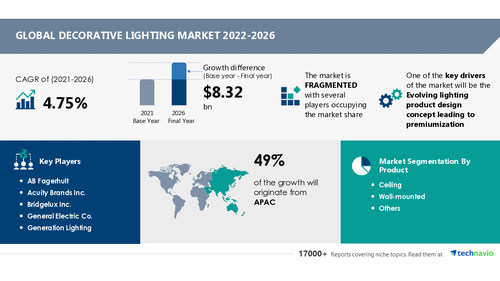

NEW YORK, Nov. 21, 2022 /PRNewswire/ — The decorative lighting market is growing at a CAGR of 4.75% and is expected to register an incremental growth of USD 8.32 from 2021 to 2026. The report has analyzed the market size, growth, and provides accurate predictions on the growth of the market. Download a Free PDF Report Sample

Key Highlights

- The report recognizes the following as the key players in the decorative lighting market: AB Fagerhult, Acuity Brands Inc., Amerlux LLC, Bridgelux Inc., Capital Lighting Fixture Co. among others.

- The global decorative lighting market structure is fragmented in nature.

- APAC is expected to have a significant share in the decorative lighting market.

- Market to observe 3.67% YOY growth in 2022.

View a comprehensive report summary that describes the market size and forecast as well as research methodology. The FREE sample report is available in PDF format

Market Dynamics

The decorative lighting market is expected to witness substantial growth during the forecast period, primarily due to the evolving lighting product design concept leading to premiumization. Growing demand for luxury decorative lighting products among premium customers has encouraged manufacturers to come up with new and unique designs in this category. Luxury decorative lighting products are available as per innovations, quality standards, modern designs, and the latest trends formed by famous interior designers. Interior designers introduce innovative and attractive design concepts such as traditional, modern, contemporary, and transitional. Decorative lighting products such as luxury chandeliers designed by interior designers are available at premium prices. These chandeliers enjoy huge demand among high-net-worth residential users. Several luxurious decorative lighting products are manufactured in Italy, the UK, Spain, Germany, and the US. Thus, the premiumization of decorative lighting products through distinctive design concepts has led to increased adoption by premium customers.

The report also covers information on the upcoming trends and challenges that will influence the market growth. Explore additional information by Downloading a FREE Sample Report

Vendor Landscape

The global decorative lighting market is fragmented and is characterized by the presence of numerous vendors, including both international and regional players. These players offer distinct designs, patterns, and other advanced technology such as smart connectivity in lighting and LED technology. In this market, the vendors compete based on product quality, product innovation, product pricing, and product portfolio. They also focus on business expansion and product innovation to increase their profit margins and market share. The vendors form several competitive strategies to maintain their position in the market. Moreover, the probability of new players entering the market is low in the market. The market constitutes both established brands and private-label brands. Some of the prominent vendors in the global decorative lighting market include Fagerhult, Acuity Brands, Bridgelux, General Electric, Generation Lighting, Honeywell International, IDEAL INDUSTRIES Inc., Maxim Lighting International, OSRAM Licht, and Signify.

This report provides a full list of key vendors, their strategies, and the latest developments. Buy Now to gain access to exclusive vendor information

Key Segments

The decorative lighting market is segmented by product into ceiling, wall-mounted, and others. The ceiling segment is expected to be the largest segment of the global decorative lighting market during the forecast period. The ceiling segment includes fixtures that are mounted on a ceiling or hung from the ceiling. These include chandeliers, pendant lights, semi-flush, and flush-mounted lights; pool table lights, buffet lamps, kitchen island lights, and outdoor ceiling lights. These are largely used in residential and commercial places. They are also available in traditional, transitional, and modern designs and are made of varied materials. Customers who do not have much ceiling space for big chandeliers opt for small-sized chandeliers, which are also known as mini chandeliers.

Get lifetime access to our Technavio Insights! Subscribe to our “Basic Plan” billed annually at USD 5000

Regional Growth Analysis

The global decorative lighting market is analyzed across five regions, namely APAC, Europe, North America, South America, the Middle East and Africa. APAC is the dominating region and is expected to account for 49% of the global market share over the forecast period. Several manufacturers of decorative lights in this region are from China and Japan. The decorative lighting market in APAC is highly fragmented and competitive due to the presence of many domestic brands that offer a wide variety of products. The increasing preference for sleek lights such as lamps, pendant lights, and floor lamps is driving the growth of the regional market.

Identify potential segments and regions to invest in over the forecast period. View FREE Sample Report

Along with the market data, Technavio offers customizations as per the specific needs of companies. The following customization options are available for the decorative lighting market report:

Regional Analysis

- Further breakdown of the market segmentation at requested regions.

Market Player Information

- Detailed analysis and profiling of additional market players, vendor segmentation, and vendor offerings.

