The on-demand grocery delivery industry in Europe (and beyond) continues to heat up amidst the pandemic, including a plethora of startups taking a vertical approach by operating their own delivery only — or “dark” — stores. The latest to show its hand is Berlin-based Flink, which today is announcing that it has raised a hefty $52 million in seed financing.

The round is led by Target Global and existing investors Northzone, Cherry Ventures, and Silicon Valley-based debt provider TriplePoint Capital. Cristina Stenbeck from Kinnevik also joins the round in a personal capacity.

TriplePoint’s inclusion is notable, since debt financing makes sense for these types of capital intensive businesses, including those that need to build out actual stores, albeit dark ones, and other deep logistics infrastructure.

To that end, the injection of capital — which brings total funding to date to $64 million — coincides with Flink’s expansion into the Netherlands and France, and follows the opening of ten dark stores in a number of German cities. They include Berlin, Hamburg, Munich, Nuremberg, Dusseldorf, and Cologne, with more planned.

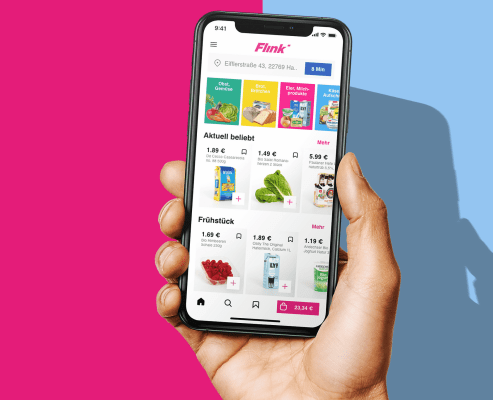

Officially launched just six weeks ago, Flink, which means “quick” in German, claims to deliver groceries from its own network of fulfilment centres in under 10 minutes. That puts it up against dark store competitors including Berlin’s much-hyped Gorillas and London’s Dija and Weezy, and France’s Cajoo, all of which also claim to focus on fresh food and groceries.

There’s also the likes of Zapp, which is still in stealth and more focused on a potentially higher-margin convenience store offering similar to U.S. unicorn goPuff. (Related: goPuff itself is also looking to expand into Europe and is currently in talks to acquire or invest in the U.K.’s Fancy, which some have dubbed a mini goPuff).

However, based on today’s funding round and an extremely experienced founding team, Flink is certainly one to watch. The rather stealthy company was founded in late 2020 by Oliver Merkel (former Bain & Company partner who led the firm’s retail practice in Germany), Christoph Cordes (former co-CEO of home24 which IPO’d in 2018), and Julian Dames (former co-founder of Foodora, CMO at foodpanda and VP at Delivery Hero, and most recently at Softbank). Founder-market-fit? Check.

As noted, Flink is pitching itself very much as a grocery solution, similar to Dija and Gorillas, for example, meaning that the real competition — in the short to mid-term, at least — is traditional supermarkets that do scheduled delivery but aren’t typically on-demand. However, delivering just-in-time fresh food poses many logistical challenges, such as the supply chain and ensuring you actually stock the products customers want when they want them. That’s a slightly different challenge to focusing on convenience store items such as beer, chocolate and snacks, or cigarettes etc., which is closer to the original goPuff model.

In a brief call last night with Christian Meermann, founding partner at Cherry Ventures, he told me that he believes truly on-demand groceries can be made to work, including the unit economics, but concedes it is a huge challenge logistically. But he also pointed out that the prize is potentially much bigger for whichever team can figure it out, since grocery shopping can easily happen multiple times per week and basket sizes can soon add up. Meermann isn’t convinced the same can be said of a pure convenience store offering, but of course there is overlap between the two.

Jessica Schultz, general partner at Northzone and previously a co-founder of HelloFresh, agrees. She says that instant shopping delivery will become “the new standard” in shopping more generally, and that groceries is the perfect category to start in, due to the nature of the products and frequency of consumption (e.g. perishables, waste, snacking, three meals per day etc.).

“Getting all your groceries, and not only convenience items but also your fresh herbs, your fruits, your bread… in less than 10 minutes is truly a wow experience,” she tells me. “I’m incredibly impressed with what the Flink team has achieved to date in this very fast-moving industry. I’m not sure I’ve seen such a rapid growth, or clean and strategic approach before. Their deep understanding of the core market dynamics is what will make them succeed”.

Schultz also argues that existing supermarket infrastructure can’t deliver on express grocery shopping and that large incumbents don’t have the skillset or agility to build on-demand grocery. “Instant delivery requires the build out of new infrastructure (micro-warehouses, hub & spoke) as well as a fully vertically integrated approach,” she adds.

Meanwhile, the new financing will be used to expand further within Germany and into additional European markets this year. “In Q2 2021, Flink will roll out its first stores in the Netherlands and France, beginning in cities like Amsterdam and Paris,” says the 120-person company.

Comments Flink founder Oliver Merkel: “Consumers absolutely love to get their grocery shopping done in 10 minutes,” says founder Oliver Merkel. “We’ve received fantastic NPS feedback and see people using Flink multiple times a week. With the additional funding, we can roll out Flink even faster in Europe.”