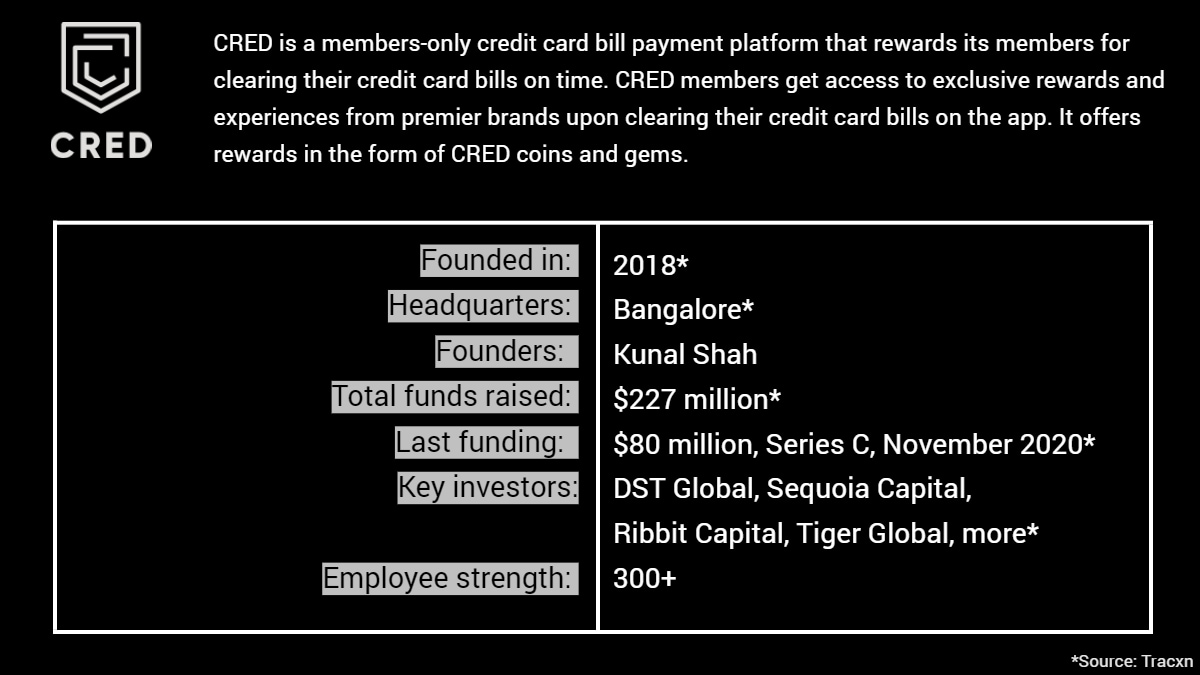

CRED, an easy credit card bill payment app, gained particular traction after it became the official partner for the big-ticket cricketing game Indian Premier League a few months ago. Its ads were catchy, although many people were left wondering, what is CRED, and why would I want to use it, even as the jingle of download CRED got stuck in their heads. Founded in April 2018, the company is currently valued at an impressive $806 million (roughly Rs. 5,894 crores) post a Series C funding round of $81 million (roughly Rs. 592 crores). It even initiated its first-ever ESOP buyback of nearly $1.2 million (roughly Rs. 9 crore) just two years since operations began.

CRED has some large investors backing its cause, and while most platforms in India are focused on building up huge userbases, CRED is sticking to a members-only policy that requires a decent credit score to avail the benefits and rewards that CRED offers. There are some great brand rewards tie-ups that CRED is proud of, and the portfolio includes popular names like Myntra, Ajio, Samsung, Dineout, Cure.fit, and many more.

The COVID-19 pandemic bought with it multiple challenges, and CRED introduced several features like CRED RentPay and CRED Cash to enable members to manage their money and credit better, during uncertain times. CRED has grown steadily to over 5.9 million members and the company claims that it processes approximately 20 percent of all credit card bill payments in India. In the future, CRED envisions becoming a valuable network where members are able to build engagements and connections with each other. It looks to build a community of creditworthy individuals that can trade with each other and develop stronger networks, though it’s clear from the reactions on Twitter that the company needs to become clearer about what it does.

Expert opinion: Research Associate at Counterpoint, Arushi Chawla says that fin-tech companies have great scope in India and they need to focus on things like data protection, regulatory practices, and customer-centric approach to see long-term success in the field. “CRED is a good example when we talk about the future of Fintech. It is working towards building a digital club of high credit scores of individuals and access to past spending history. It has built good strategies to maintain its consumer base and in creating alliances with other prominent players within the industry as well as across other industries. In this two-year journey, they have contributed to a higher sale for the brands associated with them. Further, they have focused on data security. However, for them, it does become important for addressing the challenges in expanding their reach to lower-tier cities while maintaining stronger customer support, Chawla says.

