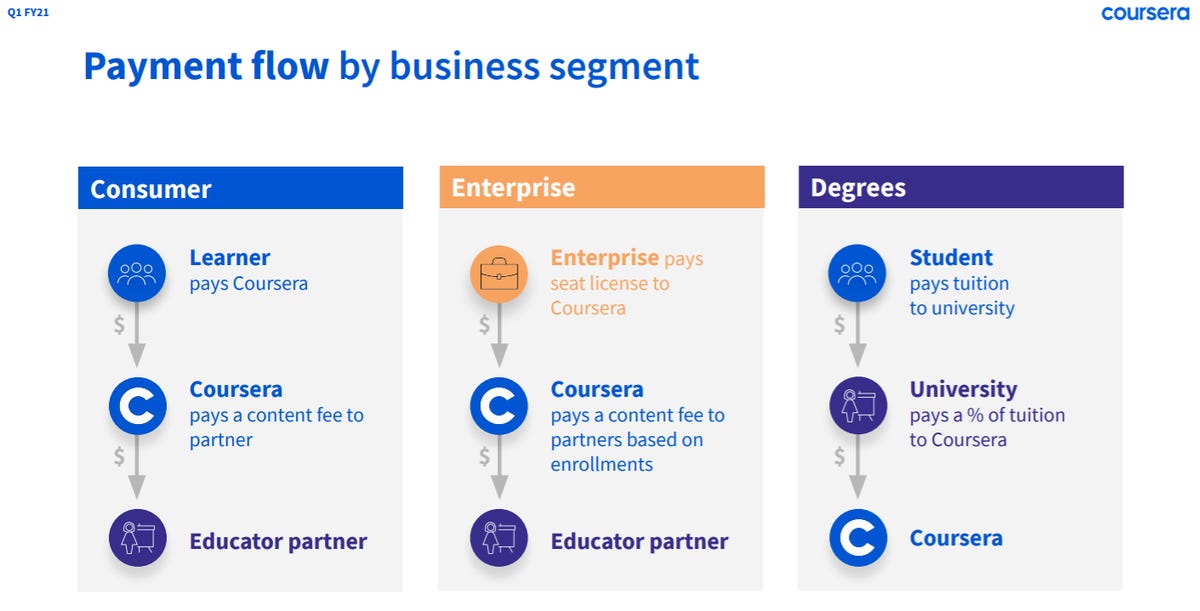

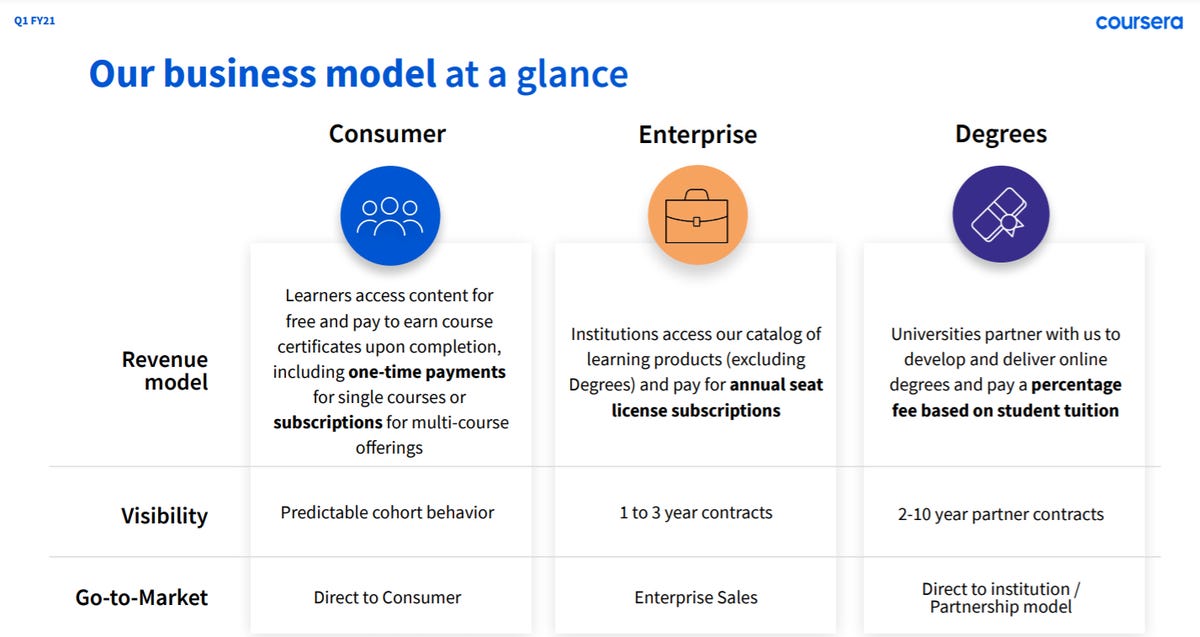

Consumer revenue remains the biggest chunk of Coursera, but enterprise and degree sales also grew in the first quarter. Here’s the breakdown:

- Consumer revenue in the first quarter was $51.9 million, up 61% from a year ago. Coursera’s professional certifications showed strong growth. Coursera added 5 million new registered users to end the quarter with 82 million.

- Enterprise revenue was $24.5 million, up 63% from a year ago. Paid enterprise customers were 479 as of the end of the first quarter. Companies are using Coursera for upskilling and reskilling.

- Degrees revenue in the first quarter was $12 million, up 81% from a year ago. For degree programs, Coursera revenue is a fee since students pay tuition directly to the university. Coursera had 13,493 degree program students at the end of the quarter.

For the second quarter, Coursera projected revenue between $89 million and $93 million. For 2021, Coursera expects revenue of $369 million to $381 million.