For this morning’s column, Alex Wilhelm looked back on the last few months, “a busy season for technology exits” that followed a hot Q4 2020.

We’re seeing signs of an IPO market that may be cooling, but even so, “there are sufficient SPACs to take the entire recent Y Combinator class public,” he notes.

Once we factor in private equity firms with pockets full of money, it’s evident that late-stage companies have three solid choices for leveling up.

Seeking more insight into these liquidity options, Alex interviewed:

- DigitalOcean CEO Yancey Spruill, whose company went public via IPO;

- Latch CFO Garth Mitchell, who discussed his startup’s merger with real estate SPAC $TSIA;

- Brian Cruver, founder and CEO of AlertMedia, which recently sold to a private equity firm.

After recapping their deals, each executive explains how their company determined which flashing red “EXIT” sign to follow. As Alex observed, “choosing which option is best from a buffet’s worth of possibilities is an interesting task.”

Thanks very much for reading Extra Crunch! Have a great weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Full Extra Crunch articles are only available to members

Use discount code ECFriday to save 20% off a one- or two-year subscription

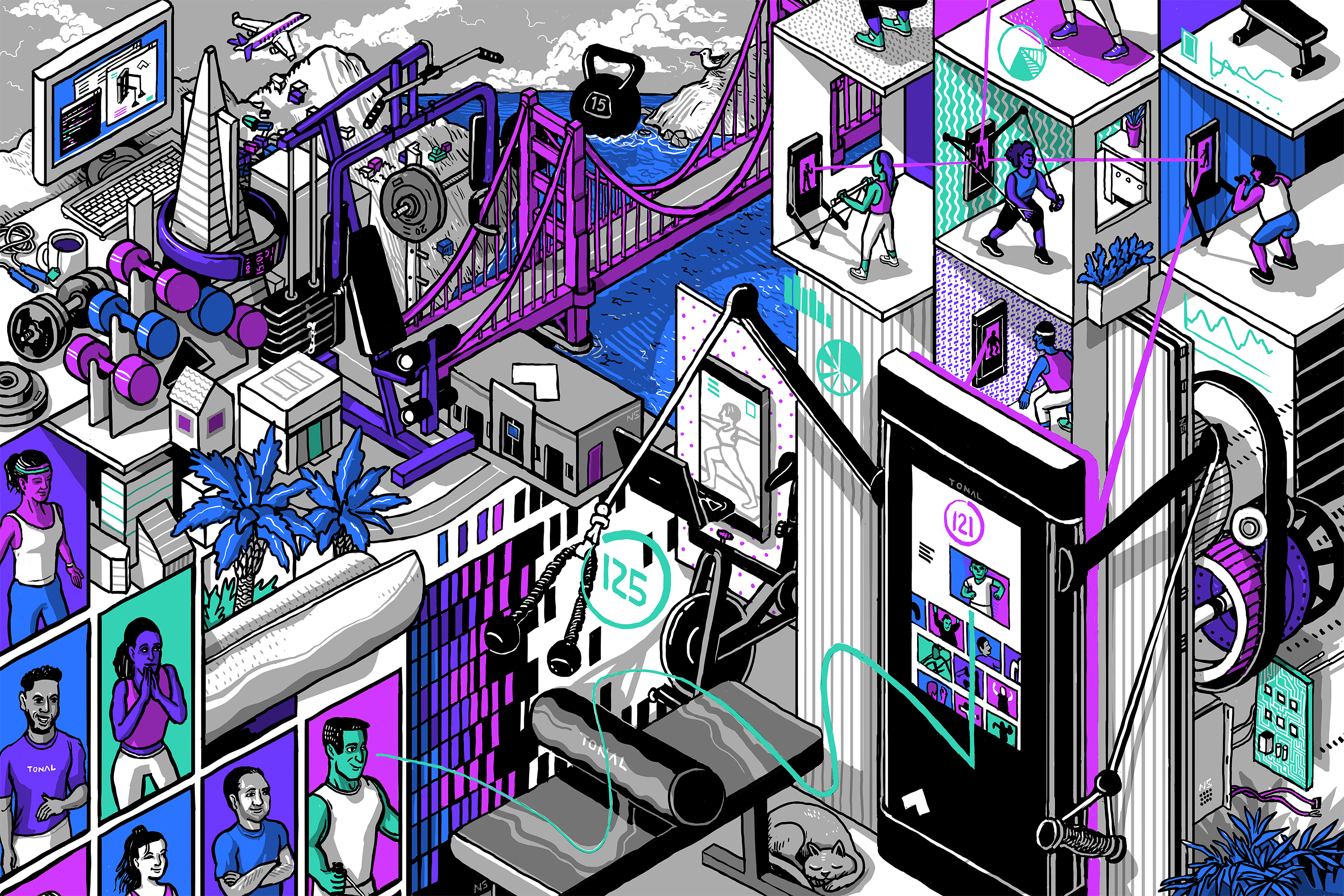

The Tonal EC-1

Image Credits: Nigel Sussman

On Tuesday, we published a four-part series on Tonal, a home fitness startup that has raised $200 million since it launched in 2018. The company’s patented hardware combines digital weights, coaching and AI in a wall-mounted system that sells for $2,995.

