FlyFin announces a new Business Structure tool for self-employed individuals that helps users determine which tax forms will be needed.

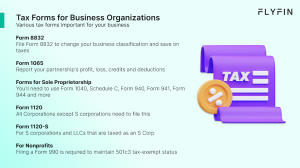

SAN JOSE, CA, U.S., December 6, 2022 /EINPresswire.com/ — FlyFin, the world’s number one AI tax preparation and tax filing service, announced a new Business Structure tool for self-employed individuals. The new tool helps the user determine which tax forms will be needed, depending on how their small business is structured. This assessment includes tax forms for the following entities: an LLC, Partnership, Sole Proprietorship, S Corp or C Corp. The company also provides a free suite of online resources that contains all the relevant information a self-employed person or a group of entrepreneurs needs to set up their chosen business structure and learn about each corporate structure’s pros and cons. FlyFin is closing the information gap for self-employed individuals and freelancers, as they don’t have access to broader resources that larger businesses can afford.

FlyFin’s new Business Structure tool enhances the company’s rapidly expanding library of resources dedicated to freelancers and self-employed individuals. This new resource comes on the heels of FlyFin’s recently introduced Business Structure Advisor tool, which guides self-employed individuals in determining the ideal structure for their small businesses.

Self-employed individuals and freelancers often need a more comprehensive understanding of the tax ramifications of the different business organization structures open to them. This information gap can often lead to confusion or mistakes when choosing the best option for their business. According to a survey by the National Association for the Self-Employed (NASE), less than half reported confidence in their understanding of the tax implications of their business structure – suggesting that there is a need for guidance.

In 2018, the IRS issued more than $10 billion in penalties to small businesses. The most common errors were related to filing and paying taxes late, needing to pay more taxes throughout the year, and keeping accurate records. FlyFin’s AI-powered platform helps tax filers save the maximum on their taxes. FlyFin’s CPAs are on standby 24/7, so taxpayers can ask a CPA for advice on how to pay the least amount of tax possible.

About FlyFin

FlyFin is an award-winning, AI-powered platform that provides self-employed, sub-contractors, independent contractors, gig workers, freelancers and creator economy workers with a convenient, easy-to-use and affordable tax filing solution. FlyFin helps individuals maximize self-employment tax deductions and income tax refunds. With a “Man + Machine” approach, FlyFin leverages AI paired with highly experienced tax CPAs to deliver automation that eliminates 95% of the work required for 1099 self-employed individuals to prepare their taxes. FlyFin is a privately-held, venture-backed company based in San Jose, California.

Carmen Hughes

Ignite X

6505766444

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

![]()