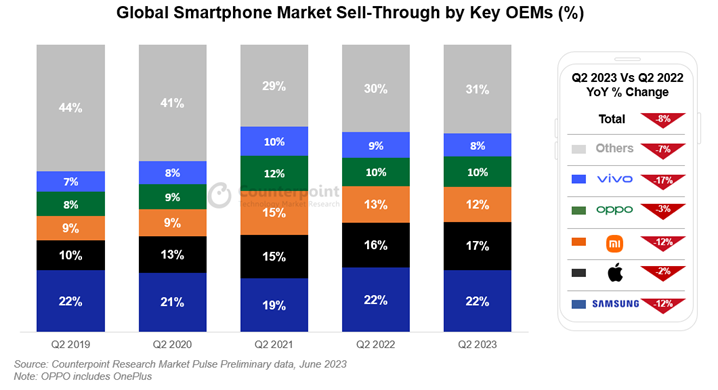

- Global smartphones sell-through declined 8% YoY and 5% QoQ in Q2 2023.

- Samsung led the quarter with healthy A-series demand as Xiaomi and vivo faced headwinds.

- Apple came in second with its share growing to 17% despite unfavorable seasonal factors.

- Premium segment demand remained resilient, with the segment’s share reaching a Q2 record.

The global smartphone market’s sell-through declined 8% YoY and 5% QoQ in Q2 2023, according to the latest research from Counterpoint’s Market Pulse service. This was the eighth consecutive quarter to see a YoY decline.

Samsung led the market with a 22% market share, benefitting from the strong performance of its Galaxy A-series globally. Apple came in second while recording its highest-ever Q2 market share. Xiaomi, the third-largest brand, faced headwinds in its biggest markets – China and India. The brand is looking to offset such declines with expansion in other markets and by refreshing its portfolio. OPPO did relatively well in its home market China and India (thanks to OnePlus), managing to hold its global market share despite registering losses in Western Europe. vivo (including iQOO) saw major growth declines in China after a strong Q2 last year as well as strong competition from Samsung, and OPPO in the offline markets of India and Southeast Asia.

The global smartphone market now seems to be well past its rapid growth phase, with consumer replacement cycles getting longer, convergence in device innovation, and the emergence of a more mature refurbished market for smartphones hitting particularly the higher-volume low-to-mid-tier price segment demand.

The premium segment ($600+ wholesale price), however, continues to grow immune to broader constraints, as the mature consumer is opting for a superior experience, supported by the easy availability of finance options across key geographies. The premium segment was the only segment that grew during the quarter, reaching its highest-ever Q2 contribution to the overall market. More than one out of five smartphones sold during the quarter belonged to the premium segment.

Apple is riding this “premiumization” wave, reaching record shares in multiple new markets which are typically not considered its core markets. A prime example is India, where it grew 50% YoY in Q2 2023. The continued strong performance of the premium segment has made sure that revenues don’t suffer as much as sales volumes, which is why brands are investing in market expansion and innovation in newer technologies.

All regions worldwide saw a contraction in sales, but the biggest decline was seen in relatively more developed markets such as the US, Western Europe and Japan, all of which recorded double-digit annual declines. The markets in China, India and Middle East & Africa declined relatively less. OEMs and channels looked to clear the excess inventory built up in the market by leveraging promotions and “big sale” festivals. For example, the postpaid carriers in the US rejigged their unlimited bundled plans to offer more flexibility to consumers. But the demand remained weak amid higher interest rates impacting the disposable income of American households. In China too, the premier sales event of “618”, which is spread over several weeks, saw lukewarm reception despite aggressive promotions. However, the event was able to arrest the decline in the smartphone market in China and, indirectly, globally in June.