Cowbell Cyber aims to combine data science, monitoring, AI, and cyber insurance for SMEs.

Cowbell Cyber, an AI-driven cyber insurance provider for small and medium enterprises, said it raised $20 million in Series A funding to expand its underwriting ability.

The Cowbell Cyber funding comes a day after Corvus Insurance raised $100 million. The upshot here is that startups are looking to expand cyber insurance using data science against incumbent providers. The market for cyber insurance is likely to expand given that security incidents aren’t exactly going away.

Also: What is cyber insurance? Everything you need to know | Best cyber insurers | Google Cloud, Allianz, Munich Re team up on cyber insurance program

Brewer Lane Ventures led the round for Cowbell Cyber with participation from Pivot Investment Partners, Avanta Ventures, and Markel Corporation. Cowbell Cyber said it will use the funding for product development, sales and marketing, and expanding its risk engineering.

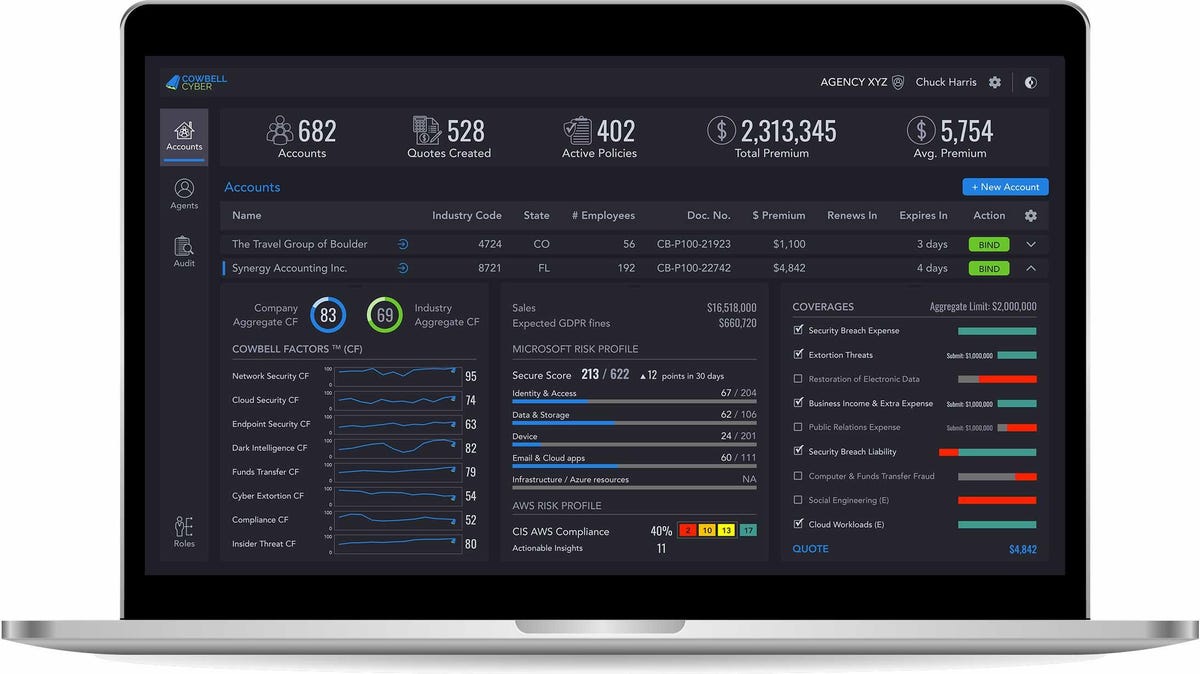

Cowbell Cyber launched its Prime 250 program in September. Prime 250 enables insurance agents to issue personalized cyber policies in 28 states. Cowbell Cyber currently has a risk pool of 10 million continuously monitored organizations and a network of more than 4,000 agents and brokers.

On the data science front, Cowbell Cyber aims to automate data collection with its cloud platform, provide observability and monitoring and then combine it with risk scoring, actuarial science, and underwriting.

The company’s portfolio includes cybersecurity awareness training, continuous risk assessment, and pre- and post-breach risk improvement services. Cowbell Cyber also has a free risk assessment service called Cowbell Factors, which adds a freemium element to selling cyber policies.