- In Q1 2023, global foldable shipments grew 64% YoY to 2.5 million units.

- China’s overall smartphone market fell in Q1 2023 but the domestic foldable market rose.

- OPPO, Samsung grew rapidly in the Chinese foldable market.

- Apple is likely to enter the foldable smartphone market in 2025.

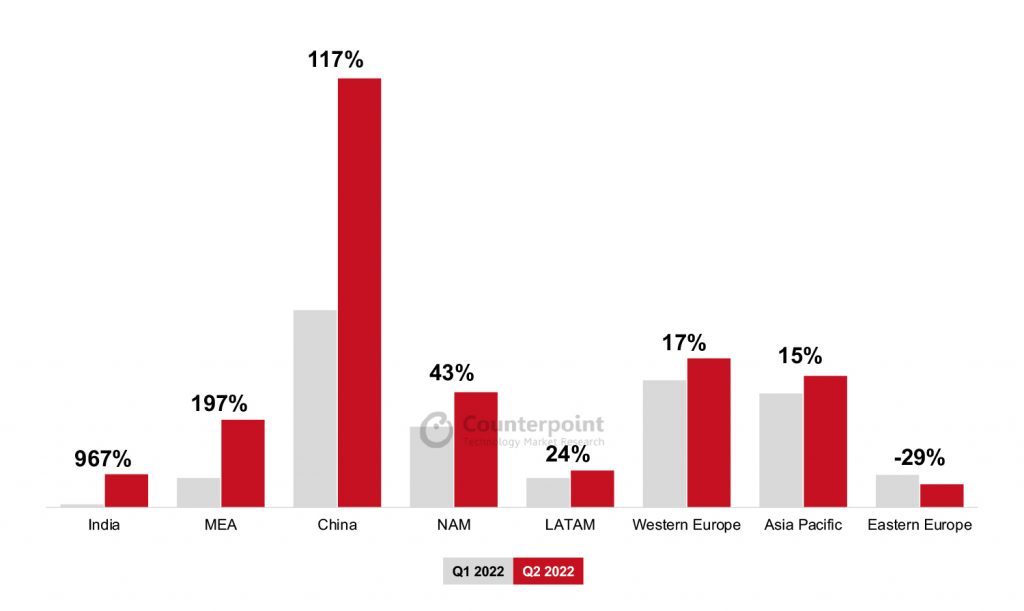

According to the counterpoint research foldable tracker and foldable insight report, the global foldable smartphone market increased 64% YoY in Q1 2023, based on sell-in volume, to reach 2.5 million units. This is quite significant because the foldable market rose amid a 14.2% year-on-year decline in the overall global smartphone market during the same period. Foldable smartphone markets in almost all major regions, including China, North America and Western Europe, displayed strong growth in Q1 2023.

[Global Foldable Market YoY Growth Rate by Major Region, Q1 2023]

Source: Global Foldable Smartphone Market Tracker, Q1 2023

The robust growth in the global foldable market was largely driven by the growth in the Chinese foldable market. Although the Chinese smartphone market declined by about 8% YoY in Q1 2023, the domestic foldable market continued to grow, surging 117% YoY to 1.08 million units.

Commenting on this phenomenon, Research Analyst Woojin Son said, “In China, new foldable products such as the OPPO N2 and N2 Flip had grand releases. These big launch events constantly pique the market’s interest. Consequently, Chinese consumers have become more familiar with foldable products compared to other regions.”

[China Foldable Market Share by OEM, Q1 2023 YoY]

Source: Global Foldable Smartphone Market Tracker, Q1 2023

Source: Global Foldable Smartphone Market Tracker, Q1 2023

OPPO’s strong Q1 2023 performance is noteworthy as it reflects the brand’s success in the Chinese foldable market, which is emerging as the world’s largest foldable smartphone market. OPPO ranked second in the Chinese foldable market with a slight gap with leader Huawei, helped by the N2 Flip and N2 which were released at the end of 2022. In particular, the N2 Flip, OPPO’s clamshell-type foldable, contributed a lot to the increase in the sales of clamshell-type products in China, beating Huawei’s Pocket S.

Samsung’s growth in the China foldable market is also noteworthy. Samsung made efforts to target the Chinese market by launching the W23 and W23 Flip, which are variants of the Z Fold 4 and Z Flip 4, respectively, produced mainly for the Chinese market and MEA market. This helped Samsung grow rapidly in the Chinese foldable market in Q1 2023.

Commenting on the foldable smartphone market outlook for 2023, Senior Analyst Jene Park said, “We believe that, in 2023, there will be 1) intensifying competition among OEMs in the global foldable market due to more aggressive target market expansion; 2) intensifying price competition; and 3) increasing sales volume of clamshell-type foldable smartphones through various product launches. Also, the Chinese foldable market is expected to continue to grow through 2023 mainly due to the Chinese consumers’ recognition of ‘foldables’ as a premium smartphone, coupled with continuous and frequent new product launches in the country.”

Addressing the big question around Apple’s entry into the foldable market, Park said, “Apple is still absent from our short-term forecasts. However, since overall consumer response to foldable phones is improving and Apple will be possibly releasing non-phone foldable products soon, the brand’s participation in the foldable smartphone market is likely to occur after 2025.”