By any measure, it is poised for success — sales increased 800% between December 2019 and 2020, and by the end of this year, the company will have 60 retail locations. On Wednesday, Tonal reported a $250 million Series E that valued the company at $1.6 billion.

Our deep dive examines Tonal’s origins, product development timeline, its go-to-market strategy and other aspects that combined to spark investor interest and customer delight.

We call this format the “EC-1,” since these stories are as comprehensive and illuminating as the S-1 forms startups must file with the SEC before going public.

Here’s how the Tonal EC-1 breaks down:

We have more EC-1s in the works about other late-stage startups that are doing big things well and making news in the process.

What to make of Deliveroo’s rough IPO debut

Image Credits: Nigel Sussman (opens in a new window)

Why did Deliveroo struggle when it began to trade? Is it suffering from cultural dissonance between its high-growth model and more conservative European investors?

Let’s peek at the numbers and find out.

Kaltura puts debut on hold. Is the tech IPO window closing?

Image Credits: Nigel Sussman (opens in a new window)

The Exchange doubts many folks expected the IPO climate to get so chilly without warning. But we could be in for a Q2 pause in the formerly scorching climate for tech debuts.

Is Substack really worth $650M?

Image Credits: Nigel Sussman (opens in a new window)

A $65 million Series B is remarkable, even by 2021 standards. But the fact that a16z is pouring more capital into the alt-media space is not a surprise.

Substack is a place where publications have bled some well-known talent, shifting the center of gravity in media. Let’s take a look at Substack’s historical growth.

RPA market surges as investors, vendors capitalize on pandemic-driven tech shift

Image Credits: Visual Generation / Getty Images

Robotic process automation came to the fore during the pandemic as companies took steps to digitally transform. When employees couldn’t be in the same office together, it became crucial to cobble together more automated workflows that required fewer people in the loop.

RPA has enabled executives to provide a level of automation that essentially buys them time to update systems to more modern approaches while reducing the large number of mundane manual tasks that are part of every industry’s workflow.

E-commerce roll-ups are the next wave of disruption in consumer packaged goods

Image Credits: Javier Zayas Photography (opens in a new window) / Getty Images

This year is all about the roll-ups, the aggregation of smaller companies into larger firms, creating a potentially compelling path for equity value. The interest in creating value through e-commerce brands is particularly striking.

Just a year ago, digitally native brands had fallen out of favor with venture capitalists after so many failed to create venture-scale returns. So what’s the roll-up hype about?

Hack takes: A CISO and a hacker detail how they’d respond to the Exchange breach

Image Credits: TarikVision (opens in a new window) / Getty Images

The cyber world has entered a new era in which attacks are becoming more frequent and happening on a larger scale than ever before. Massive hacks affecting thousands of high-level American companies and agencies have dominated the news recently. Chief among these are the December SolarWinds/FireEye breach and the more recent Microsoft Exchange server breach.

Everyone wants to know: If you’ve been hit with the Exchange breach, what should you do?

5 machine learning essentials nontechnical leaders need to understand

Image Credits: David Malan (opens in a new window) / Getty Images

Machine learning has become the foundation of business and growth acceleration because of the incredible pace of change and development in this space.

But for engineering and team leaders without an ML background, this can also feel overwhelming and intimidating.

Here are best practices and must-know components broken down into five practical and easily applicable lessons.

Embedded procurement will make every company its own marketplace

Image Credits: Busakorn Pongparnit / Getty Images

Embedded procurement is the natural evolution of embedded fintech.

In this next wave, businesses will buy things they need through vertical B2B apps, rather than through sales reps, distributors or an individual merchant’s website.

Knowing when your startup should go all-in on business development

Image Credits: twomeows / Getty Images

There’s a persistent fallacy swirling around that any startup growing pain or scaling problem can be solved with business development.

That’s frankly not true.