Expert opinion: Research Associate at Counterpoint, Arushi Chawla says that fin-tech companies have great scope in India and they need to focus on things like data protection, regulatory practices, and customer-centric approach to see long-term success in the field. “CRED is a good example when we talk about the future of Fintech. It is working towards building a digital club of high credit scores of individuals and access to past spending history. It has built good strategies to maintain its consumer base and in creating alliances with other prominent players within the industry as well as across other industries. In this two-year journey, they have contributed to a higher sale for the brands associated with them. Further, they have focused on data security. However, for them, it does become important for addressing the challenges in expanding their reach to lower-tier cities while maintaining stronger customer support, Chawla says.

Gadgets 360 spoke to Founder of CRED, Kunal Shah to know a bit more about the company’s success story in the auto tech sector.

Founder of CRED, Kunal Shah

1. What were you doing before CRED was brought to life. What was the conceptualization process behind CRED?

Prior to CRED, I was the Founder and CEO of FreeCharge. In 2015, we delivered a successful exit, marking the end of that journey. For nearly a year after this, I dabbled in multiple things. I considered creating my own fund to invest in growth-stage startups as I believed there were so many good founders with good ideas who weren’t getting enough support at the time. I also spent some time with Y Combinator as a partner and worked with Sequoia as an advisor. All of these opportunities made it clear that starting another company and being able to create wealth for consumers and my team would give me purpose and satisfaction. This is when I decided to start CRED.

We started CRED keeping in mind two objectives. The first was to enable a good life for creditworthy individuals, and the second was to incentivize good financial behaviour to expand the base of creditworthy people in the country. There were two insights that contributed to the conceptualization of CRED.

The first was that the tax payer’s problems are not being solved. Global companies in India look at acquisition and DAU/MAU rather than ARPU since the country is just a statistic that adds volume to global numbers. So in the rush to make numbers, companies try to address the broadest market. The government’s responsibility and focus, on the other hand, is also on addressing the broadest swathe of the population and improving their lives. That leaves the tax-payers – the nation-building minority – ignored and unattended. We wanted to build something that improved their lives. The second was that the audience we were targeting loved their credit cards, but nobody was building good products for them. Credit card usage has grown tremendously in the last four years. Everyone talks about UPI and wallets, but the truth is that Indians love their credit cards, and there have been no good products to help them manage these tools. While using cards is delightful because spending is incentivized, we hate paying bills and there is no platform that incentivizes good behaviour and makes it easy.

This led to the creation of our core product, which enables members to manage all their credit cards in one place. The product also enables members to keep track of their credit card payment journey, providing due date reminders, alerts on hidden charges, and insights into their spending patterns based on credit card usage across categories. In this manner, the product has helped raise awareness and provide members the information they need to make responsible financial decisions.

2. When was it that you finally decided you want to start CRED? Please elaborate on probably that one scenario that cemented your intention to work towards making CRED a reality.

I came to understand that educated, affluent people are losing crores every month by using credit cards sub-optimally. I remember a scenario where a chartered accountant spoke to her friend who is a CA rank holder. She asked him what he thought the interest rate was on his credit card. The friend said 10 percent. This made me realize then that 95 percent of credit cardholders in the country are the first people in their entire family to get a credit card and nobody taught them how to use these tools. This indicated the need and opportunity in this space and helped cement our intention to address these issues and make CRED a reality.

3. Were there any operational challenges (or any other challenges) that you faced when starting CRED? Please offer our readers details on what those challenges were and how you overcame them.

CRED was created for creditworthy individuals, and for a lot of our users, it was necessary to build awareness about the importance of this metric, how it worked and what it indicated. We also needed to make it easy for consumers to access their credit scores, as opposed to a 7-step process used earlier which required individuals to share their address, PAN and other details. To facilitate this, we worked with credit bureaus to build a flow that allows users to become aware of their credit scores in an easy, hassle free manner.

4. Did you have to put in any money to start the business? When did you decide that funding was required? Could you offer broad details on how a startup gets funding and how CRED managed its first round?

Till date, we’ve raised 4 rounds of funding, and as part of the first round I had invested $1 million (CONVERSION PLEASE) as seed capital after which we started accepting funding from other investors. Funding has been important for CRED to help us launch at scale and create a meaningful impact, build a world class product that requires an A+ team, and partner with brands and financial institutions. With regards to how a startup gets funding, I am of the opinion that if a founder has a product that solves a real need and a vision that benefits the larger ecosystem, he will win the confidence of his investors and be able to raise funds for his venture. This is what our focus was when we presented the opportunity CRED taps into, and we’ve been fortunate to have investors and partners that have supported our vision since day one.

5. Could you share some interesting stories about your initial days? What learnings have you picked up from those hustle days?

Initially, we spent a lot of time researching and learning about other fintech products across the globe. What we found was that our vision and the product that we wanted to build with CRED was original in its approach. We realised that the top 10 percent of our country were underserved, despite their contribution in terms of consumption. This brought about the need to reward this cohort of individuals, incentivizing consumption by providing them opportunities that enable a better lifestyle.

