After filing earlier this year, DoorDash dropped its public S-1 filing this morning, bringing clarity to its numbers and moving it closer to a public debut that should happen before the end of the year.

The company is one of several startups that we expect to see IPOs from before the year ends, despite some recent market chop and election chaos in the United States.

DoorDash is a heavily-backed company, with Crunchbase reporting that the food-delivery giant has accessed around $2.5 billion in capital during its life, most recently in a $400 million round this June. At the time, DoorDash was valued at a towering $16 billion, post-money, giving the company big valuation shoes to fill when it prices its IPO, and begins to trade.

What follows is a brief rundown of its numbers. The TechCrunch crew will be digging through the IPO filing all morning, so expect more coverage on ownership, legal risks, and other details soon. Let’s go!

The numbers

DoorDash has grown incredibly rapidly, scaling its revenues from $291 million in 2018 to $885 million in 2019. And more recently, from $587 million in the first nine months of 2019 to $1.92 billion in the same period of 2020.

That is 226% growth in 2020 thus far, the sort of expansion that explains why DoorDash was able to attract so much capital at such high prices.

How high-quality is DoorDash’s revenue? In the first three quarters of 2019, the company had gross margins of 39.9%, and in the same period of 2020 the figure rose to 53.1%, a huge improvement for the consumer consumable delivery confab.

The result of DoorDash’s epic growth, and gross margin improvement has been radically improving profitability. The company’s operating loss fell from $479 million in the first nine months of 2019 to just $131 million in the same period of 2020. DoorDash’s net losses are slightly worse — $533 million and $149 million over the same timeframes, respectively — but, again, compared to the company’s topline growth and revenue quality improvements, are inconsequential.

DoorDash has around $1.6 billion in cash and equivalents heading into the fourth quarter, meaning that it has ample cash to fund itself, sans an IPO. The company is therefore going out because it thinks the time is ripe.

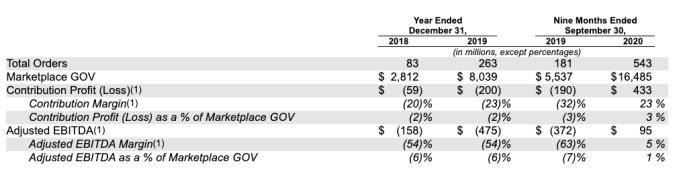

Driving DoorDash’s epic growth has been a huge boom in the company’s order volumes and gross order volumes, while its gross margins appear driven by an epic gain in the profitability of the company’s core activity. Observe the following dataset:

The 2019 to 2020 change in contribution margin at DoorDash, and its jump into positive-adjusted EBITDA, makes one wonder why Uber is struggling to accomplish the same task with its Uber Eats business. Regardless, the flip into adjusted profitability should be enough to allay Wall Street concerns about DoorDash’s path to eventual GAAP profits.

At that trajectory it can get the job done in a year or so.

And DoorDash’s operations have flipped into the cash-generating territory, with the company reporting operating cash flow of $315 million during the first three quarters of 2020, up from -$308 million in the same period of 2019.

Overall I am impressed at first blush. The company is bigger, growing more quickly, and losing less money than I expected. Throw in cash generation and adjusted EBTIDA positivity and improving gross margins, and DoorDash could be worth a pretty penny. Without recurring revenues akin to a software company, and the possibility of a vaccine slowing is future growth, DoorDash won’t get a SaaS multiple when it prices. But perhaps defending that $16 billion valuation won’t be as hard as we might have guessed before getting our hands on the numbers.

More to come. Stick with TechCrunch.