- Know the strategies adopted by vendors during the recovery phase. View our FREE Sample Report

Related Reports:

- The outdoor landscape lighting market share in North America is expected to increase by USD 147.51 million from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 5.22%. The growing demand for LED lighting for different applications is notably driving the outdoor landscape lighting market growth in North America, although factors such as poor performance of LED lighting products at high temperatures may impede the market growth.

- The industrial and commercial LED lighting market is projected to grow by USD 41.56 billion with a CAGR of 17.44% during the forecast period 2021 to 2026. The declining manufacturing cost of LEDs is notably driving the industrial and commercial LED lighting market growth, although factors such as the limited thermal tolerance of LEDs installed in industrial facilities may impede the market growth.

|

Decorative Lighting Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.75% |

|

Market growth 2022-2026 |

USD 8.32 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

3.67 |

|

Regional analysis |

APAC, Europe, North America, South America, and MEA |

|

Performing market contribution |

APAC at 49% |

|

Key consumer countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading companies, competitive strategies, consumer engagement scope |

|

Companies profiled |

AB Fagerhult, Acuity Brands Inc., Bridgelux Inc., General Electric Co., Generation Lighting, Honeywell International Inc., IDEAL INDUSTRIES INC., Maxim Lighting International, OSRAM GmbH, and Signify NV |

|

Market Dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and future consumer dynamics, and market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Table of contents:

1 Executive Summary

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 01: Parent market

- Exhibit 02: Market characteristics

- 2.2 Value chain analysis

- Exhibit 03: Value chain analysis: Electrical components and equipment market

3 Market Sizing

- 3.1 Market definition

- Exhibit 04: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 05: Market segments

- 3.3 Market size 2020

- 3.4 Market outlook: Forecast for 2020 – 2025

- Exhibit 06: Global – Market size and forecast 2020 – 2025 ($ million)

- Exhibit 07: Global market: Year-over-year growth 2020 – 2025 (%)

4 Five Forces Analysis

- 4.1 Five Forces Analysis

- Exhibit 08: Five forces analysis 2020 & 2025

- 4.2 Bargaining power of buyers

- Exhibit 09: Bargaining power of buyers

- 4.3 Bargaining power of suppliers

- Exhibit 10: Bargaining power of suppliers

- 4.4 Threat of new entrants

- Exhibit 11: Threat of new entrants

- 4.5 Threat of substitutes

- Exhibit 12: Threat of substitutes

- 4.6 Threat of rivalry

- Exhibit 13: Threat of rivalry

- 4.7 Market condition

- Exhibit 14: Market condition – Five forces 2020

5 Market Segmentation by Product

- 5.1 Market segments

- Exhibit 15: Product – Market share 2020-2025 (%)

- 5.2 Comparison by Product

- Exhibit 16: Comparison by Product

- 5.3 Ceiling – Market size and forecast 2020-2025

- Exhibit 17: Ceiling – Market size and forecast 2020-2025 ($ million)

- Exhibit 18: Ceiling – Year-over-year growth 2020-2025 (%)

- 5.4 Wall-mounted – Market size and forecast 2020-2025

- Exhibit 19: Wall-mounted – Market size and forecast 2020-2025 ($ million)

- Exhibit 20: Wall-mounted – Year-over-year growth 2020-2025 (%)

- 5.5 Others – Market size and forecast 2020-2025

- Exhibit 21: Others – Market size and forecast 2020-2025 ($ million)

- Exhibit 22: Others – Year-over-year growth 2020-2025 (%)

- 5.6 Market opportunity by Product

- Exhibit 23: Market opportunity by Product

6 Market Segmentation by Distribution channel

- 6.1 Market segments

- Exhibit 24: Distribution channel – Market share 2020-2025 (%)

- 6.2 Comparison by Distribution channel

- Exhibit 25: Comparison by Distribution channel

- 6.3 Offline – Market size and forecast 2020-2025

- Exhibit 26: Offline – Market size and forecast 2020-2025 ($ million)

- Exhibit 27: Offline – Year-over-year growth 2020-2025 (%)

- 6.4 Online – Market size and forecast 2020-2025

- Exhibit 28: Online – Market size and forecast 2020-2025 ($ million)

- Exhibit 29: Online – Year-over-year growth 2020-2025 (%)

- 6.5 Market opportunity by Distribution channel

- Exhibit 30: Market opportunity by Distribution channel

7 Customer landscape

8 Geographic Landscape

- 8.1 Geographic segmentation

- Exhibit 32: Market share by geography 2020-2025 (%)

- 8.2 Geographic comparison

- Exhibit 33: Geographic comparison

- 8.3 APAC – Market size and forecast 2020-2025

- Exhibit 34: APAC – Market size and forecast 2020-2025 ($ million)

- Exhibit 35: APAC – Year-over-year growth 2020-2025 (%)

- 8.4 Europe – Market size and forecast 2020-2025

- Exhibit 36: Europe – Market size and forecast 2020-2025 ($ million)