6. Is there any particular incident that is a milestone in CRED’s journey? Please share that incident with our readers. Also, outline all of the big milestones that CRED has crossed since inception.

The pandemic has been an important moment in our journey, enabling us to introduce offerings that enhance financial confidence at a time of economic uncertainty. In late March, when the RBI moratorium was announced, it became apparent to us that individuals needed advice and tools that help them manage money and credit better, during a time of great uncertainty. It was then that we decided to accelerate the launch of our products CRED RentPay and CRED Cash, which were planned to roll out much later in the year. We knew that these products would serve as useful tools that offered members the flexibility and confidence they needed, helping them optimize the use of cash and credit.

Member response for these products was fantastic, and we found that CRED members were a cohort, whose spending was more or less unaffected during the pandemic. This proved to be a huge value proposition that the community offered partner brands and institutions, who could now reach and engage with the top 10 percent of Indians in terms of consumption. This led to the launch of CRED Store, our curated, in-app e-commerce offering and Rewards, which are customized digital engagements we created for premium and urban brands to reach and engage with members. Both of these products were launched in April 2020.

The success of products launched in partnership with our brand partners enabled us to continue building products that helped increase the use cases of credit cards by simplifying payments, offering our members additional rewards in the process. In December, we launched our latest product CRED Pay, a new payment experience for members on select merchant platforms. The product launch follows a successful and incredibly promising pilot with over 30 merchants, who experienced larger basket sizes and improved customer satisfaction. It enables brands to create a direct-to-consumer channel by offering them an instant payment experience on their platforms, reducing their dependence on other avenues to sell products and services.

In terms of other milestones for CRED, we were an official sponsor for the much anticipated 13th edition of the Indian Premier League. With millions of Indians tuned in to watch the IPL this season, CRED’s partnership helped create widespread awareness about the brand, while helping extend our mission to educate individuals about managing their finances, more specifically, manage credit better.

7. Could you help give a sense of how far CRED has come? From when it began to where it is now

When we started CRED in 2018, we initially focussed on our members and innovating on distribution to create a community of high-trust individuals in the country. In under two years, we have grown tremendously. Today we process over 20 percent of all credit card bill payments in India. 35 percent of premium credit card holders in the country are on CRED, while 30 percent of CRED users own premium credit cards. Our members spend 2x when compared to the average credit card user and what’s better is that they all exhibit responsible financial behaviour and are creditworthy individuals, as they are granted admission into the community on the basis of their credit scores which needs to be above 750.

We’ve grown steadily over to 5.9 million members who exhibit value to stakeholders such as brands and financial institutions as a low- risk community whose propensity to spend is undeterred, despite the pandemic and economic uncertainty it has brought in. We also work with over 1,300+ brands and financial institutions. This includes premium, urban and DTC brands including the likes of Myntra, The Man Company, Isprava and OnePlus. Some of the financial institutions we have partnered for our offerings include Visa, IDFC Bank and Razorpay.

8. What was it like sailing through the COVID-19 crisis? Did you see a fall in business or an unexpected spurge? How did you deal with it?

The pandemic and subsequent lockdown saw a high degree of uncertainty and anxiety amongst individuals, especially with regards to their finances. It provided us an opportunity to launch products that enabled our members to optimize their use of cash and credit and manage their money better with tools that offered them enhanced confidence and flexibility. This led to the launch of CRED Rent Pay and CRED Cash.

We carried out a study which found that during the time to analyse how credit card spends of our members across cities were affected and found that our members were relatively insulated from the impact of the pandemic. While member spends fell during the introduction of the lockdown, we found that this was not because of a decreased propensity to spend, but because of limited avenues to consume. This led to the creation of products in partnership with brands, that enabled them to reach and engage with our high-trust, affluent members. Both CRED Store — our curated, in-app e-commerce offering and Rewards — customized digital engagements we created for premium and urban brands to reach and engage with members we launched in April 2020.

In this manner, the changes and uncertainties brought about by the pandemic enabled us to pivot and create products that were of use to our members, and our ecosystem stakeholders such as brands and financial institutions.

9. Any advice for young Indian entrepreneurs out there?

I believe that all students should have a startup during college. It doesn’t matter how big or small the venture is, or if it’s successful. There’s a lot to learn from being an entrepreneur, it helps build business acumen and persistence. Even if your venture fails, your experience will make you a 10x better employee than someone with no exposure to how a business works. If you don’t go through the journey of failure, you are not going to have any probability of being successful.

10. What are the big plans in the future?

We foresee that the CRED platform will become a valuable network when members are able to build engagements and connections with each other. Today members can engage with merchants, financial institutions and CRED. Over a period of time they will be able to interact with each other as trusted members of a closed network. This could translate into a CRED member choosing to rent their home only to other CRED members, trade with each other or develop stronger personal networks with trusted individuals.

11. What is the employee strength? Is CRED hiring currently?

Over 300 employees are part of our team currently and we are constantly on the lookout for driven individuals who qualify for various roles across the board.