Your information technology gear is going to get more expensive due to component shortages, supply chain woes and a demand spike.

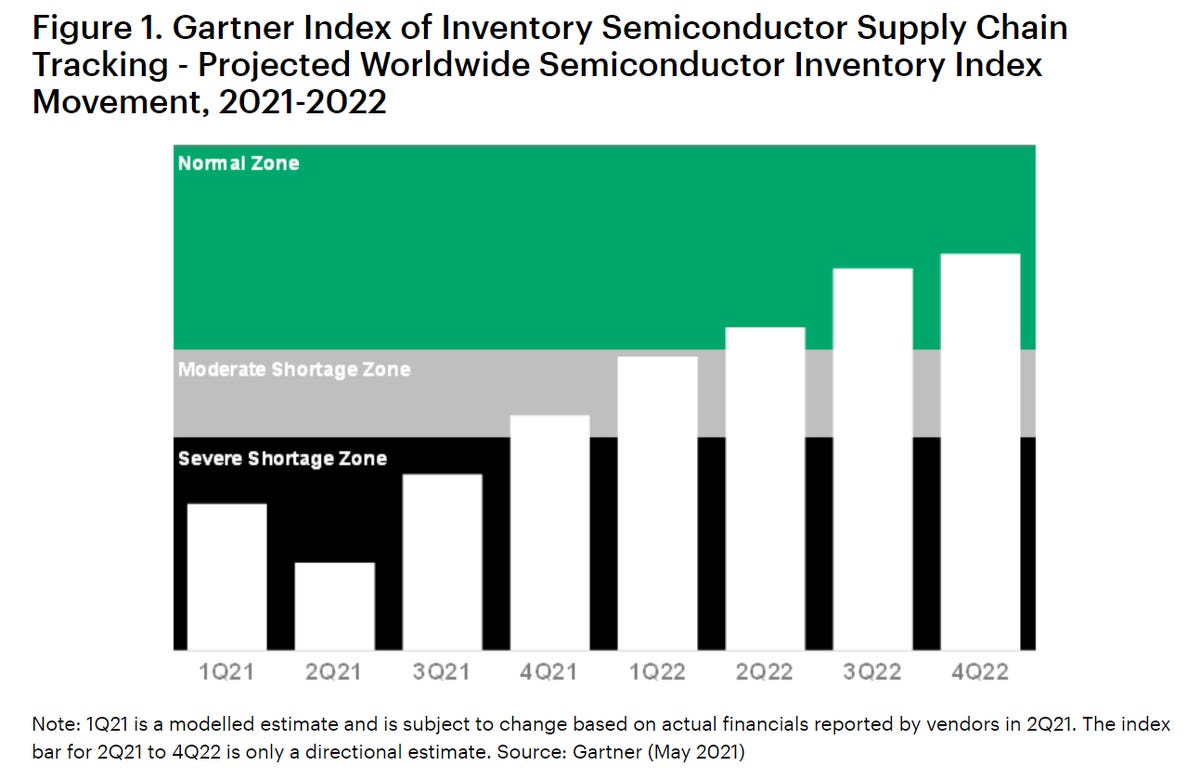

Cisco Systems’ third quarter results tell the tale. The company is a bellwether for IT demand and typically is an early indicator of what other tech suppliers will see in the future. Gartner has projected that the global semiconductor shortage will run through the second quarter of 2022.

Keep the comments from Cisco CEO Chuck Robbins in mind as Dell Technologies, Lenovo and Hewlett Packard Enterprise all report earnings next week. Component inflation is real, and enterprises may accelerate buying to get ahead of rising prices. US inflation grew at a 4.2% rate in April over the last 12 months, according to the US Bureau of Labor Statistics.

While Cisco’s quarter was solid, inflation worries lingered over the company’s outlook. Cisco projected fourth quarter revenue growth of 6% to 8% with non-GAAP gross margins of 64% to 65%. Non-GAAP earnings in the fourth quarter will be 81 cents a share to 83 cents a share. Wall Street was modeling non-GAAP earnings of 85 cents a share and gross margins pushing 66%.

Cisco executives said the company has locked in supply and pricing with component makers, but shortages will be an issue through the end of 2021. Robbins also acknowledged that the supply chain issues may push prices higher amid strong demand for networking and return to work software. Robbins said:

What we do know is that if we come to the conclusion that any of these cost increases or this inflation are going to be more sustained then we will look at strategic price increases where we have to. That work is already underway. There are already some decisions that we’ve made. So, we will do that. It’s a pretty dynamic situation. It’s going to be pretty obvious that if a customer has extended lead times, they’re probably going to place order sooner than when they would. That just makes sense.

Later, Robbins was asked to elaborate on price increases. He added:

On the pricing front, I think we have made some decisions on certain products that we will be making price increases on, and we’re looking surgically at the rest of the portfolio based on where we have costs that we believe are going to be sustained. But we’re erring hard right now on taking care of our customers and trying to get, optimize our ability to deliver to them right now because we think that improves our relationships and it improves our position over the long term with these customers.

Indeed, Cisco is No. 1 in Gartner’s supply chain ranking for 2021.

Cisco is seeing industries like hospitality bounce back, strong demand for 5G networking gear and multi-cloud deployments. Toss in security technology and software like WebEx and Cisco is seeing a demand spike just as component costs have surged. “If we didn’t have the supply chain challenges, we would have been guiding higher on revenue,” said Robbins.

The comments from Cisco are the most direct about component inflation in tech gear and how those costs may be passed along. Cisco is one big player, but inflation is going to impact a wide range of technology gear.

Last month, enterprise technology suppliers noted shortages and supply chain issues, but stopped short of predicting a margin hit or price increases. For instance, Juniper Networks CEO Rami Rahim said the company had long-term pricing contracts, but the company would see some impact. However, Juniper, which said it was working to fortify its supply chain, stuck to its full year gross margin target of 60%.

Arista on May 4 also cited supply chain woes on its first quarter earnings conference call. Arista CEO Jayshree Ullal said:

The supply chain has never been so constrained in Arista history. To put this in perspective, we now have to plan for many components with 52-week lead times. COVID has resulted in substrate and wafer shortages and reduced assembly capacity. Our contract manufacturers have experienced significant volatility due to country specific COVID orders. Naturally, we’re working more closely with our strategic suppliers to improve planning and delivery.

Customer demand and visibility, though, has improved in the past few months. We are working with our customers to understand the timing of their deployment needs. We do not believe at this time that our customers are pre-ordering. However, we do think they’re exercising prudent planning for second half of 2021 and even into 2022. With this as a backdrop, we believe supply chain will remain a pain point for the balance of this year as a result of all these shortages.

Add it up the component squeeze is challenging three large networking giants. Next week, we’ll get the server and storage side of the equation. It’s highly likely that supply chain issues, strong demand and potential price increases will be a hot topic.

More: