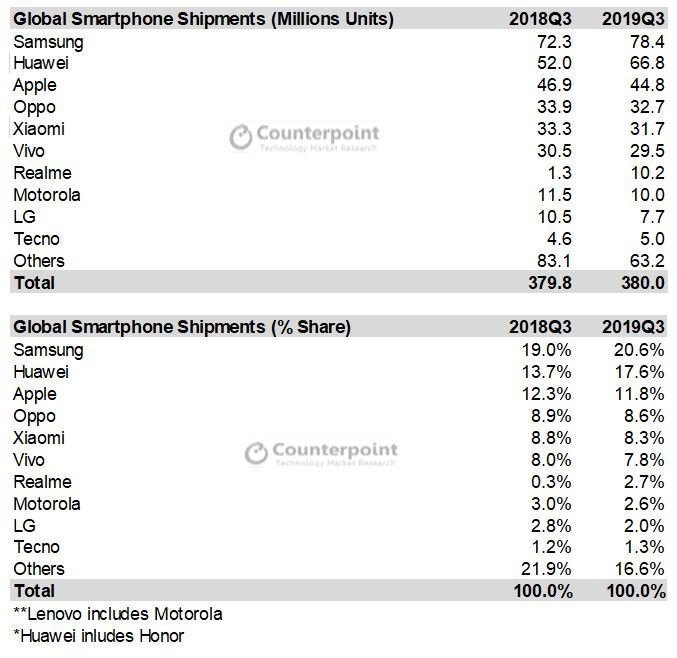

• Samsung led the market with 21% share, strong demand for A & Note series ; Huawei reached a record high 18% share

• Realme was the fastest growing brand, jumping to seventh spot ; India market reached a record 49 Million Units, second largest globally

The global smartphone market remained almost flat during Q3 2019, reaching 380 million units in shipments, as compared to 379.8 million units in Q3 2018. In terms of brands, Huawei, Realme, and Samsung registered positive growth, increasing their market share globally. Stronger demand in India and China in September, helped the global smartphone market to halt the seven-month streak of year-on-year (YoY) declines.

Commenting on the smartphone market recovery, Shobhit Srivastava, Research Analyst at Counterpoint Research, noted, “The global smartphone market ended a long period of continuous YoY declines in Q3 2019 due to increased shipments in India and China, the two top-focus markets for every player in the mobile value chain. In India, smartphone OEMs started preparing early for the festive Diwali season this year with healthy channel buildups. In China, Huawei, OPPO & vivo (HOV) continued to see healthy channel demand ahead of National Day Golden Week holiday break in October which led the market to grow a positive 6% sequentially. This along with upcoming holiday season in the next quarter, should drive up the overall smartphone demand into a positive growth territory for the second half of this year compared to the last year.”

Smartphone Shipment Market Share 2019 Q3

Source: Counterpoint Research: Quarterly Market Monitor 2019 Q3

Note: The shipment numbers for all brands exclude certified refurbished devices.

Huawei continued to defy the market decline with a 4% increase in market share globally.

Commenting on Huawei’s continued growth Tarun Pathak, Associate Director at Counterpoint Research, said, “The US trade ban on Huawei did not affect the overall brand’s shipments and growth in Q3 2019 after the uncertainties in June. Huawei’s strategy to supplement its decline in overseas market share with domestic push paid off handsomely. The rising sense of nationalism towards Huawei amidst US-China trade war coupled with aggressive go-to-market strategy in China helped Huawei boost mindshare and marketshare domestically. Outside China, the widening gap being created in overseas markets such as Europe, Latin America & Middle East due to the lack of shipping new models with Google services gives a window of opportunity especially Samsung, Xiaomi and others to capture share away.

Huawei, though will have to be careful of the inventory levels in domestic market as the market could quickly transition to the upcoming 5G wave which could affect its market share in coming quarters.”

Commenting on the 5G progress, Peter Richardson, Research Director at Counterpoint Research, highlighted, “The 5G rollouts from both networks and devices over the past twelve months have been faster than the 4G era, and we expect the rollouts to further accelerate going into 2020. 5G smartphones already accounted for 2% of the market in Q3 2019, growing over 200% sequentially. China has already commenced rolling out the 5G networks and the massive market scale it brings for the entire industry will make 2020 the breakout year for 5G, This should catalyze the slowing smartphone volume demand over the past couple of years and certainly continue to boost the upward trend in the overall smartphone Average-Selling-Price (ASP).”

Key Takeaways:

- The top three brands, Samsung, Huawei and Apple, together cornered almost half of the smartphone market, with the rest of the market left for hundreds of other brands to compete fiercely.

- Samsung continued its growth at 8.4% YoY, capturing over one-fifth of the global smartphone market. This is due to strong Note 10 and Galaxy A series sales. The company also posted an increased profit with an improved product mix. The company will continue to launch new A series smartphones, including some models with 5G, to try and maintain momentum. Huawei’s loss in overseas market would be a big opportunity for Samsung in coming quarters.

- Huawei grew a very healthy 28.5% YoY globally. It captured a record 40% market share in the Chinese smartphone market. As it continues its aggressive push in the market, it will have to keep a check on inventory levels in China and Europe in Q4 2019.

- Apple iPhone shipments were down 4%, and as a result revenues fell 11% YoY. The positive response for the latest iPhone 11 series during the tail end of the quarter is a silver lining for Apple going into the holiday season quarter. In US pre-orders and the first week of sales saw early adopters buying more of the iPhone Pro Max and iPhone Pro but the iPhone 11 rose quickly then on into the top seller’s list. Apple’s price corrections in China and elsewhere with the iPhone 11 and XR, as well as introducing a new palette of colors, stimulated demand during the last week of September offsetting the sharp annual decline earlier months.

- Realme remained the fastest-growing brand for the second time. It also climbed up the ladder in global rankings since its last appearance. This is one of the fastest ramp-ups of companies to-date. Strong performances in India and expansions overseas drove its growth. This was also the fourth consecutive quarter that Realme was within the top 5 brands in India.

- BBK Group (OPPO, Vivo, Realme, and OnePlus) is close to becoming the largest smartphone manufacturer group globally, accounting for over 20% of the global smartphone market and three of its brands in the top 10.

- The market consolidated further with the top 10 brands’ market share increasing to 83% from 78% a year ago.