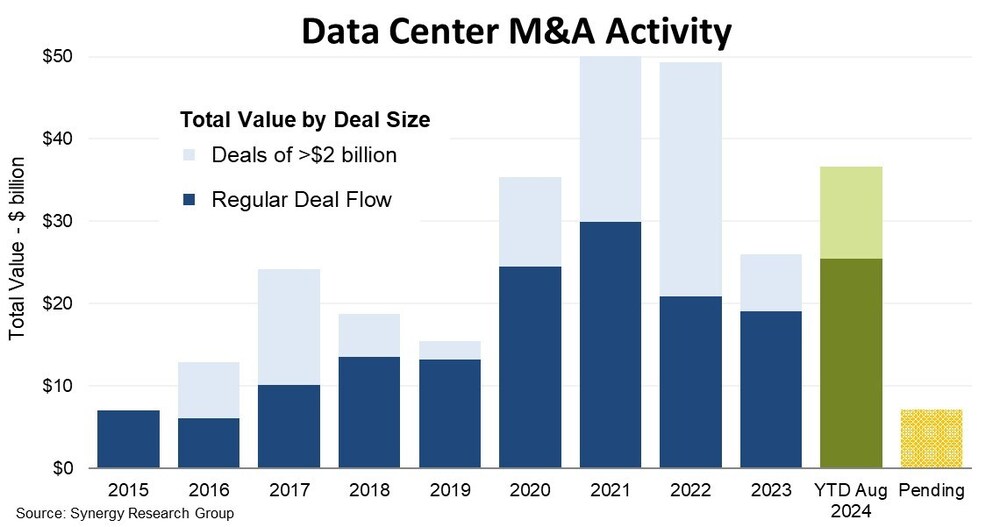

RENO, Nev., Aug. 22, 2024 /PRNewswire/ – New data from Synergy Research Group shows that after a relative lull in 2023, data center-oriented M&A deals in 2024 are once again poised to pass the $40 billion milestone. Total topline numbers show that 2021 and 2022 were the peak in terms of the aggregate value of all deals formally closed. In both years the total value of deals closed was around $50 billion. In 2023 there was then a drop off with total value falling by 47% to $26 billion. However, those 2021 and 2022 numbers were boosted by the four biggest deals ever seen in the industry, each valued at $10 billion or more. If mega-deals of $2 billion or more are separated out, then the trend in the flow of what might be termed “regular deals” shows a different pattern. 2021 was still the peak, 2022 dropped off by 30%, 2023 dropped again but only by 9%, and 2024 is now poised to potentially surpass the 2021 record. Total deals closed so far in 2024 are valued at $36.7 billion, with another $7.1 billion agreed but not yet formally closed. Synergy is also aware of a pipeline of well over $20 billion in possible future deals, where companies are seeking sales or considering strategic options. When some or all of those pending deals close, and taking into account the flow of deals which happen without prior notice and the conversion of some of the pipeline, the final 2024 M&A figure could well match the high seen in 2021.

Since 2015 Synergy has logged a total of 1,381 data center-oriented M&A deals, with an aggregate value of $276 billion. Most of this comes from company acquisitions, but the numbers also include minority equity investments, investments in joint ventures, acquisitions of individual data centers, share sales and acquisition of land for data center development. The four $10 billion-plus deals that closed in 2021 and 2022 were the acquisitions of CyrusOne, Switch, CoreSite and QTS. All four acquired companies feature in the worldwide top 15 ranking of colocation operators, while they are ranked in the top seven in the US market. The biggest deals to close so far in 2024 are the equity investments in Vantage Data Centers and EdgeConneX. Apart from the rapid rise in overall data center M&A activity over the ten-year period, the most notable feature has been the extent to which private equity has flooded into the market. In 2020 private equity accounted for 54% of the value of closed deals, rising to 65% in 2021, and since then it has remained in the 85-90% range.

“There has been an inexorable rise in the demand for data center capacity, driven by cloud services, social networking and a range of both consumer and enterprise digital services. The rise of generative AI is adding a further boost to demand. Specialist data center operators have either not been able to fund those investments themselves, or they were not prepared to put their balance sheets at risk,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “Meanwhile, data centers are very much being viewed as long-term safe havens for investments, even during turbulent times, which has caused a huge influx in private equity. We do not anticipate that picture changing any time soon.”