Dear Sophie: What should I know about prenups and getting a green card through marriage?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie:

I’m a founder of a startup on an E-2 investor visa and just got engaged! My soon-to-be spouse will sponsor me for a green card.

Are there any minimum salary requirements for her to sponsor me? Is there anything I should keep in mind before starting the green card process?

— Betrothed in Belmont

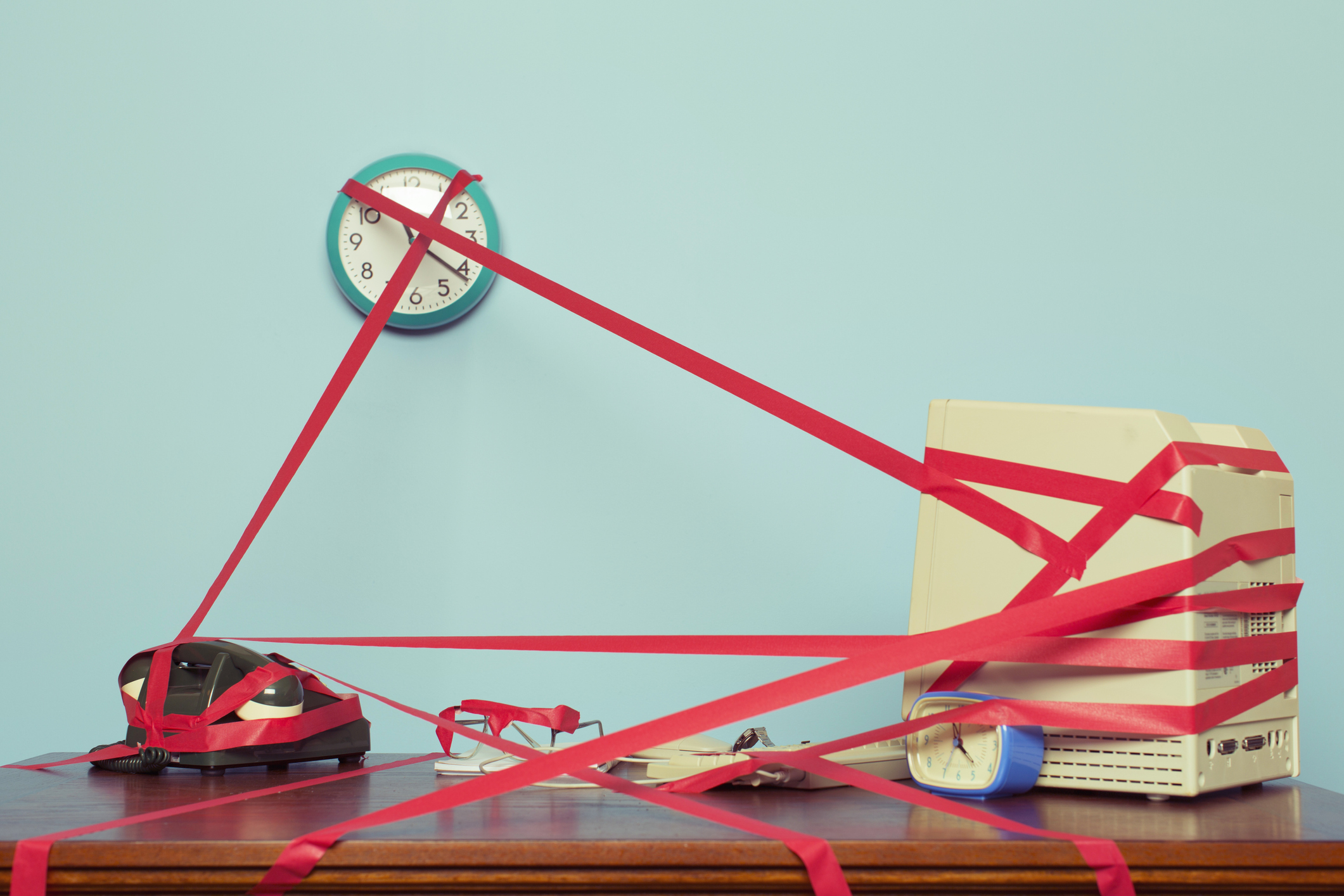

Startups must curb bureaucracy to ensure agile data governance

Image Credits: RichVintage / Getty Images

Many organizations perceive data management as being akin to data governance, where responsibilities are centered around establishing controls and audit procedures, and things are viewed from a defensive lens.

That defensiveness is admittedly justified, particularly given the potential financial and reputational damages caused by data mismanagement and leakage.

