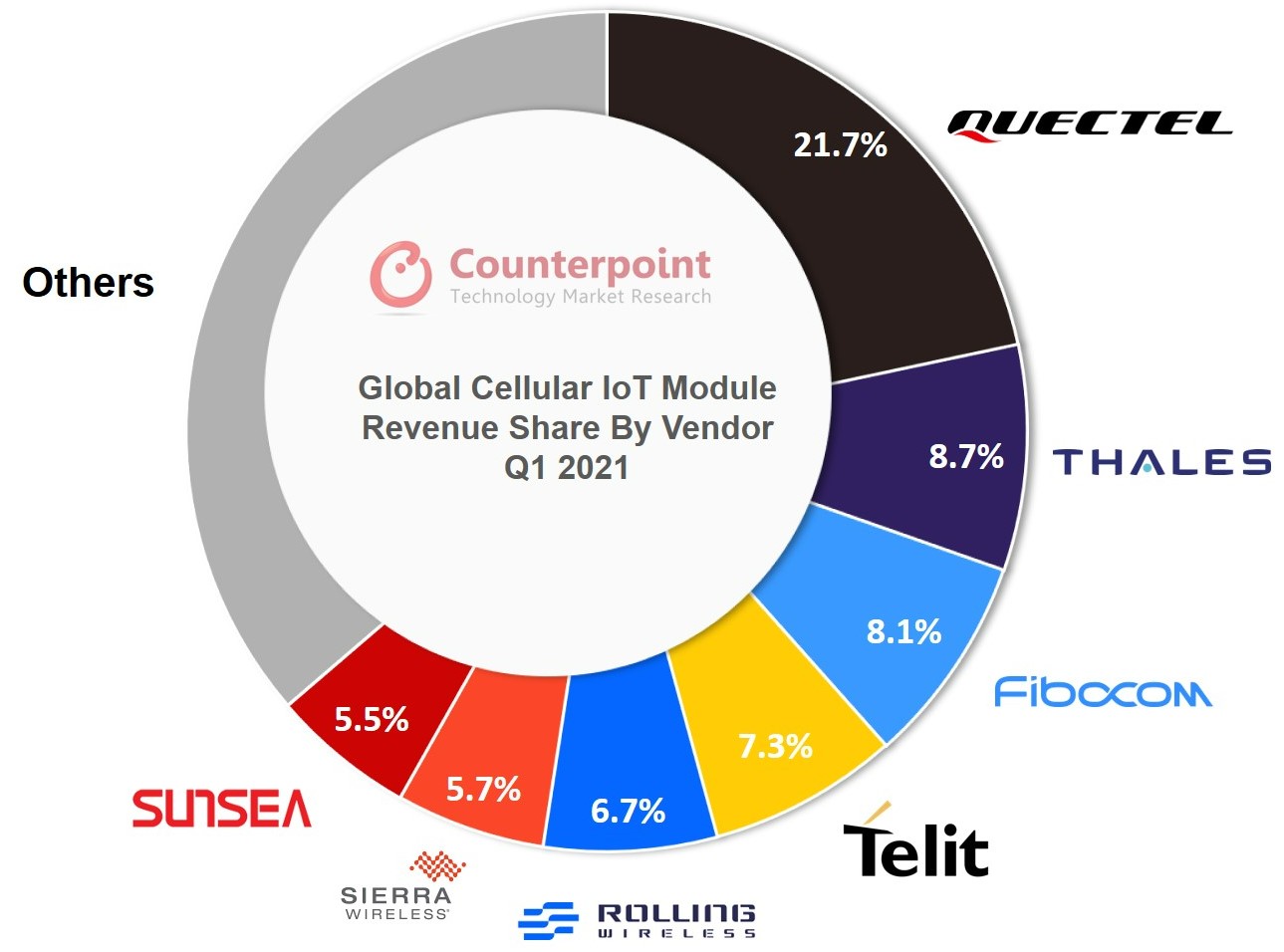

- Quectel and Qualcomm maintained their top positions in the cellular IoT module vendor and chipset player market shares, respectively.

- Automotive, router/CPE and industrial are the top three applications in terms of revenue.

- 5G captured nearly 20% share of the IoT module revenues during this quarter.

Global cellular IoT module shipments increased by 50% YoY and 11% QoQ during Q1 2021, according to the latest research by Counterpoint’s Global Cellular IoT Module, Chipset and Application Tracker. The market made a tremendous comeback during the quarter as the COVID-19 pandemic was under control globally in that period. Europe, North America and Japan registered healthy growth annually while Latin America was the only region that did not grow in terms of revenue during Q1 2021. China maintained its lead across geographies with a growing demand for cellular IoT modules.

Commenting on the market dynamics, Research Analyst Soumen Mandal noted, “Quectel continues to lead the global cellular IoT module vendor rankings in terms of volume and revenue. The Shanghai-based vendor saw its shipments and revenues climb 67% and 78% respectively during the quarter. Thales continued to maintain its second position. 5G revenues increased by more than 80% QoQ, which helped Thales decrease the gap with top-ranked Quectel and maintain the gap with Fibocom. The third-largest module vendor, Fibocom, is expanding globally beyond China with a strong focus on telematics, router and PC segments. We can expect strong competition between Fibocom and Thales in coming quarters for the second position in terms of revenue share.”

Exhibit 1: Global Cellular IoT Module Revenue Share by Vendor, Q1 2021

Mandal added, “Some of the leading incumbents such as Telit and Sierra Wireless continue to stay focused on specific Western markets, applications and expanding their services revenue. Both Telit and Sierra have divested their automotive businesses. Sierra’s automotive module business was acquired last year by a consortium of investors led by Fibocom to form Rolling Wireless, which quickly grew to become the fifth largest cellular IoT module vendor globally, serving high-ASP automotive applications. The rising contracts with leading automakers like Volkswagen, Audi, Porsche, Renault-Nissan and Stellantis, and scaling up of operations with a lower cost and higher quality are helping Rolling Wireless increase market share.”