- Exhibit 37: Europe – Year-over-year growth 2020-2025 (%)

- 8.5 North America – Market size and forecast 2020-2025

- Exhibit 38: North America – Market size and forecast 2020-2025 ($ million)

- Exhibit 39: North America – Year-over-year growth 2020-2025 (%)

- 8.6 South America – Market size and forecast 2020-2025

- Exhibit 40: South America – Market size and forecast 2020-2025 ($ million)

- Exhibit 41: South America – Year-over-year growth 2020-2025 (%)

- 8.7 MEA – Market size and forecast 2020-2025

- Exhibit 42: MEA – Market size and forecast 2020-2025 ($ million)

- Exhibit 43: MEA – Year-over-year growth 2020-2025 (%)

- 8.8 Key leading countries

- Exhibit 44: Key leading countries

- 8.9 Market opportunity by geography

- Exhibit 45: Market opportunity by geography ($ million)

9 Drivers, Challenges, and Trends

- 9.1 Market drivers

- 9.2 Market challenges

- Exhibit 46: Impact of drivers and challenges

- 9.3 Market trends

10 Vendor Landscape

- 10.1 Overview

- Exhibit 47: Vendor landscape

- 10.2 Competitive scenario

- 10.3 Landscape disruption

- Exhibit 48: Landscape disruption

- Exhibit 49: Industry risks

11 Vendor Analysis

- 11.1 Vendors covered

- Exhibit 50: Vendors covered

- 11.2 Market positioning of vendors

- Exhibit 51: Market positioning of vendors

- 11.3 AB Fagerhult

- Exhibit 52: AB Fagerhult – Overview

- Exhibit 53: AB Fagerhult – Business segments

- Exhibit 54: AB Fagerhult – Key news

- Exhibit 55: AB Fagerhult – Key offerings

- Exhibit 56: AB Fagerhult – Segment focus

- 11.4 Acuity Brands Inc.

- Exhibit 57: Acuity Brands Inc. – Overview

- Exhibit 58: Acuity Brands Inc. – Business segments

- Exhibit 59: Acuity Brands Inc. – Key news

- Exhibit 60: Acuity Brands Inc. – Key offerings

- 11.5 Bridgelux Inc.

- Exhibit 61: Bridgelux Inc. – Overview

- Exhibit 62: Bridgelux Inc. – Product and service

- Exhibit 63: Bridgelux Inc. – Key news

- Exhibit 64: Bridgelux Inc. – Key offerings

- 11.6 General Electric Co.

- Exhibit 65: General Electric Co. – Overview

- Exhibit 66: General Electric Co. – Business segments

- Exhibit 67: General Electric Co. – Key news

- Exhibit 68: General Electric Co. – Key offerings

- Exhibit 69: General Electric Co. – Segment focus

- 11.7 Generation Lighting

- Exhibit 70: Generation Lighting – Overview

- Exhibit 71: Generation Lighting – Product and service

- Exhibit 72: Generation Lighting – Key offerings

- 11.8 Honeywell International Inc.

- Exhibit 73: Honeywell International Inc. – Overview

- Exhibit 74: Honeywell International Inc. – Business segments

- Exhibit 75: Honeywell International Inc. – Key news

- Exhibit 76: Honeywell International Inc. – Key offerings

- Exhibit 77: Honeywell International Inc. – Segment focus

- 11.9 IDEAL INDUSTRIES INC.

- Exhibit 78: IDEAL INDUSTRIES INC. – Overview

- Exhibit 79: IDEAL INDUSTRIES INC. – Product and service

- Exhibit 80: IDEAL INDUSTRIES INC. – Key offerings

- 11.10 Maxim Lighting International

- Exhibit 81: Maxim Lighting International – Overview

- Exhibit 82: Maxim Lighting International – Product and service

- Exhibit 83: Maxim Lighting International – Key offerings

- 11.11 OSRAM GmbH

- Exhibit 84: OSRAM GmbH – Overview

- Exhibit 85: OSRAM GmbH – Business segments

- Exhibit 86: OSRAM GmbH – Key offerings

- Exhibit 87: OSRAM GmbH – Segment focus

- 11.12 Signify NV

- Exhibit 88: Signify NV – Overview

- Exhibit 89: Signify NV – Business segments

- Exhibit 90: Signify NV – Key news

- Exhibit 91: Signify NV – Key offerings

- Exhibit 92: Signify NV – Segment focus

12 Appendix

- 12.1 Scope of the report

- 12.2 Currency conversion rates for US$

- Exhibit 93: Currency conversion rates for US$

- 12.3 Research methodology

- Exhibit 94: Research Methodology

- Exhibit 95: Validation techniques employed for market sizing

- Exhibit 96: Information sources

- 12.4 List of abbreviations

- Exhibit 97: List of abbreviations

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com/

SOURCE Technavio