Nonetheless, there’s an element of myopia here, and being excessively cautious can prevent organizations from realizing the benefits of data-driven collaboration, particularly when it comes to software and product development.

Bring CISOs into the C-suite to bake cybersecurity into company culture

Image Credits: Jetta Productions Inc (opens in a new window) / Getty Images

Cyber strategy and company strategy are inextricably linked. Consequently, chief information security officers in the C-Suite will be just as common and influential as CFOs in maximizing shareholder value.

How is edtech spending its extra capital?

Image Credits: Tetra Images (opens in a new window) / Getty Images

Edtech unicorns have boatloads of cash to spend following the capital boost to the sector in 2020. As a result, edtech M&A activity has continued to swell.

The idea of a well-capitalized startup buying competitors to complement its core business is nothing new, but exits in this sector are notable because the money used to buy startups can be seen as an effect of the pandemic’s impact on remote education.

But in the past week, the consolidation environment made a clear statement: Pandemic-proven startups are scooping up talent — and fast.

Tech in Mexico: A confluence of Latin America, the US and Asia

Image Credits: Orbon Alija (opens in a new window)/ Getty Images

Knowledge transfer is not the only trend flowing in the U.S.-Asia-LatAm nexus. Competition is afoot as well.

Because of similar market conditions, Asian tech giants are directly expanding into Mexico and other LatAm countries.

How we improved net retention by 30+ points in 2 quarters

Image Credits: Steven Puetzer (opens in a new window) / Getty Images

There’s certainly no shortage of SaaS performance metrics leaders focus on, but NRR (net revenue retention) is without question the most underrated metric out there.

NRR is simply total revenue minus any revenue churn plus any revenue expansion from upgrades, cross-sells or upsells. The greater the NRR, the quicker companies can scale.

5 mistakes creators make building new games on Roblox

Image Credits: SOPA Images (opens in a new window) / Getty Images

Even the most experienced and talented game designers from the mobile F2P business usually fail to understand what features matter to Robloxians.

For those just starting their journey in Roblox game development, these are the most common mistakes gaming professionals make on Roblox.

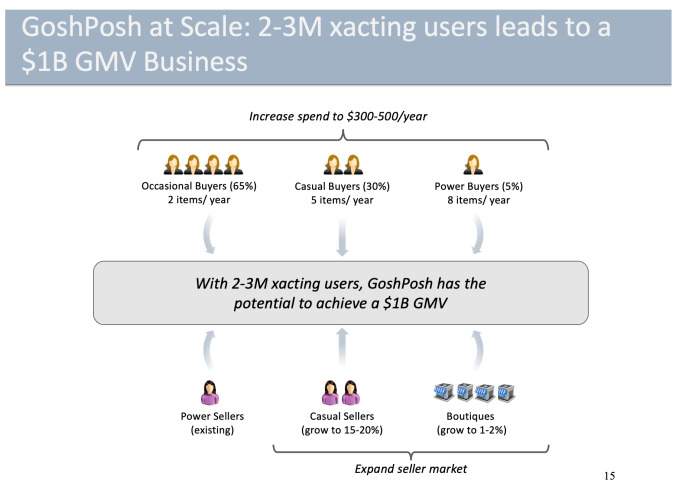

CEO Manish Chandra, investor Navin Chaddha explain why Poshmark’s Series A deck sings

“Lead with love, and the money comes.” It’s one of the cornerstone values at Poshmark. On the latest episode of Extra Crunch Live, Chandra and Chaddha sat down with us and walked us through their original Series A pitch deck.

Will the pandemic spur a smart rebirth for cities?

Image Credits: hopsalka (opens in a new window) / Getty Images

Cities are bustling hubs where people live, work and play. When the pandemic hit, some people fled major metropolitan markets for smaller towns — raising questions about the future validity of cities.

But those who predicted that COVID-19 would destroy major urban communities might want to stop shorting the resilience of these municipalities and start going long on what the post-pandemic future looks like.

The NFT craze will be a boon for lawyers

Image Credits: Gearstd (opens in a new window) / Getty Images

There’s plenty of uncertainty surrounding copyright issues, fraud and adult content, and legal implications are the crux of the NFT trend.

Whether a court would protect the receipt-holder’s ownership over a given file depends on a variety of factors. All of these concerns mean artists may need to lawyer up.

Viewing Cazoo’s proposed SPAC debut through Carvana’s windshield

Image Credits: Nigel Sussman (opens in a new window)

It’s a reasonable question: Why would anyone pay that much for Cazoo today if Carvana is more profitable and whatnot? Well, growth. That’s the argument anyway.