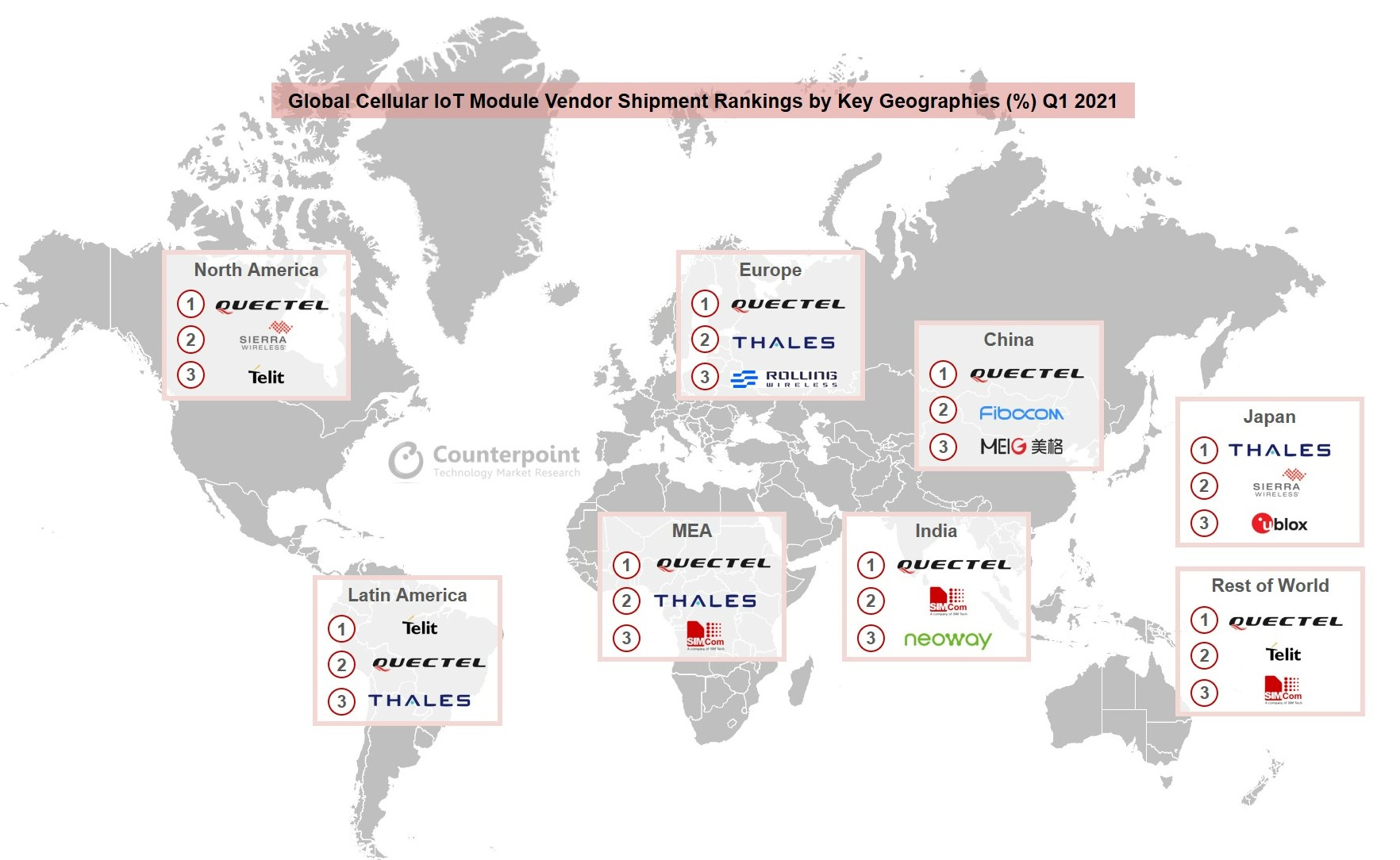

The following exhibit showcases the competitive dynamics for IoT module vendors across different geographies, with a good divide between Western and Eastern markets. These dynamics are a function of the vendor’s IoT application focus, breadth and depth of portfolio, channel partnerships, certification across operators and the quality of FAE (Field Application Engineers) force in the respective regions.

Exhibit 2: Global Cellular IoT Module Vendor Shipment Rankings by Key Geographies, Q1 2021

Commenting on the cellular IoT module chipset supplier landscape, Vice President Research Neil Shah noted, “While modules based on LPWA technologies such as NB-IoT and LTE-M continued to grow above the market average, LTE-Cat 1 and 5G became the fastest-growing cellular technologies in the IoT space this quarter. This adoption has helped Qualcomm strengthen its dominant position further to capture almost half of the market in terms of volume, offering different types of cellular IoT chipset solutions to these module vendors.”

Shah added, “Other notable vendors making strides in this market are Shanghai-based ASR Microelectronics, and Unisoc with growing design wins in the 4G Cat 1 segment. French chipset manufacturer Sequans is also in a growth mode with a robust 4G broadband, 4G Cat-1, LPWA, and 5G chipset and module portfolio. This should drive significant competition in the fast-growing LTE Cat-1 segment with the ASP of these modules falling below $10. MediaTek is expected to improve its share over 4G Cat 4, 4G Cat other and 5G technology. As IoT applications and project implementations are increasing, more chipset players are entering this space. GCT Semiconductor and XINYI Semi are the latest entrants in this segment. It will be interesting to see whether these new entrants are able to strike partnerships with larger module vendors to grow further.”